Beyond EWZ A Better Way To Get Brazilian ETF Exposure

Post on: 27 Март, 2015 No Comment

Brazil has become a popular destination for investors seeking exposure to emerging marketsfor good reason. The South American nation has parlayed its vast mineral wealth and clean energy revolution into decades of strong economic growth, becoming one of the largest and most promising emerging markets in the process. As a net exporter of oil with a relatively sound balance sheet, Brazil has avoided many of the issues that are now plaguing developed markets. Meanwhile, the massive and urbanizing population has created fuel for a growing consumer sector that is thriving from an increasingly large and increasingly wealthy middle class. And the upcoming opportunities to showcase the Brazilian economy and culture on the world stage have spurred aggressive infrastructure initiatives that are creating additional jobs and driving new spending.

Brazil certainly faces a few challengesinflation and drug-related violence are major issuesbut overall the long-term outlook is bright. And investors looking to add Brazilian equities to their portfolios have no shortage of options; a number of providers offer funds that slice and dice the Brazilian market in various ways. Innovation in the ETF space has given investors products targeting small caps, mid caps, and even a suite of sector-specific Brazilian ETFs.

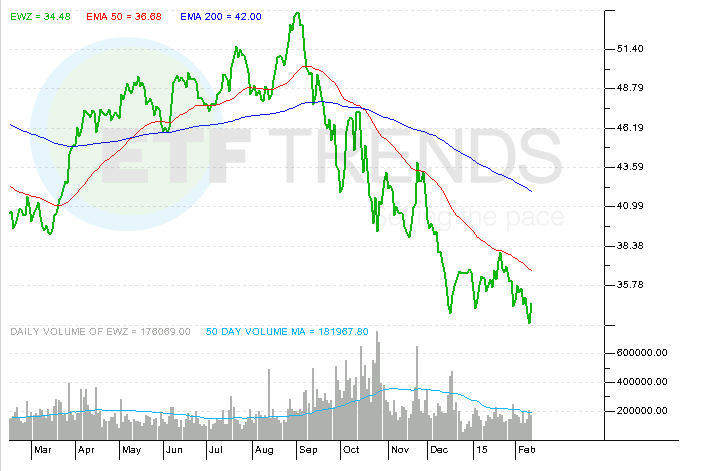

Still, the original Brazil ETF is by far the most popular. The iShares MSCI Brazil Index Fund (EWZ ) has more than $12 billion in assets under management and is by far the oldest ETF targeting the continent. having debuted more than a decade ago. The product is also very liquid; more than 14 million shares change hands every day. Though some investors elect to pursue more finely tuned Brazilian exposure, most stick to the original, investing in a handful of large cap stocks through EWZ.

Better Brazil ETF?

Theres a lot to like about EWZ. The expense ratio of 0.61% is below the average for the Latin America Equities ETFdb Category. And the underlying portfolio consists of the largest Brazilian companies, allowing investors to achieve exposure to a significant portion of the economy through a single ticker.

But there are some potential drawbacks as well. While EWZ maintains a deep basket of underlying holdings (about 90 stocks in total), 60% of the funds total assets go towards the top ten holdingsindicating some significant concentration in a top-heavy fund. A few of those names account for significant chunks of the popular Brazil ETF; close to 18% goes to oil giant PetroBras, with another 15% is given to mining behemoth Vale. So two companies, both of whom are sensitive to swings in commodity prices, account for nearly one third of total exposure. ETFs, like mutual funds before them, became popular in part because of the easy and cheap diversification offered. But not all ETFs are equally balanced, and top-heavy funds may feature significant company-specific risk [see Brazil ETF In Focus After Puzzling PetroBras Deal ].

Beyond individual security concentration, EWZ also is heavily invested in a few sectors as well. The fund puts close to 75% of its assets in three sectors: materials (24%), financials (24%), and energy (22%). That highlights the dependence on natural resource production, and the relative lack of exposure to corners of the Brazilian economy that may thrive from increased disposable income. A case can be made that optimal exposure to Brazils growth story should include companies in the health care and consumer industries, neither of which receives much weight in EWZ [see Five Ultra-Concentrated ETFs ].

Inside FBZ

Perhaps the ETF offering the most similar exposure to EWZ is the recently-launched First Trust Brazil AlphaDEX Fund (FBZ ), which offers exposure to many of the large cap Brazilian stocks found in the popular iShares fund. FBZ, which debuted in April of this year, is part of the AlphaDEX suite of ETFs from First Trust, a group of exchange-traded products that blur the line between active and passive management. Technically, these AlphaDEX ETFs are very much passive in nature; they seek to replicate the performance of rules-based indexes. But in another, they exhibit some characteristics of active management; the underlying indexes utilize quant-based methodologies to determine stocks with the greatest potential for capital appreciation from a broader equity universe. The Defined Brazil Index underlying FBZ considers a number of performance and pricing metrics to determine its holdings, resulting in a group of Brazilian equities that the AlphaDEX system recognizes as having the potential to outperform more broad-based market cap-weighted indexes [see First Trust Rolls Out International AlphaDEX ETFs ].

Some investors believe wholeheartedly in the AlphaDEX methodology, pointing to generally stellar results in the domestic equity space as evidence of the ability to consistently generate excess returns. Others are more skeptical of the enhanced indexing practice, presenting a boatload of academic research as proof that stock picking destroys value. Regardless of your stance on the methodology, its hard to argue that the application of the AlphaDEX approach to Brazilian stocks results in a product that might be appealing as an efficient way to overweight one of the largest and fastest-growing emerging markets.