Bearish Butterfly Option Strategy

Post on: 8 Апрель, 2015 No Comment

Strategy: Butterfly, Bearish

The Outlook: Bearish. Expecting a drop in the stock before the expiration of the options. Entering when volatility is high is preferable.

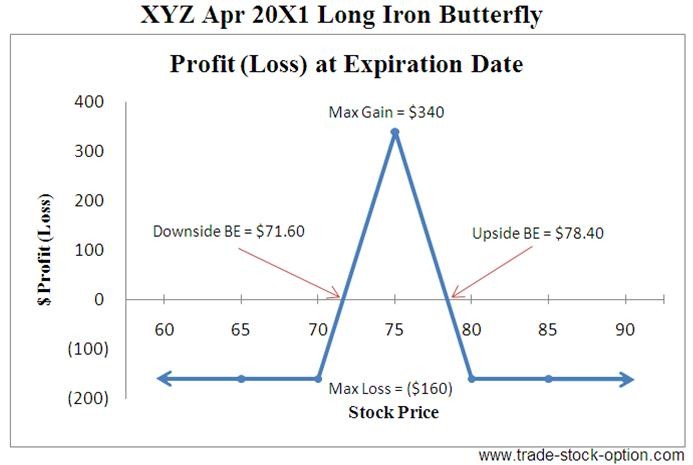

The Trade: For the trade graphed above, an Iron Butterfly, sell puts and calls at the next strike below the current stock price, buy calls one strike higher and buy puts one strike lower than the short strike.

Gains when: Stock moves to and stays in a narrow range near the sold strike.

Maximum Gain: On an Iron Butterfly, limited to the initial credit.

Loses when: Stock does not fall to the lower breakeven point, or moves beyond the lower breakeven point.

Maximum Loss : Limited to the largest difference in strike prices on one side times the number of shares represented, less the initial credit.

Breakeven Calculation: (For an Iron Butterfly) Lower breakeven = sold strike price — initial credit. Upper breakeven = sold strike price + initial credit.

Advantages compared to short stock: Increased leverage, much less capital required, built-in stop loss, can gain from a drop in implied volatility.

Disadvantages compared to short stock: Will lose if stock falls too much.

Volatility: after entry, increasing implied volatility is negative.

Time: after entry, the passage of time is positive.

Margin Requirement : Most options-oriented brokers will require the difference in the strike prices x the number of shares represented, reduced by the amount of credit taken in. In the example above the margin would be $187.

Variations: Use all calls or all puts. An Iron Butterfly is called Iron because it uses both puts and calls.

Synthetic Equivalent:

- A Butterfly trade is an anti-gambler’s trade. There is a good chance of a small profit, and a small chance of a loss. If you manage the trade so that you only take relatively small losses and not the maximum possible loss, you increase your chances of coming out ahead over the long term.

- A Butterfly trade can be thought of as a safer alternative to selling a Straddle. Just selling a Straddle could expose you to unlimited losses. The long options that are part of the Butterfly trade serve to limit losses to a manageable amount, even if the stock moves unexpectedly beyond one of the breakeven points.

- Butterfly trades require a large commission expense. Entering the trade will cost four commissions, and if you need to exit early there will be another four commissions. If you do not use the lowest-commission discount option brokers, the Butterfly trade might not make much sense. With most brokers, using more contracts will result in lower per-leg commissions overall and might make the trade reasonable.

- The Butterfly is an anti-volatility trade: it will benefit from a drop in volatility. For this reason the Bearish Butterfly is a possible strategy to use at earnings time on a stock whose volatility has risen, and you expect some downward movement in the stock. After the earnings are out, the options may experience a volatility crush, meaning they drop back to normal volatility, and the trade may benefit from that drop as well as the drop in the stock price.

- Another scenario is a stock trading within a channel, that has recently risen to the top of the channel or above. If you think the move is over-enthusiastic, and especially if the implied volatility has risen because of too much enthusiasm, a Bearish Butterfly could be a good strategy. If the stock falls back within the channel and the volatility drops as enthusiasm wanes, a Bearish Butterfly would benefit from both the drop in the stock price, and the return to a normal (lower) implied volatility.

- The Bearish Butterfly can be used as a limited-protection strategy for stock owners. Using the example graph for instance, this strategy could be employed by someone committed to owning the stock who thought there was a possibility of the stock dropping to 45 after a disappointing earnings report. Buying an ATM 50 strike Long Put for protection would cost $189, and would gain by $311 if the stock did fall to 45. Using the Bearish Butterfly, the entry is made for a credit, the maximum possible loss is $130, and the strategy would gain by $370 if the stock fell to exactly 45. The tradeoff is that the protection with the Bearish Butterfly falls off rapidly below the sweet spot, whereas the Long Put would continue to gain.

- If you have a bearish outlook, but want to benefit from an increase in volatility, the Calendar Call, ITM is a similar strategy. Plus, it requires only two commissions.

- The Butterfly strategy gets it’s name from the graph. It reminded traders of a small creature with wings. Compare to the Condor graph, that looks like something bigger with wings.

- The Bearish Butterfly trade gains if the stock moves to a narrow range around the short strike and time passes. If the stock rises, or moves beyond the lower breakeven at any time, the losses can multiply quickly up to the maximum possible. Using the graph at the top of the page, if the stock were to move to 40 or 51 at any time, it would be wise to cut the losses short at about $50, which is about half of the maximum possible loss.

- If the reason for entry was to capture a decline in volatility, then an exit when the volatility drops makes sense.

- This trade is similar to the Calendar Call in that the closer you are to expiration, the greater your risk of giving back any gains you have. For this reason, it may be a good idea to exit Butterfly trades when there is a week left to expiration. See the Delta Neutral Trading page for more information.

Just like the normal Butterfly, the Bearish Butterfly strategy can be set up with all Calls or all Puts, and the graph is nearly identical to the Bearish Iron Butterfly. The main difference is the Iron Butterfly is entered for a credit, whereas the strategy using all calls or all puts has an initial debit. See the Butterfly page for graphs with all calls or all puts.

If you are more bearish than might make sense with a normal Bearish Butterfly, you can use a modified Bearish Butterfly as shown in the graph below. This strategy will show greater gains at the sweet spot, and will not lose at any price if the stock drops. The tradeoff is that there is more of a loss if the stock rises. The modified Bearish Butterfly is constructed by buying the long call one strike higher than normal. Your broker will require more margin for the modified Butterfly — up to $1000 on the example shown.

Before using a modified Bearish Butterfly, it makes sense to compare it to a Bear Call using similar strikes, as shown below. The Bear Call will respond more quickly to a drop in prices, keeps the gains on any drop beyond the short strike, and requires fewer commissions. The modified Bearish Butterfly will respond more quickly to a drop in implied volatility and allows for very slight stock price movement to the upside.