Benefit with Backspreads

Post on: 28 Июль, 2015 No Comment

Options Expert

One of my favorite types of trades is called the backspread. Its another one of those trades where you can make money in several different ways, but like every other trade and strategy that I know of, its not foolproof you can also lose money. I keep looking, but I just cant seem to find all the free money trades that some advertisers say are out there! Before we get started, I have some important options news to share with you.

**Options Alert** Earlier this month, on Tuesday July 15th to be precise, the CBOE started publishing the CBOE Crude Oil Volatility Index with ticker symbol OVX. Using the same methodology that is used to calculate the VIX, the OVX represents a 30 day implied volatility (IV) of crude oil prices. The calculation is based on options on the United States Oil Fund, LP (USO). A complete description of the methodology and historical prices is available at www.cboe.com/oilvix. As of now, there is no way to actually trade this volatility product, although it has been predicted that in a relatively short period of time options and/or futures trading on OVX will become available. Several options gurus have also predicted that before too long there will be VIX type calculations on some of the individual large capitalization stocks. And then there will be futures and options on those, and thenâ¦.

Wow, with all these new products Im sure there will be lots of profit making opportunities. The key to finding them will be in understanding exactly how the products work and how to take advantage of any mis-pricings or inconsistencies. Online Trading Academy will continue to provide the education you need to stay ahead of the pack.

Back to Backspreads. Unfortunately, the nomenclature in the options industry is not precise, and in the past some serious mistakes have been made because of this. So lets start the discussion with a definition:

Definition: A Backspread is a delta neutral options position that consists of more long options than short options on the same underlying stock. Backspreads can be established with either Puts or Calls in the same expiration month. There is also a Calendar or Diagonal Backspread which has more options being bought in a far month than are being sold in a near month. Those spreads will not be discussed in this article, but will be the subject of a future article.

To make the Backspread delta neutral, the ratio of long to short options is usually somewhere in the neighborhood of 2:1 or 3:2. Extreme ratios should be avoided. Lets look at an example of a Call Backspread using my favorite hypothetical stock XYZ. With XYZ @ 100, and

the Sept 90 Call @ $12 with a delta of 80, and the Sep 100 Call @ $6 with a delta of 55.

If we sell 5 of the 90s and buy 7 of the 100s, well have a position that is net short 15 deltas, which is close to delta neutral. Its calculated as follows: -5 x 80 + 7 x 55 = -15.

Also note, that the net cost of putting on this position is a credit of $1,800, calculated as -5 x $1,200 + 7 x $600 = -$1,800.

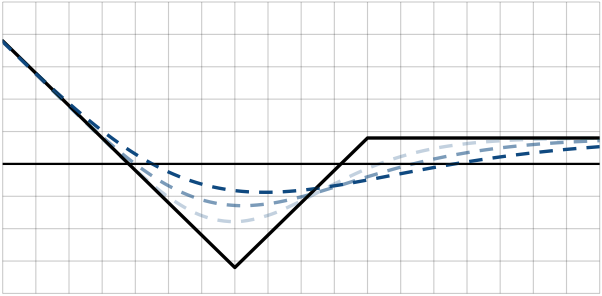

At expiration, the graph of this position will look like this:

(I think It would help you to understand this topic if you could draw a graph of a Put Backspread. Try it and if you have trouble just send me an email.)

Three things become immediately apparent when looking at this graph:

1) There is unlimited gain potential on the upside.

2) There is a limited gain potential on the downside.

3) The worst place for the stock to end up at expiration is where the 2 diagonal lines meet, which is the strike price of the long options.

From the graph it looks like the breakeven points (where the graph crosses the horizontal axis) are about $94 on the downside and about $115 on the upside. Lets see if we can determine exactly where these breakeven points are. We know that at $90 or below both the 90 and 100 Calls are worthless, so we keep the credit of $1,800. As the stock price goes up from $90 towards $100, the 100s will still be worthless, but the 90s will be losing $500/point, since we are short 5 of them. If we take the $1,800 credit and divide it by 500, we see that if the stock moves up 3.6 points (1800/500) to $93.60, well be at exactly breakeven.

If the stock continues to climb to $100, we will have lost a total of 10 points (from 90 to 100) 5 times or, $5,000. But we had the initial $1,800 credit, so the maximum loss is $3,200. Things get better from this point. For every $1 increase in stock price, the position is now gaining $200. So the upside breakeven point is going to be 16 (3200/200) points higher than $100 or $116.

I went through this in some detail because I get many emails from readers asking me how to calculate the breakeven points of a spread. Keep in mind that this is just basic arithmetic, nothing fancy.

We could also notice from the graph that it looks similar to a ratioed Straddle. The difference of course is that there is not unlimited gain on the downside. On the other hand, the cost is much less and in this case, it is being put on for a net credit. Its not always possible to get a credit when putting on a Backspread and so sometimes theyre done for a small debit.

What else can we determine about Backspreads? Lets look at the Greeks.

Price - This one is easy, we put the position on delta neutral, so we know a small move up or down in the price of the stock should not have much of an impact in the value of the spread initially. However, the gamma of the position is positive, indicating that a large move in the price helps the position.

Time - This position has negative theta, so time is working against you. That implies that you might not want to put this position on close to expiration.

Volatility - This position has positive vega, so an increase in IV is helpful. Also, since the crash of 1987, most index options and many stock options exhibit a reverse (or negative) vertical skew. That means that the lower strikes trade with a higher IV than the higher strikes. When putting on a Call Backspread, that is exactly what we want; sell the higher IV and buy the less expensive IV. This is also the reason that Put Backspreads have lost some of their appeal and have come out of favor. A Put Backspread would require you to buy the expensive IV and sell the cheaper IV, not recommended.

Now we can put it all together and see when it makes sense to use the Call Backspread. You want a situation where youre very bullish on a stock, and expect a large move. A large move to the downside is better than no move at all. You want to go out at least 2 months and up to 5 or 6. Youre expecting the IV of the options to increase and finally you want to put the position on for a net credit or a very small debit. If these conditions are met, the Backspread will have a high probability of success. It is a common and useful strategy and one that you should become familiar with.

As always, if you have any questions about my articles, have suggestions for future topics, or want more information about our options mentoring program, feel free to email me at: sfreifeld@tradingacademy.com or call me at: (888) OTA-2580 ext. 2010.