Best Etf Portfolio For Retirement 2015

Post on: 18 Апрель, 2015 No Comment

Sponsored Links

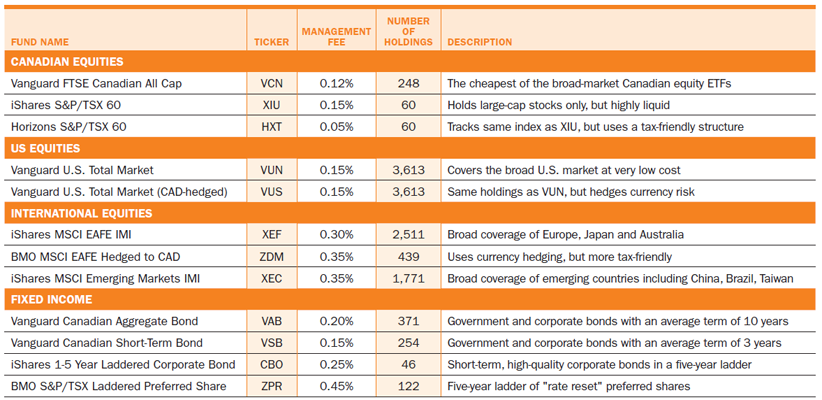

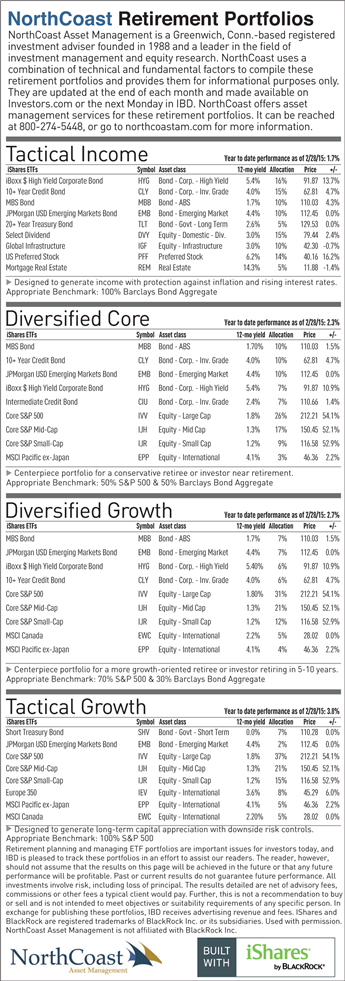

3A%2F%2Fwww.forbes.com%2F?w=250 /% A popular recent article in the New York Times suggested that Americans who aren’t saving enough for retirement of portfolio returns over time. One answer to this problem is to choose a few simple low-fee investments like passive funds and ETFs

3A%2F%2Fseekingalpha.com%2F?w=250 /% In December 2014, a new actively managed ETF was issued by Validea Capital Management The ten models earning the highest scores are selected for use in the portfolio, and the top ten companies selected by each model becomes a portfolio holding

3A%2F%2Fwww.fool.com%2F?w=250 /% Ask around, and you’ll likely get the same answer: Saving for retirement isn’t as easy as it sounds you can add a bit more focus and control to your portfolio by purchasing index funds or ETFs. An index fund will track the return of an index such

3A%2F%2Finvestorplace.com%2F?w=250 /% The good news: When it comes to securing a successful retirement records have rivaled the best of any breed — from ballyhooed hedge funds and smarty-pants institutional endowments to soporific index funds and ETFs. But not all Fidelity managers

3A%2F%2Fetfdailynews.com%2F?w=250 /% That creates a real problem for retirement investors Now, you can’t just jump into all high-growth stocks and hope for the best. You have to take a new look at your portfolio and take a reasoned approach on how to adjust it. That’s going to

3A%2F%2Fwww.newsmax.com%2F?w=250 /% Three factors are crucial when you’re searching for retirement investments — safety The second fund Waggoner likes is the Schwab U.S. Dividend Equity ETF (SCHD). If you’re looking for a portfolio of large-company stocks with a long history of

3A%2F%2Fwww.thestreet.com%2F?w=250 /% Options for Retirement Accounts / Incorporating Your Stock Plan Assets (Online) 6:00 — 8:00 pm Local: One of the following in-person sessions at branch locations: Fundamentals of Building a Long-Term Portfolio Essential Steps for Planning a Secure

3A%2F%2Fblogs.wsj.com%2F?w=250 /% Many face questions (on mortgages, insurance, estate planning or retirement U.S. Broad Market ETF, an index fund that mimics the return on about 2,500 stocks, charges only 0.04% in annual expenses. But Schwab’s robo-portfolios won’t be dominated

3A%2F%2Fwww.mainstreet.com%2F?w=250 /% Here are some top ETF ideas for your retirement savings can serve as an ideal complement for retirement savers looking to build a well-balance portfolio. “The technology sector represents the largest contributor of dividends of any sector in the