Asset liability management Wikipedia the free encyclopedia

Post on: 20 Июль, 2015 No Comment

This article may need to be rewritten entirely to comply with Wikipedia’s quality standards . You can help. The discussion page may contain suggestions. (May 2009)

Initially pioneered by Anglo-Saxon financial institutions during the 1970s as interest rates became increasingly volatile, asset and liability management (often abbreviated ALM) is the practice of managing risks that arise due to mismatches between the assets and liabilities .

The process is at the crossroads between risk management and strategic planning. It is not just about offering solutions to mitigate or hedge the risks arising from the interaction of assets and liabilities but is focused on a long-term perspective: success in the process of maximising assets to meet complex liabilities may increase profitability.

Contents

§ ALM objectives and scope [ edit ]

The exact roles and perimeter around ALM can vary significantly from one bank (and other financial institutions) to another depending on the business model adopted and can encompass a broad area of risks.

The traditional ALM programs focus on interest rate risk and liquidity risk because they represent the most prominent risks affecting the organization balance-sheet (as they require coordination between assets and liabilities).

But ALM also now seeks to broaden assignments such as foreign exchange risk and capital management. According to the Balance sheet management benchmark survey conducted in 2009 by the audit and consulting company PricewaterhouseCoopers (PwC), 51% of the 43 leading financial institutions participants look at capital management in their ALM unit.

The scope of the ALM function to a larger extent covers the following processes:

- Liquidity risk. the current and prospective risk arising when the bank is unable to meet its obligations as they come due without adversely affecting the bank’s financial conditions. From an ALM perspective, the focus is on the funding liquidity risk of the bank, meaning its ability to meet its current and future cash-flow obligations and collateral needs, both expected and unexpected. This mission thus includes the bank liquidity’s benchmark price in the market.

- Interest rate risk. The risk of losses resulting from movements in interest rates and their impact on future cash-flows. Generally because a bank may have a disproportionate amount of fixed or variable rates instruments on either side of the balance-sheet. One of the primary causes are mismatches in terms of bank deposits and loans.

- Currency risk management: The risk of losses resulting from movements in exchanges rates. To the extent that cash-flow assets and liabilities are denominated in different currencies.

- Funding and capital management: As all the mechanism to ensure the maintenance of adequate capital on a continuous basis. It is a dynamic and ongoing process considering both short- and longer-term capital needs and is coordinated with a bank’s overall strategy and planning cycles (usually a prospective time-horizon of 2 years).

- Profit planning and growth.

- In addition, ALM deals with aspects related to credit risk as this function is also to manage the impact of the entire credit portfolio (including cash, investments, and loans) on the balance sheet. The credit risk, specifically in the loan portfolio, is handled by a separate risk management function and represents one of the main data contributors to the ALM team.

The ALM function scope covers both a prudential component (management of all possible risks and rules and regulation) and an optimization role (management of funding costs, generating results on balance sheet position), within the limits of compliance (implementation and monitoring with internal rules and regulatory set of rules). ALM intervenes in these issues of current business activities but is also consulted to organic development and external acquisition to analyse and validate the funding terms options, conditions of the projects and any risks (i.e. funding issues in local currencies).

Today, ALM techniques and processes have been extended and adopted by corporations other than financial institutions; e.g. insurance.

§ Treasury and ALM [ edit ]

For simplification treasury management can be covered and depicted from a corporate perspective looking at the management of liquidity, funding, and financial risk. On the other hand, ALM is a discipline relevant to banks and financial institutions whose balance sheets present different challenges and who must meet regulatory standards.

For banking institutions, treasury and ALM are strictly interrelated with each other and collaborate in managing both liquidity, interest rate, and currency risk at solo and group level: Where ALM focuses more on risk analysis and medium- and long-term financing needs, treasury manages short-term funding (mainly up to one year) including intra-day liquidity management and cash clearing. crisis liquidity monitoring.

§ ALM governance [ edit ]

The responsibility for ALM is often divided between the treasury and Chief Financial Officer (CFO). In smaller organizations, the ALM process can be addressed by one or two key persons (Chief Executive Officer. such as the CFO or treasurer ).

The vast majority of banks operate a centralised ALM model which enables oversight of the consolidated balance-sheet with lower-level ALM units focusing on business units or legal entities.

To assist and supervise the ALM unit an Asset Liability Committee (ALCO), whether at the board or management level, is established. It has the central purpose of attaining goals defined by the short- and long-term strategic plans:

- To ensure adequate liquidity while managing the bank’s spread between the interest income and interest expense

- To approve a contingency plan

- To review and approve the liquidity and funds management policy at least annually

- To link the funding policy with needs and sources via mix of liabilities or sale of assets (fixed vs. floating rate funds, wholesale vs. retail deposit, money market vs. capital market funding, domestic vs. foreign currency funding. )

§ Legislative summary [ edit ]

Relevant ALM legislation deals mainly with the management of interest rate risk and liquidity risk:

- Most global banks have benchmarked their ALM framework to the Basel Committee on Banking Supervision (BCBS) guidance ‘Principles for the management and supervision of interest rate risk’. Issued in July 2004, this paper has the objective to support the Pillar 2 approach to interest rate risk in the banking book within the Basel II capital framework.

- In January 2013, the Basel Committee has issued the full text of the revised Liquidity Coverage Ratio (LCR) as one of the key component of the Basel III capital framework. This new coming ratio will ensure that banks will have sufficient adequacy transformation level between their stock of unencumbered high-quality assets (HQLA) and their conversion into cash to meet their liquidity requirements for a 30-calendar-day liquidity stress scenario (and thus hoping to cure shortcoming from Basel II that was not addressing liquidity management).

§ ALM concepts [ edit ]

§ Building an ALM policy [ edit ]

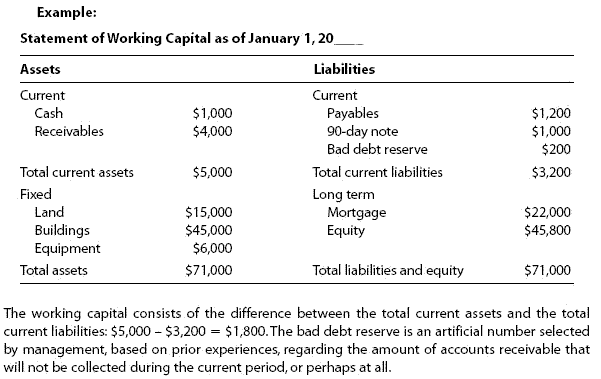

Illustrative example of a balance sheet mix limits mechanism

As in all operational areas, ALM must be guided by a formal policy and must address:

- Limits on the maximum size of major asset/ liability categories

- Balance sheet mix : in order to follow the old adage ‘Don’t put all your eggs in one basket’

- Limits on the mix of balance sheet assets (loans by credit category, financial instruments. ) considering levels of risk and return and thus guided by annual planning targets, lending licence constraints and regulatory restrictions on investments.

- Limits on the mix of balance sheet liabilities such as deposits and other types of funding (all sources of funding are expressed as a % of total assets with the objective to offer comparability and correlate by term and pricing to the mix of assets held) considering the differential costs and volatility of these types of funds

- Policy limits have to be realistic :based on historical trend analysis and comparable to the peers or the market

Note that the ALM policy has not the objective to skip out the institution from elaborating a liquidity policy. In any case, the ALM and liquidity policies need to be correlated as decision on lending, investment, liabilities, equity are all interrelated.

§ ALM core functions [ edit ]

The objective is to measure the direction and extent of asset-liability mismatch through the funding or maturity gap. This aspect of ALM stresses the importance of balancing maturities as well as cash-flows or interest rates for a particular set time horizon.

For the management of interest rate risk it may take the form of matching the maturities and interest rates of loans and investments with the maturities and interest rates of deposit, equity and external credit in order to maintain adequate profitability. In other words, it is the management of the spread between interest rate sensitive assets and interest rate sensitive liabilities..

Static/Dynamic gap measurement techniques

Gap analysis suffers from only covering future gap direction of current existing exposures and exercice of options (i.e. prepayments) at different point in time. Dynamic gap analysis enlarges the perimeter for a specific asset by including ‘what if’ scenarios on making assumptions on new volumes, (changes in the business activity, future path of interest rate, changes in pricing, shape of yield curve, new prepayments transactions, what its forecast gap positions will look like if entering into an hedge transaction. )

§ Liquidity risk management [ edit ]

The role of the bank in the context of the maturity transformation that occurs in the banking book (as traditional activity of the bank is to borrow short and lend long) lets inherently the institution vulnerable to liquidity risk and can even conduct to the so-call risk of ‘run of the bank’ as depositors, investors or insurance policy holders can withdraw their funds/ seek for cash in their financial claims and thus impacting current and future cash-flow and collateral needs of the bank (risk appeared if the bank is unable to meet in good conditions these obligations as they come due). This aspect of liquidity risk is named funding liquidity risk and arises because of liquidity mismatch of assets and liabilities (unbalance in the maturity term creating liquidity gap). Even if market liquidity risk is not covered into the conventional techniques of ALM (market liquidity risk as the risk to not easily offset or eliminate a position at the prevailing market price because of inadequate market depth or market disruption), these 2 liquidity risk types are closely interconnected. In fact, reasons for banking cash inflows are  :

- when counterparties repay their debts (loan repayments): indirect connect due to the borrower’s dependence to market liquidity to obtain the funds

- when clients put deposit: indirect connect due to the depositor’s dependence to market liquidity to obtain the funds

- when the bank purchases assets hold: direct connect with market liquidity (security’s market liquidity as the ease at trading it and thus potential sharp in price)

- when the bank sells debts it has primary bought: direct connect

§ Liquidity gap analysis [ edit ]

Indicative maturity liquidity profile

To do so, ALM team is projecting future funding needs by tracking through maturity and cash-flow mismatches gap risk exposure (or matching schedule). In that situation, the risk depends not only on the maturity of asset-liabilities but also on the maturity of each intermediate cash-flow, including prepayments of loans or unforeseen usage of credit lines.

- Determining the number and length of each relevant time interval (time bucket)

- Defining the relevant maturities of the assets and liabilities where a maturing liability will be a cash outflow while a maturing asset will be a cash inflow (based on effective maturities or the ‘liquidity duration': estimated time to dispose of the instruments in a crisis situation such as withdrawal from the business). For non maturity assets (such as overdrafts, credit card balances, drawn and undrawn lines of credit or any other off-balance sheet commitments), their movements as well as volume can be predict by making assumptions derived from examining historic data on client’s behaviour.

- Slotting every asset, liability and off-balance sheet items into corresponding time bucket based on effective or liquidity duration maturity

In dealing with the liquidity gap, the bank main concern is to deal with a surplus of long-term assets over short-term liabilities and thus continuously to finance the assets with the risk that required funds will not be available or into prohibitive level.

Before any remediation actions, the bank will ensure first to :

- Spread the liability maturity profile across many time intervals to avoid concentration of most of the funding in overnight to few days time buckets (standard prudent practices admit that no more than 20% of the total funding should be in the overnight to one-week period)

- Plan any large size funding operation in advance

- Hold a significant productions of high liquid assets (favorable conversion rate into cash in case distressed liquidity conditions)

- Put limits for each time bucket and monitor to stay within a comfortable level around these limits (mainly expressed as a ratio where mismatch may not exceed X% of the total cash outflows for a given time interval)

§ Non-maturing liabilities specificity [ edit ]

As these instruments do not have a contractual maturity, the bank needs to dispose of a clear understanding of their duration level within the banking books. This analysis for non-maturing liabilities such as non interest-bearing deposits (savings accounts and deposits) consists of assessing the account holders behavior to determine the turnover level of the accounts or decay rate of deposits (speed at which the accounts ‘decay’, the retention rate is representing the inverse of a decay rate).

Calculation to define (example):

- Average opening of the accounts : a retail deposit portfolio has been open for an average of 8,3 years

- Retention rate : the given retention rate is 74,3%

- Duration level : translation into a duration of 6,2 years

Various assessment approaches may be used:

- To place these funds in the longest-dated time bucket as deposits remain historically stable over time due to large numbers of depositors.

- To divide the total volume into 2 parts: a stable part (core balance) and a floating part (seen as volatile with a very short maturity)

- To assign maturities and re-pricing dates to the non-maturing liabilities by creating a portfolio of fixed income instruments that imitates the cash-flows of the liabilities positions.

The 2007 crisis however has evidence fiercely that the withdrawal of client deposits is driven by two major factors (level of sophistication of the counterparty: high-net-worth clients withdraw their funds quicker than retail ones, the absolute deposit size: large corporate clients are leaving faster than SMEs) enhancing simplification in the new deposit run-off models.

- A surplus of liabilities creates a funding requirement, i.e. a negative mismatch that can be finance

- By long-term borrowings (typically costlier) : long-term debt, preferred stock, equity or demand deposit

- By short-term borrowings (cheaper but with higher incertainty level in term of availability and cost)  : collateralized borrowings (repo), money market

- By asset sales : distressed sales (at loss) but sales induce drastic changes in the bank’s strategy

§ Measuring liquidity risk [ edit ]

The liquidity measurement process consists of evaluating :

- Liquidity consumption (as the bank is consumed by illiquid assets and volatile liabilities)

- Liquidity provision (as the bank is provided by stable funds and by liquid assets)

2 essential factors are to take into account  :

- Speed: the speed of market deterioration in 2008 fosters the need to daily measurement of liquidity figures and quick data availability

- Integrity

But daily completeness of data for an internationally operating bank should not represent the forefront of its procupation as the seek for daily consolidation is a lengthy process that may put away the vital concern of quick availability of liquidity figures. So the main focus will be on material entities and business as well as off-balance sheet position (commitments given,movements of collateral posted. )

For the purposes of quantitative analysis, since no single indicator can define adequate liquidity, several financial ratios can assist in assessing the level of liquidity risk. Due to the large number of areas within the bank’s business giving rise to liquidity risk, these ratios present the simpler measures covering the major institution concern. In order to cover short-term to long-term liquidity risk they are divided into 3 categories  :

- Indicators of operating cash-flows

- Ratios of liquidity

- Financial strength (leverage)

Liquidity risk oriented ratios