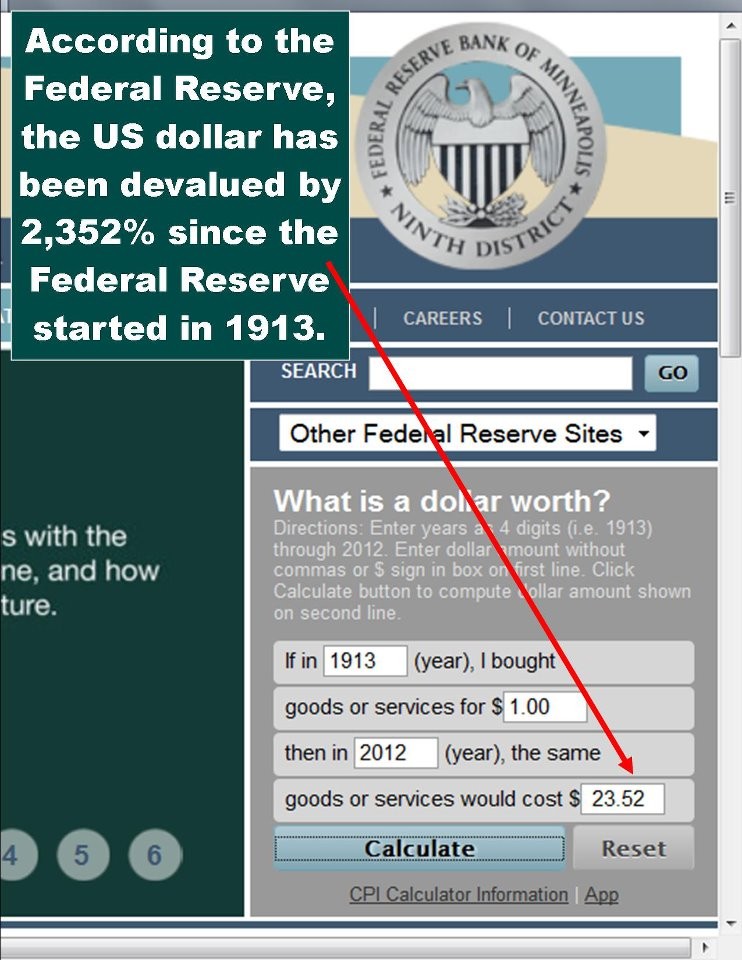

Asset Protection and US Dollar Devaluation

Post on: 7 Октябрь, 2015 No Comment

Question: Protecting yourself against the accelerating devaluation of the US dollar is a primary motive to become an ex-pat. Which countries in Caribbean/Central America are best places to relocate if asset protection is your primary motive?

First, there is a big difference between living overseas and asset protection. You dont have to take your assets with you if you relocate. It really depends on what you think you are protecting your assets from. Keeping yourself and your assets producing income in every kind of economy is the key to a prosperous and healthy lifestyle. So lets talk about some strategies to accomplish this.

Asset Protection Strategies

If you believe the US Dollar is doomed, one option is to keep your liquid assets like cash and bonds in non-US Dollar currencies. Many banks today enable you to hold foreign currencies, and foreign currency bonds, most of which will pay higher interest rates than the US Dollar. For example, Australian dollars might pay 5% 6% p.a. in a plain old savings account, and the Ozzie dollar has recently done well against the US Dollar.

You can also build a multi-currency sandwich, whereby you spread your funds across bonds of multiple currencies, all of which pay higher interest rates than US Dollars. Thus you can hedge against US Dollars while earning a significantly higher return.

However, wed argue that no currency is really safe from a major US Dollar devaluation because no country desires to have a strong currency. Most nations feel the pressure to keep their currencies low or within a trading range relative to the US Dollar, to make their products/exports cheaper. In other words, living in a country that uses US Dollars (Panama, Ecuador, El Salvador, some Caribbean nations, etc.) may not be any more risky than any other currency.

The more likely scenario is that the US Dollar does not devalue against other currencies . as much as it will devalue against commodities, precious metals, agriculture, land, energy, tangible assets. In other words food, clothing, gas; just about everything we buy is going up in price, and may continue to go up in price regardless of which currency it’s measured in. Safe haven precious metals like gold and silver have done well and should continue to do well to hedge against inflation/US Dollar devaluation.

On the flip side, as we saw during the crisis in 2008/2009 deflation can quickly become a threat and cash (even US Dollars) can become king once again. However, its our belief that deflation will only apply to assets that are tied to excessively cheap credit (eg. Miami condos and shares of Lehman Brothers). The possibility of widespread deflation is real however, as Japan is still trying to figure out how to shake it after two decades.

Buying stock in companies that stand to benefit due to rampant inflation is a good asset protection strategy (eg. food producers, energy producers, miners, etc.). In the event of a currency crisis, it is possible the world will keep making things, and your shares will still be valid. Some stocks could potentially be more valuable than any other form of currency.

Real estate is another good performer in an inflationary environment as house prices and rents tend to increase along with the price of everything else. The obvious exceptions are properties in areas where excessive leverage and/or speculation have already driven prices to unsustainable levels. Properties that generate rental income or farm income are good options in real estate, especially if long-term financing is available at low rates.

Use Of Legal Entities

Use of legal entities is another part of the asset protection puzzle. The use of trusts, foundations, corporations and other entities are often used to protect ones assets (not usually against hyperinflation/US Dollar devaluation, but against law suits, judgments, liabilities, bankruptcies, tax implications, etc.).

Moving assets to an offshore bank, using an offshore corporation, offshore trust or other vehicle is a good idea if you have significant sums to protect. In Panama for example, its common to hold bank accounts and other assets using a Private Interest Foundation or Corporation, to separate risk and liability from ones personal actions. Equivalent asset protection vehicles exist in the US, Canada and Europe, although a structure held offshore is arguably better protected depending on your situation.

Further research in this area requires expert professional advice and is beyond the scope of this article. Retire Worldwide Research Members gain access to our recommended attorney in Panama City, Panama who can advise on asset protection structures both in Panama and in other jurisdictions.

Lifestyle Protection Strategies

If you are thinking of relocating, it would also be beneficial to live in a country with plenty of its own food, water and energy supply. Nations that import the bulk of their food would be at a severe disadvantage as countries with surplus stop exporting and start hoarding. That said, Canada and the United States are both net food exporters the US big problem is its reliance on imported oil to fuel its highway-dependent distribution network.

So countries that are more self-sufficient on a global trading scale should be better off. For example, Panama largely feeds itself, produces its own electricity, and has plenty of its own water. The Philippines, Indonesia, as well as many parts of Africa, are examples of countries that import a lot of their food. In the case of an extreme global inflationary environment, it would be every nation for itself and the have-nots would end up paying exorbitant prices for basic goods. If you dont want to be a farmer, and you are worried about rising costs, live in a community that produces a lot of food.

Hobby Farming

Production of your own agriculture would be an excellent strategy to ride out any inflation or currency crisis. The hobby farmer lifestyle is more feasible in Central and South America compared to North America, where long growing seasons provide local food production year round. Tropical countries tend to be less reliant on the mass scale food distribution system like we have in the United States.

Small scale agriculture is a great way to generate cash flow regardless of currency turmoil. In the event of hyperinflation, having your own source of food, water and energy is the ultimate asset protection. And even if the world doesnt end, or if we hit deflation, youll be producing food which is always in demand. And munching from your own backyard which is bound to be healthy and fun.

Here are a couple of hobby farms for sale in Panama:

Pedasi Panama 28 Acres $119,000

Penonome Panama 5 Acres $79,000

Half Full or Half Empty?

Some people believe the strains of hyper-inflation would drive the U.S. economy into collapse. As peoples dollar savings lose value, it would lead to panic buying, and result in societal chaos. However, pessimism is not the answer to lasting fulfillment. The real key is to stay in the moment, be nimble and alert, and be happy wherever you are, because if the end of the world doesnt come, youll wish you hadnt worried so much.