Beyond TIP 10 ETFs To Protect Against Inflation

Post on: 16 Май, 2015 No Comment

Over the last year, U.S. equity markets have staged a remarkable recovery as volatility has plummeted and the emergency stimulus measures implemented amidst heated debate appear to have had their intended effect. Indications that unemployment may be close to peaking and that consumer confidence is on the rise once again only add fuel to the recovery fire [for ETF industry news, sign up for the Free ETFdb Newsletter ].

But amidst all the unbridled optimism is a growing number of investors concerned that the time will soon come to pay the piper following the massive capital injections of the last two years. The theories as to what will drive a surge in inflation are as numerous as the predictions of just how high CPI could go. Some inflation bugs think rates will only test the high end of the Feds comfort zone, while others are betting on a hyperinflationary period that sees rates as high as 20%.

Beyond TIP

The default solution to the potential problem has so far come in the form of ETFs that invest in inflation-protected government bonds. The iShares Barclays TIPS Bond Fund (TIP ) is by far the most popular of such funds. At the end of 2009, TIP had more than $18 billion in assets, making it the eighth largest ETF. TIP saw almost $9 billion in inflows in 2009. demonstrating its popularity as a hedge against an uptick in prices (see more about TIPs fundamentals here ).

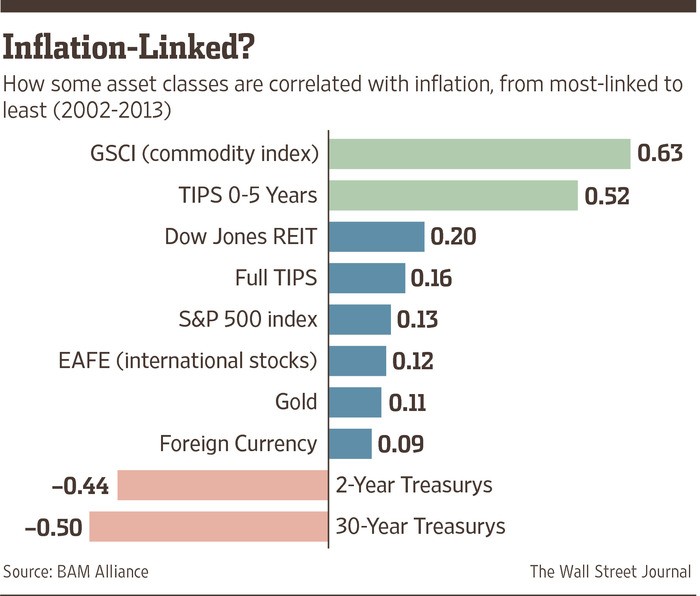

But some investors worry that TIPS have the potential to disappoint investors expecting a surge in value should inflation accelerate, especially if a hyperinflationary environment sets in. TIPS have historically exhibited certain limitations in providing an effective hedge against inflation, including stronger correlation to bonds than inflation and greater volatility than changes in the Consumer Price Index (see some of the support for these assertions in this document ).

For those investors wary of inflation, there are a number of ETF options beyond TIP that may provide portfolio protection during a period of high inflation [see Free Report: How To Pick The Right ETF Every Time ]:

1. IndexIQ CPI Inflation Hedged ETF (CPI )

This cleverly-named ETF tracks a benchmark that seeks to deliver a real return, or a return above the rate of inflation as measured by the Consumer Price Index. This fund, which is the first U.S.-listed real return ETF, has the latitude to invest in a variety of asset classes, including equities, fixed income, commodities, and currencies. As of January 14, CPIs holdings consisted of five ETFs, including three bond funds (SHV. BIL. and TLT ), one commodity ETF (GLD ), and one currency product (FXY ).

The index underlying CPI is a rules-based benchmark, and the fund will be rebalanced on a monthly basis. CPI is a relatively new fundlaunched in October 2009so its difficult to gauge its correlation with inflation over such a short time period. Read more about how CPI seeks to beat inflation here .

2. WisdomTree Dreyfus Emerging Currency Fund (CEW )

CEW has seen a surge in popularity recently, more than doubling in size in December as investors looked overseas to generate meaningful money market returns. This fund seeks returns reflective of both money market rates in certain emerging markets and changes in value of these currencies relative to the U.S. dollar. While money market rates in the U.S. remain at near-zero levels, many emerging economies offer returns in excess of 6%.

Generally speaking, countries with lower rates of inflation will experience currency appreciation, since purchasing power will increase relative to other nations. If inflation rises above the high end of the Feds comfort zone, the dollar could face some significant downward pressure, and the money market returns offered by emerging economies could be further amplified (see charts of CEW here ).

3. Market Vectors Hard Assets Producers ETF (HAP )

This fund tracks the Rogers/Van Eck Hard Assets Producers Index, a benchmark developed with legendary commodities investor Jim Rogers in order to provide investors with one stop shopping for the global hard assets industry. This benchmark is composed of large cap companies engaged in the production and distribution of hard assets and related products and services.

In addition to companies engaged in the production of oil and gold, HAP invests in firms that produce fertilizer, seeds, paper, water, and alternative energy making it one of the first commodity index fund to invest in such a wide array of products. HAPs largest holdings include Monsanto (6.2%), ExxonMobil (5.1%), and Potash Corp of Saskatchewan (3.9%) (you can see all of HAPs top holdings here ). The profitability of these companies is often tied to the prices of the underlying resources they produce and sell, meaning that an uptick in inflation could result in an increase in revenue preceding a subsequent increase in expenses.

HAPs focus is global in scope, and U.S. companies account for slightly more than 40% of total holdings. Other countries that comprise material allocations of the index are Canada (12.9%), United Kingdom (5.9%), and Russia (5.5%). By sectors, HAP is heavily weighted towards energy (40%), agriculture (31%), and industrial metals (13%). The fund charges an expense ratio of 0.65%.

4. Market Vectors Gold Miners ETF (GDX )

This fund seeks to track the NYSE Arca Gold Miners Index, a benchmark composed of companies engaged primarily in the mining for gold. GDX invests in firms of all market capitalization levels in both developed and emerging markets. The fund currently holds about 31 securities of which 77% are large cap, 20% are medium cap and the rest in small cap firms. Geographically, GDX is heavily concentrated in North America with about 61% in Canada and 12% in U.S. firms. South Africa also makes up a large portion of the fund, comprising 14% of the total assets.

Because gold has historically been an effective inflation hedge, the companies engaged in the precious metals mining could get a boost if bullion prices surge. GDX maintains a relatively weak correlation with the S&P 500, and effectively acts as a leveraged play on spot gold prices. The potential for GDX to perform well in an inflationary environment can be explained by the fact that gold miners pay workers in depreciating paper money while they receive a premium for the gold they are mining.

GDX charges an expense ratio of 0.55% and is up more than 60% over the last year.

5. PowerShares DB Base Metals Fund (DBB )

This fund offers exposure to three base metalsaluminum, zinc, and copperby investing in futures contracts on these commodities. Increases in demand for raw materials in emerging markets and hopes for an uptick in manufacturing activity in the developed world have boosted prices of these metals over the last year. Now, its possible that a jump in price levels could give DBB further momentum (see technical analysis of DBB here ).

If a surge in inflation in the U.S. hammers the greenback, prices of base metals could get a boost. It should be noted, however, that DBBs futures-based strategy complicates its investment outlook somewhat.

6. Market Vectors Agribusiness ETF (MOO )

MOO is designed to track the performance of the DAXglobal Agribusiness Index, a benchmark that measures the performance of companies that derive at least 50% of their revenues from the business of agriculture. Components of this ETF include companies engaged in agricultural chemicals, agriproduct operations, agricultural equipment, and livestock operations. Major holdings of MOO include Potash, Monsanto, and Wilmar.

Food prices are often among the first to rise in inflationary environments, allowing companies engaged in the business of agricultural products to boost revenues before expenses also surge. For a closer look at MOO, see this feature .

7. IndexIQ ARB Global Resources ETF (GRES )

This ETF is based on a benchmark that uses momentum and valuation factors to identify global companies that operate in commodity-specific market segments and whose equity securities trade in developed markets (including the U.S.). Segments represented by GRES include livestock, precious metals. grains, food, energy, industrial metals, timber, water, and coal. Historically, commodity-related equities have served as an effective diversifier and an effective hedge against inflation.

Like most commodity-related ETFs, GRES invests in stocks of gold miners, energy firms. and food producers. But unlike most ETFs that invest in equities of commodity producers, GRES takes a short position in broad-based equity markets, using futures contracts to partially hedge away exposure to the S&P 500 and MSCI EAFE Index. By doing so, GRES reduces the exposure to broad U.S. and international stock markets, essentially isolating the commodity component of its underlying holdings (see our guide to inverse ETFs for a look at how similar strategies can be implemented).

8. Claymore/Beacon Global Timber Index ETF (CUT )

This ETF is based on the Beacon Global Timber Index, a benchmark that invests in stocks of companies who own or lease forested land and harvest the timber for commercial use and sale of wood-based products, including lumber, pulp or other processed or finished goods such as paper and packaging. As its name suggests, CUTs focus is global in nature; in addition to the U.S. the fund has significant allocations to Japan. Canada, Finland, Sweden, and Hong Kong .

In addition to its valuable diversification characteristics, timber is attractive to long-term institutional investors because it is in relatively stable demand (timber demand has historically tracked population growth), meaning it generates a stable return to investors. And unlike agricultural investments, harvesting of timber is flexible, allowing landowners to delay sales if prices are temporarily low. Moreover, timber has historically been positively correlated with inflation, generally providing a return 300 to 800 basis points above the increase in price levels. This characteristic may be particularly valuable for investors concerned about the long-term impact of the massive injections of cash into the economies of several developed nations. For a closer look at timber ETFs, see this feature .

9. PowerShares DB Agriculture Fund (DBA )

One of the most popular exchange-traded commodity products, DBA offers exposure to livestock, grains, and soft commodities, investing in a total of about 11 different futures contracts. In addition to maintaining a negative relationship with the dollar, the resources underlying these securities are often among the first to rise when inflation kicks in. While the futures markets for many of these commodities are in contango (thereby presenting the potential for a futures-based strategy to underperform a physical investment in these resources), DBA could still get a nice bump if food prices head higher.

For a look at how DBA stacks up next to competing ETF options, see the Ultimate Guide to Agriculture ETFs .

10. iShares Dow Jones Oil & Gas Exploration & Production Index Fund (IEO )

This ETF is linked to a benchmark designed to measure the performance of the oil exploration and production sub-sector of the U.S. equity market, and includes companies engaged in exploration for and extraction, production, refining, and supply of oil and gas .

Since oil prices tend to rise during times, demand for the services of companies focused on discovering and producing crude oil can surge as well. Moreover, because oil exploration and production companies are generally able to pass on increases in expenses to consumers, inflation may increase profit margins (see more information on IEO take a look at the fact sheet here ).

Disclosure: No positions at time of writing.