Betterment Review Get Up To Six Months Commission Free

Post on: 17 Апрель, 2015 No Comment

In this low-interest rate environment most investors know parking their money in a bank CD is almost a surefire way to lose money against inflation. For the average individual, investing in the stock market can be complicated. So, what is someone to do?

You have to be concerned about high fees, good asset allocation and whether a financial advisor has your best interest at heart. Betterment is one possible solution to make investing easy. This Betterment review has been updated for 2014.

Traditionally, investing and asset allocation require basic finance skills of which many individuals lack. If you were to use an investment advisor, their fees are quite cost prohibitive. Which is why advisors are usually only available to high net worth individuals. Betterment gives similar investment advice, in an automated fashion and at a much lower annual fee.

How Does Betterment Work?

Betterment is all about the end-game. When saving, we dont care about investment theory, we care about the end result. We are investing for some purpose, whether saving for retirement, college, home down-payment or for a vacation trip to Hawaii.

Allocation Summary

(Click for full view)

Betterment walks you backwards in the steps required to meet your end goal. From your initial deposit, monthly savings and time horizon, Betterment will tell you the chances of achieving your objective.

Theres no researching which investments you need to purchase, and at what percentage for each. Betterment does this all for you automatically. This makes investing easy for beginners, and is different than any other discount stock broker weve reviewed.

Betterments goal is to maximize return but minimize the risk. This sounds like an oxymoron, but its not. The question Im sure you are asking is; how do they do this? They do it via the Modern Portfolio Theory or MPT for short. By investing in a diverse pool of assets it should collectively lower the risk and yet stabilize returns over the long-term.

Traditionally this type of service was only available with a full service financial adviser. So this makes Betterment somewhat unique since its all done via automated methods.

Betterment was created from the start to make investing as easy as opening a bank account. Though, let me be clear, Betterment is NOT FDIC insured. Your returns are not guaranteed and are subject to market risk. Its possible your investment could lose principal. Though compared to other investment options which dont have principal risk, they do have other types of risk. Betterment is a SEC registered broker-dealer and member FINRA/SIPC.

With the service, you dont own individual stocks or bonds, instead investments are held in the form of an exchange traded funds or ETFs. The ETFs own a portion of the equities market via indexing. The asset allocation between these various ETFs then ensures your account is not weighted too heavily into one specific area, company, country or sector. While this doesnt lead to outrageous returns, it prevents putting all your eggs into one basket.

The way Betterment is designed, you have access to a lot of automated options and the process is streamlined so that it requires little day-to-day involvement. Its kind of set it and forget it, compared to traditional investing options.

Easy Signup Process

The signup process is easy and takes approximately five minutes. During the process you respond to a series of short questions about your investment needs. There is also a slide bar that allows users to set the allocation of their assets (ie: 60% stocks with 40% bonds). Once the choices are selected, you must then link your personal checking account. Money can be transferred into the Betterment account whenever you desire or you can setup an automated deposit.

Graph with possible investment outcomes

Model Portfolio

When I first reviewed Betterment, their stock asset allocation was slightly different than what is available today. Originally, Betterment did not include international equities and only included TIPS for the bond portfolio. They have since fixed this with the new model portfolio and it was a much needed improvement.

Stock Portfolio Makeup

- Vanguard U.S. Total Stock Market Index ETF (VTI )

- Vanguard U.S. Large-Cap Value Index ETF (VTV )

- Vanguard U.S. Mid-Cap Value Index ETF (VOE )

- Vanguard U.S. Small-Cap Value Index ETF(VBR )

- Vanguard FTSE Developed Market Index ETF (VEA )

- Vanguard FTSE Emerging Index ETF (VWO )

Bond Portfolio Makeup

- iShares Short-Term Treasury Bond Index ETF (SHV )

- Vanguard Short-Term Inflation Protected Bonds ETF (VTIP )

- Vanguard U.S. Total Bond Market Index ETF (BND )

- iShares National AMT-Free Muni Bond Index ETF(MUB )

- iShares Corporate Bond Index ETF(LQD )

- Vanguard Total International Bond Index ETF (BNDX )

- Vanguard Emerging Markets Government Bond Index ETF (VWOB )

Betterments portfolio is now much more diversified, and includes low-cost, liquid, index-tracking, ETFs. Their tax-efficient algorithm is geared towards maximizing your moneys ability to grow.

The percentage of the ETF allocation is no longer fixed either. Depending upon your allocation of stocks-to-bonds, Betterment adjusts the allocation of each individual ETF to meet the efficient frontier. In plain English: this means Betterment has optimized the portfolio to give you the best performance possible.

All the ETFs Betterment has selected are great picks. They all follow their respective index very closely, are very liquid (which lowers the bid/ask spread), tax efficient and low annual fees.

Even with these recent changes in their asset allocation, I would like to see some additional asset classes (such as commodities and REITs).

Though Betterments portfolio should be more than adequate for someone investing less than $100,000. Betterment no longer offers custom portfolios if you have over $100,000 in assets. Betterment now requires $500,000 for custom portfolios. Though based upon the new portfolio mix the need for customization (except as I mentioned sectors above) is almost now nil.

Tax Loss Harvesting

In June 2014, Betterment announced a new service called Tax Loss Harvesting, which helps boost your after-tax returns and is twice as effective as other TLH strategies. Basically, an investor with Betterment can improve their after-tax returns by capitalizing on investment losses.

This service doesnt require any action on your part and is fully-automated for Betterment customers. The extra growth within the investment portfolio has been studied and found that it offers no additional risk or cost. See the graph below:

Is tax loss harvesting right for you? According to Betterment. tax loss harvesting is best for the majority of investors who can write off losses against capital gains, and have up to $3,000 of ordinary income. If youre in a high tax bracket, and start using tax loss harvesting now, the more beneficial this service will become over time.

Betterment Fees

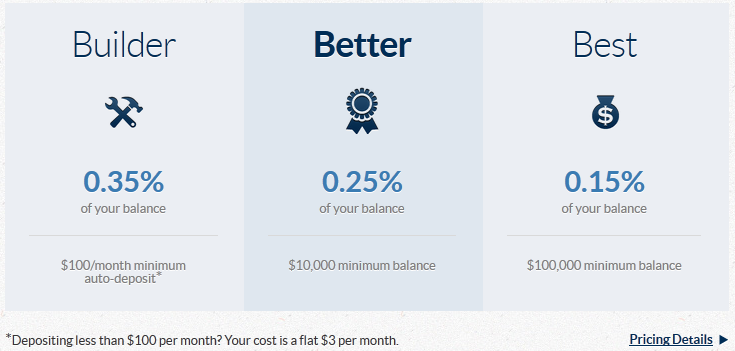

The great thing about their service is you can start with little money to invest and the fees are quite low (0.35%). Once you get past $10,000, they decrease the annual fee to 0.25%. Past $100,000 invested with Betterment and it lowers to 0.15%.

While you can start with no money, they do request you deposit at least $100/month. Otherwise you get charged an additional $3 per month, if under $10,000. I do think its a great idea on their part. It does create some forced savings and I have no issue with their pricing. This fee structure translates to about $17.50 a year on an account with a $5,000 balance.

Summary

Betterments service makes it super easy to implement a savings plan. You can setup a new taxable account in minutes, or transfer an existing 401(k) or IRA account.

Betterment is a perfect starting point for young investors. It helps teaches the ropes to investing and more importantly, proper asset allocation. This, in my opinion, is a good thing as too often I hear about inexperienced investors with poor, or no, asset allocation. Their fees are low enough if you have a less than $10,000 to invest that it wont eat away too much of your investments.

Without question, the fees are much lower than if you were to hire a professional money manager. If anything, with a professional money manager you would get similar or lower returns but pay much more in management fees.

Their goal setting feature makes their service somewhat unique and perfectly visualizes the steps required to meet your objectives. Though this feature is available in some personal finance apps (like Quicken ), Betterments is one of the best available either online or offline.

For the more advanced investor or higher net worth individual, Betterment might not be the perfect fit. If you can roll your own asset allocation and know investment theory, theres little need for using a service like Betterment. The more advanced investor will do better with a more diverse asset allocation selection and save money in annual fees in the process.

Individuals with more than $100,000 and do not want to do it themselves, Personal Capital might be a better option. Typically individuals with that level of net worth or greater have a much more complex investment portfolio. Unlike Betterment, Personal Capital has access to see your entire net worth. This allows them to get more holistic view of your life. Betterments asset allocation is cookie cutter and makes it somewhat limited for more advanced needs. Keep in mind Betterment does not know about or have access to other accounts outside of their service.

When we first reviewed Betterment, we gave them three and half out of five stars. This was mainly because of their high annual fees and limited asset allocation. But with the decreases in their fees and some improvements in their asset allocation, Betterment is an almost perfect investment service. We now rate them five out of five stars.

Disclosure: I have over $13,000 invested with Betterments service since August 2012.