Best Vanguard Money Market Mutual Funds 2014

Post on: 19 Июнь, 2015 No Comment

2014 list of best Vanguard money market mutual funds with top ratings. Highest performing, recommended money market funds for IRA/brokerage account investors in the last 10 years: VMMXX, VOHXX, VMSXX, VPTXX, VNJXX, VCTXX, VYFXX

Best Vanguard Money Market Funds for 2014

Money market funds invest in high-quality, short-term securities. Their goal is to maintain a stable value while providing income.

Who should invest

Investors who want the most conservative type of mutual fund.

What to keep in mind

- Designed for savings that you want to preserve, but also want to earn income on.

- Provide convenient access to your savings; write checks or transfer money electronically to and from your bank account.

Vanguard Prime Money Market Fund (VMMXX)

Strategy

Vanguard Prime Money Market Fund seeks to provide current income and preserve shareholders’ principal investment by maintaining a share price of $1. As such it is considered one of the most conservative investment options offered by Vanguard. Although the fund invests in short-term, high-quality securities, the amount of income that a shareholder may receive will be largely dependent on the current interest-rate environment. Investors who have a short-term savings goal and seek a competitive yield may wish to consider this option.

The fund has returned 0.02% over the past year, 0.04% over the past three years, 0.34% over the past five years, and 1.77% over the past decade.

Vanguard Ohio Tax-Exempt Money Market Fund (VOHXX)

Strategy

Vanguard Ohio Tax-Exempt Money Market Fund—designed only for Ohio residents—seeks to provide federal and Ohio state tax-exempt income and preserve shareholders’ principal investment by maintaining a share price of $1. As such it is considered one of the most conservative investment options offered by Vanguard. Although the fund invests in short-term, high-quality securities, the amount of income that a shareholder may receive will be largely dependent on the current interest rate environment and the availability of eligible Ohio municipal securities. Investors in a higher tax bracket who have a short-term savings goal and seek a competitive tax-free yield may wish to consider this option.

Returns

The fund has returned 0.03% over the past year, 0.07% over the past three years, 0.33% over the past five years, and 1.37% over the past decade.

Purchase info: minimum initial investment is $3,000; an expense ratio is 0.16%.

Vanguard Tax-Exempt Money Market Fund (VMSXX)

Strategy

Vanguard Tax-Exempt Money Market Fund seeks to provide federally tax-exempt income and preserve shareholders’ principal investment by maintaining a share price of $1. As such it is considered one of the most conservative investment options offered by Vanguard. Although the fund invests in short-term, high-quality securities, the amount of income that a shareholder may receive will be largely dependent on the current interest rate environment and the availability of eligible municipal securities. Investors in a higher tax bracket who have a short-term savings goal and seek a competitive tax-free yield may wish to consider this option.

Returns

The fund has returned 0.03% over the past year, 0.06% over the past three years, 0.32% over the past five years, and 1.37% over the past decade.

Purchase info: minimum initial investment is $3,000; an expense ratio is 0.16%.

Vanguard Pennsylvania Tax-Exempt Money Market Fund (VPTXX)

Strategy

Vanguard Pennsylvania Tax-Exempt Money Market Fund—designed only for Pennsylvania residents—seeks to provide federal and Pennsylvania state tax-exempt income and preserve shareholders’ principal investment by maintaining a share price of $1. As such it is considered one of the most conservative investment options offered by Vanguard. Although the fund invests in short-term, high-quality securities, the amount of income that a shareholder may receive will be largely dependent on the current interest rate environment and the availability of eligible Pennsylvania municipal securities. Investors in a higher tax bracket who have a short-term savings goal and seek a competitive tax-free yield may wish to consider this option.

Vanguard New York Tax-Exempt Money Market Fund (VYFXX)

Strategy

Vanguard New York Tax-Exempt Money Market Fund—designed only for New York residents—seeks to provide federal and New York state tax-exempt income and preserve shareholders’ principal investment by maintaining a share price of $1. As such it is considered one of the most conservative investment options offered by Vanguard. Although the fund invests in short-term, high-quality securities, the amount of income that a shareholder may receive will be largely dependent on the current interest-rate environment and the availability of eligible New York municipal securities. Investors in a higher tax bracket who have a short-term savings goal and seek a competitive tax-free yield may wish to consider this option.

Returns

The fund has returned 0.02% over the past year, 0.05% over the past three years, 0.27% over the past five years, and 1.31% over the past decade.

Purchase info: minimum initial investment is $3,000; an expense ratio is 0.16%.

Vanguard New Jersey Tax-Exempt Money Market Fund (VNJXX)

Strategy

Vanguard New Jersey Tax-Exempt Money Market Fund—designed only for New Jersey residents—seeks to provide federal and New Jersey state tax-exempt income and preserve shareholders’ principal investment by maintaining a share price of $1. As such it is considered one of the most conservative investment options offered by Vanguard. Although the fund invests in short-term, high-quality securities, the amount of income that a shareholder may receive will be largely dependent on the current interest rate environment and the availability of eligible New Jersey municipal securities. Investors in a higher tax bracket who have a short-term savings goal and seek a competitive tax-free yield may wish to consider this option.

Returns

The fund has returned 0.02% over the past year, 0.05% over the past three years, 0.28% over the past five years, and 1.32% over the past decade.

Purchase info: minimum initial investment is $3,000; an expense ratio is 0.16%.

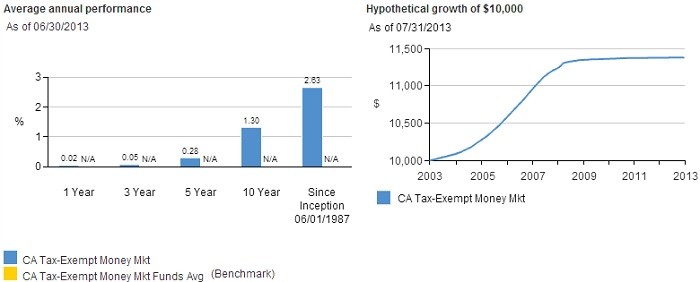

Vanguard California Tax-Exempt Money Market Fund (VCTXX)

Strategy

Vanguard California Tax-Exempt Money Market Fund—designed only for California residents—seeks to provide federal and California state tax-exempt income and preserve shareholders’ principal investment by maintaining a share price of $1. As such it is considered one of the most conservative investment options offered by Vanguard. Although the fund invests in short-term, high-quality securities, the amount of income that a shareholder may receive will be largely dependent on the current interest rate environment and the availability of eligible California municipal securities. Investors in a higher tax bracket who have a short-term savings goal and seek a competitive tax-free yield may wish to consider this option.