Balance Sheet_2

Post on: 25 Май, 2015 No Comment

Contents

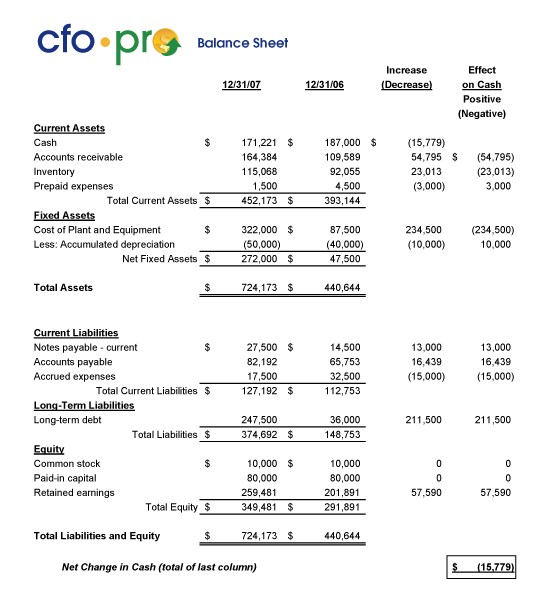

A balance sheet. or statement of financial position. provides a snapshot of a company’s assets and liabilities at a given point in time. It also shows shareholders’ equity. the net value of the company, by taking the difference between the company’s assets and liabilities. The balance sheet is one of the four basic financial statements. and is the only one which applies to a single point in time (as opposed to a given period).

Conceptually, the balance sheet is based on the accounting equation. which states that the total amount of assets must balance the total amount of liabilities and owner’s equity: Assets = Liabilities + Owner’s Equity. Hence the balance sheet is divided into these three primary sections.

Each of these sections displays the various accounts that contribute to it. For example: Cash, Inventory and Machinery are assets owned by a company — and therefore they are shown under the Assets section of the balance sheet. Similarly, Accounts payable and Mortgages go under the Liabilities section. Even though the three primary segments do not vary from one company to the next, the accounts that constitute each segment could vary depending on the type of the business. For example, a service-oriented firm such as Goldman Sachs does not display inventory on its annual balance sheet — however, that is not the case with General Electric. a manufacturing firm.

Corporate balance sheet structure

Guidelines for corporate balance sheets are given by the International Accounting Standards Committee and numerous country-specific organizations, such as the SEC in the US.

Balance sheet account names and usage depend on the organization’s country and the type of organization. Government organizations do not generally follow standards established for individuals or businesses. [1]

If applicable to the business, summary values for the following items should be included on the balance sheet: [2]

Assets

- property, plant and equipment

- investment property, such as real estate held for investment purposes

- intangible assets

- financial assets (excluding investments accounted for using the equity method, accounts receivables, and cash and cash equivalents)

- investments accounted for using the equity method

- biological assets, which are living plants or animals. Bearer biological assets are plants or animals which bear agricultural produce for harvest, such as apple trees grown to produce apples and sheep raised to produce wool. [3]

Liabilities

- accounts payable

- provisions for warranties or court decisions

- financial liabilities (excluding provisions and accounts payable), such as promissory notes and corporate bonds

- liabilities and assets for current tax

- deferred tax liabilities and deferred tax assets

- minority interest in equity

- issued capital and reserves attributable to equity holders of the parent company

Equity

The net assets shown by the balance sheet equals the third part of the balance sheet, which is known as the shareholders’ equity. Formally, shareholders’ equity is part of the company’s liabilities: they are funds owing to shareholders (after payment of all other liabilities); usually, however, liabilities is used in the more restrictive sense of liabilities excluding shareholders’ equity. The balance of assets and liabilities (including shareholders’ equity) is not a coincidence. Records of the values of each account in the balance sheet are maintained using a system of accounting known as double-entry bookkeeping. In this sense, shareholders’ equity by construction must equal assets minus liabilities, and are a residual.

- numbers of shares authorized, issued and fully paid, and issued but not fully paid

- par value of shares

- reconciliation of shares outstanding at the beginning and the end of the period

- description of rights, preferences, and restrictions of shares

- treasury shares. including shares held by subsidiaries and associates

- shares reserved for issuance under options and contracts

- a description of the nature and purpose of each reserve within owners’ equity

Uses and Limitations of the Balance Sheet

The balance sheet provides a snapshot of a company’s resources and obligations at a given point in time. Specifically, the balance sheet allows an investor to recognize a company’s future earnings capacity and its ability to meet debt obligations.Balance sheets (of the same company) from two different periods can be used to understand how the company’s financial position has changed. For example: A continuous increase in accounts receivable could hint towards the fact that not all revenues translate in to cash flow.

However, the balance sheet is limited in its ability to provide a true picture. This is mainly because of the fact that values in the balance sheet are recorded on a historical basis. For example: The current value of real-estate bought 30 years ago would not be reflected in the balance sheet.