Basel III liquidity requirements and implications Regulatory rules’ operational and strategic

Post on: 16 Март, 2015 No Comment

Regulatory rules’ operational and strategic implications

An outcome of the crisis—Basel III—has been recognition by regulators and financial institutions alike that liquidity is of equal importance and must be addressed in a comprehensive risk management framework.

In December 2010, the Basel Committee on Banking Supervision issued Basel III: International framework for liquidity risk measurement, standards and monitoring. This step coincides with its release of enhanced capital standards and completes the reformed framework called for by G20 leaders.

Basel III: new global standards

Collectively, these new global standards, referred to as Basel III, are intended to strengthen the resilience of global banking institutions. Before the financial crisis, the focus of banking regulators was primarily on capital.

One outcome of the crisis, however, has been recognition by regulators and financial institutions alike that liquidity is of equal importance and must be addressed in a comprehensive risk management framework.

Consequently, most large financial services firms have made significant investments in their liquidity risk management frameworks. The current focus of leading institutions is to enhance their reporting and stress testing capabilities through investments in data and technology infrastructure, as well as to incorporate liquidity formally within their enterprise risk and funds transfer pricing frameworks.

The management of funding and liquidity is increasingly a core part of the strategic planning framework and proactive balance sheet management. The new Basel III liquidity rules mark the first time that specific global quantitative minimum standards for liquidity have been introduced. Monitoring of the new standards commenced as of year-end 2010.

Preparing for the new rules

Specifically, the new rules call for an additional Quantitative Impact Study (QIS) to be conducted based on year-end 2010 and mid-year 2011 reference data. Banks should anticipate a specific QIS request in the first quarter of 2011.

To provide institutions with time to develop their reporting systems, the first observation-period reporting to supervisors is expected by January 2012 for both standards. The liquidity coverage ratio (LCR) will have to be met from January 2015, with any revisions to its calibration to address unintended consequences issued by mid-2013.

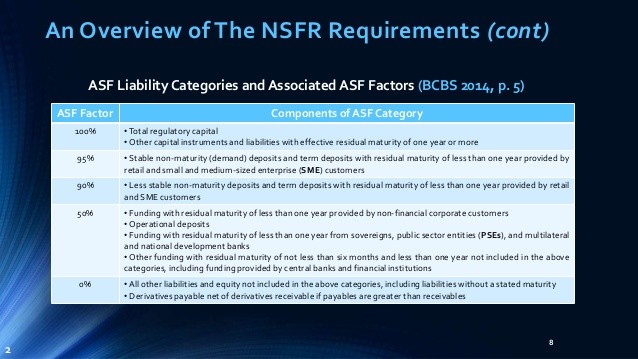

The net stable funding ratio (NSFR) will undergo a longer observation period and will not be introduced until January 2018. Revisions will be made to the NSFR no later than mid-2016. Banks will also be required to observe the principles regarding governance and management of liquidity risk set out in the September 2008 Principles for Sound Liquidity Risk Management and Supervision .

These principles were also the foundation for the US Interagency Policy Statement on Funding and Liquidity Risk Management (introduced in March 2010).

The final Basel III liquidity rules, as well as global supervisory efforts such as the December 2010 report by the Senior Supervisors Group (SSG), Observations on Developments in Risk Appetite Frameworks and IT Infrastructure . provide a global foundation that should help to harmonize the regulatory and infrastructure expectations for liquidity being defined by supervisors.

In the US, the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank) calls for enhanced prudential requirements for liquidity and capital for financial services institutions. Consequently, US supervisors have been working to define expectations for enhanced capabilities for funding and liquidity, including how these capabilities are incorporated within enterprise-wide initiatives such as recovery and resolution planning.

Noteworthy additions and changes since July 2010

The detailed fourth generation (4G) daily liquidity reporting being rolled out by the US Federal Reserve for large financial institutions is an example of the direction of supervisory expectations. While the final Basel III rules for liquidity are consistent with the original proposal and the July 2010 follow up press release, there are noteworthy additions and changes to assumptions.

- National discretion. Since the Basel liquidity rules are minimum standards, national differences will occur, particularly in those items subject to national discretion, such as reporting formats, as well as assumptions for deposit runoff rates, contingent funding obligations and market valuation changes on derivatives.

The rules specify that where differences exist, the home supervisor parameters should apply to all entities being consolidated, except for retail or small business deposits, where local assumptions should be used. This means that global banks will need to monitor parameters set by the local supervisors in the countries where they take deposits and to develop the flexibility to incorporate these differences in their risk analyses.