Best 401k Rollover Brokerage Firm 2015

Post on: 28 Август, 2015 No Comment

Best 401k Account Rollover Broker Commissions

Scottrade Trading Tools

Scottrade is a widely known online investment platform. The company was founded in 1980 and their investment services are used by millions of customers in the United States. Scottrade offers many services, including IRAs, 401(k)s, and trusts; but they are best known for their online brokerage services. This article will focus on reviewing Scottrade’s 401(k) plan offering. Before getting started with the full review, it will give a brief overview of what, exactly, a 401(k) is. After the explanation it will launch into an analysis of Scottrade’s website, navigation, investment options, portfolio management, extra resources, and then end with a summary.

What’s a 401(k)?

A 401(k) is, simply, an employer sponsored retirement plan that first started use in 1980. Since then, they have gained popularity with employers for their relatively low cost when compared to pension plans. In addition to this, they also offer the retiree much more control over their retirement funds.

As the description implies, an individual must be employed and making an income with an employer who provides a 401(k) plan to qualify. When setting up the 401(k) plan, the employer chooses the company, funds, matching rates, etc. that will be included in the plan.

After this, employees are able to opt-in to the plan. The employee sets their contribution rate, allocates funds, and sits back and watches the money grow. There are rules regarding the withdrawal and transfer of the money within the account, among other things. This is all detailed when signing up for the plan.

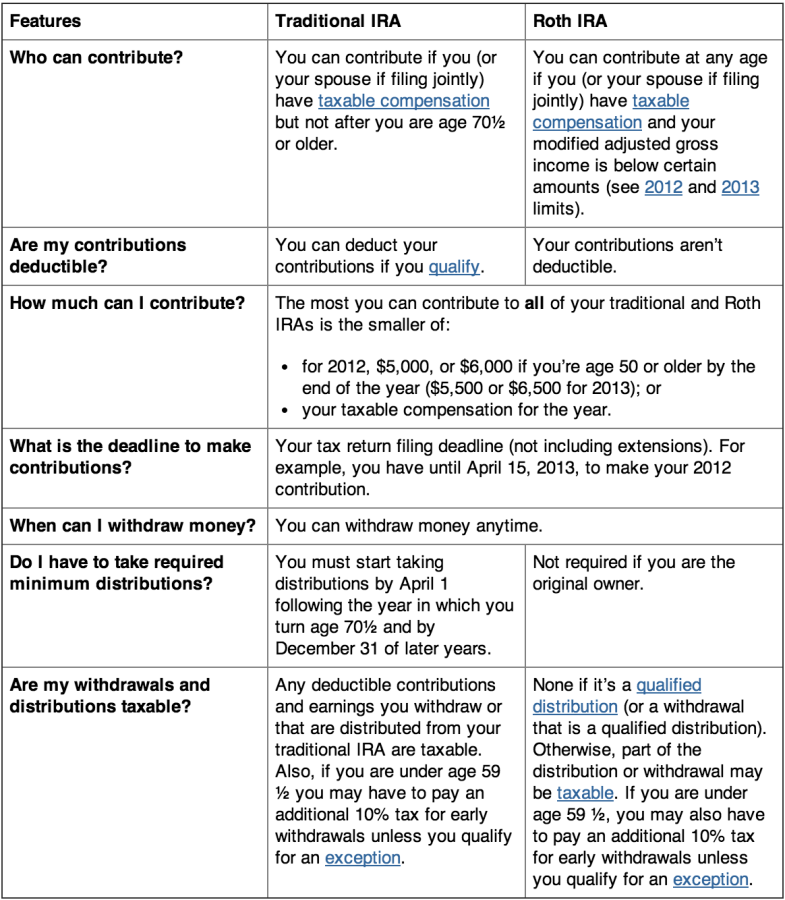

The main benefit of the 401(k) is that it offers tax-advantaged growth. Traditional 401(k)s allow plan participants to invest money pre-tax, while withdrawals are taxed as income in retirement. The Roth 401(k) option allows plan participants to contribute money after-tax, but they can withdrawal money tax-free.

There are many more intricacies to 401(k)s, but this section is only intended to provide a foundation for the full review.

Website and Navigation

Scottrade’s website is very cluttered and outdated. For starters, there are six different tabs and navigation bars, and the main frame is saturated with information. This is, understandably, very confusing and alienating to a new user. The learning curve is pretty steep too, taking hours of use to be able to figure out how to get the most out of the site.

Fortunately, once a user knows their way around they’ll be able to use this tool to its full potential. The Scottrade website allows users to access an almost overwhelming amount of information. Plan participants can look into the funds’ Morningstar reports, daily market information, performance analysis, retirement calculators, and more. These offerings make it very easy for investors to pick and choose their investment options for retirement.

Investment Options

As mentioned in the description section above, the employer selects the funds that are available in their 401(k). For participants, this means that they can only choose investment options from the “basket” of funds preselected by their employer.

Typically, most funds are around the average expense ratio of 1%. There are some that are much lower, but they aren’t available to everyone. Luckily, fund analysis is made very easy by all of the wonderful tools discussed above.

Portfolio Management

Scottrade makes it fairly easy to manage the account’s portfolio. The main page displays the gains in percent and dollars. Participants can also easily change their contribution ratios and investment ratios. Unfortunately Scottrade doesn’t seem to offer automatic rebalancing, so participants will have to keep an eye on that themselves.

Extra Resources

Scottrade’s website, as mentioned above, contains a huge amount of information that plan participants can use to increase their investment knowledge. Surprisingly, they offer even more on top of the already great (and free) Morningstar fund ratings and reports, daily market digests, and performance analysis.

These include webinars, podcasts, and question and answer segments found in the “Knowledge Center”. The webinars aren’t very frequent, but they offer very good information and are definitely worth watching when they happen. The podcasts are a great way to have investing advice and market insights everywhere, and without having to be tied to a computer. Question and answer posts are a great way to learn about commonly asked questions, and a great location to ask anything that’s been on your mind.

Scottrade also has very good customer service. Their online customer service has a fast response time and they give quality answers. They also have a national phone line that’s operated most hours of the night. During normal business hours, that number redirects to the participant’s closest Scottrade branch.

The in-person branches are great for people looking for a more personal touch. The employees aren’t allowed to give you investment advice, but they can answer any questions you have about the platforms, laws, taxes, and investing in general.

Summary

Overall, Scottrade offers a very good option in the 401(k) market. Scottrade has a very strong showing when it comes to educational materials, fund selection, and analysis.

401(k)s are a fantastic vehicle to save for retirement. In 2015, individuals can put in $18,000 per year, which can grow tax-free. This alone provides enough reason to contribute to an employer sponsored 401(k) plan, regardless of the provider. Just bear in mind that Scottrade’s website will take a little longer to understand than others.