Basel II Accord To Guard Against Financial Shocks

Post on: 16 Март, 2015 No Comment

The world financial market is an extremely complex system that involves many different participants from your local bank to the central banks of each nation and even you, the investor. Due to its importance on the global economy and our everyday lives it is vital that it is functioning properly.

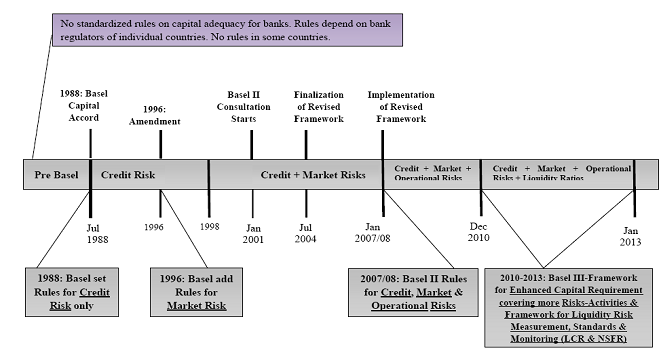

One tool that helps the financial markets run smoothly is a set of international banking agreements called the Basel Accords. These accords coordinate the regulation of global banks, and are an international framework for internationally active banks . The accords are obscure to people outside banking, but they are the backbone of the financial system; the Basel Accords were created to guard against financial shocks, which is when a faltering capital market hurts the real economy, as opposed to a mere disturbance.

In this article, we will take a look at intent of the Basel Accords and see where the markets are headed with the formation of the Basel Accord II. (For background reading, see Does The Basel Accord Strengthen Banks? and What Is The Bank For International Settlements? )

Basel Accords Determine Bank Equity Capital

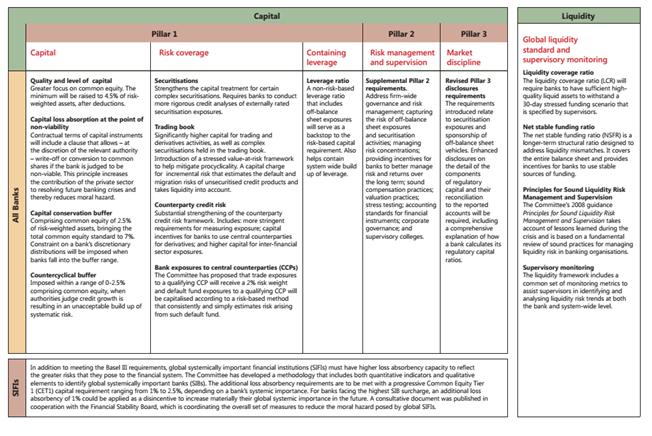

The Basel Accords determine how much equity capital — known as regulatory capital — a bank must hold to buffer unexpected losses. Equity is assets minus liabilities. For a traditional bank, assets are loans and liabilities are customer deposits. But even a traditional bank is highly leveraged (i.e. the debt-to-equity or debt-to-capital ratio is much higher than for a corporation). If the assets decline in value, the equity can quickly evaporate. So, in simple terms, the Basel Accord requires banks to have an equity cushion in the event that assets decline, providing depositors with protection.

The regulatory justification for this is about the system: If big banks fail, it spells systematic trouble. If not for this, we would let banks set their own levels of equity -known as economic capital — and let the market do the disciplining. So, Basel attempts to protect the system in much the same way that the Federal Deposit Insurance Corporation (FDIC) protects individual investors. (For more insight, read Are Your Bank Deposits Insured? )

Bank Loans — Then and Now

The traditional loan and hold bank may now only exist in a museum. Modern banks originate and distribute and they have astonishingly complex balance sheets. For example, many banks have been tilting away from long-term illiquid assets and toward tradable assets. In addition, many banks routinely securitize. That is, they sell loan assets off of their balance sheets, or achieve a similar risk transfer by purchasing credit protection from a third party, often a hedge fund indirectly. This is a called a synthetic securitization. (To learn more, read Behind The Scenes Of Your Mortgage and What is securitization? )

The Original Accord Is Broken

The Basel I Accord. issued in 1988, has succeeded in raising the total level of equity capital in the system. Like many regulations, it also pushed unintended consequences; because it does not differentiate risks very well, it perversely encouraged risk seeking. It also promoted the loan securitization that led to the unwinding in the subprime market. (For more on the subprime crisis, check out our Subprime Mortgage Feature page.)

In short, Basel I has several shortcomings. And, although some people are mistakenly implicating all of Basel in some of the problems it has created, it is too early to tell whether Basel II will fail in regard to credit derivatives and securitizations. Basel II does try to address new innovations in risk but the cost is complexity.