Asset Allocation Strategies_1

Post on: 2 Апрель, 2015 No Comment

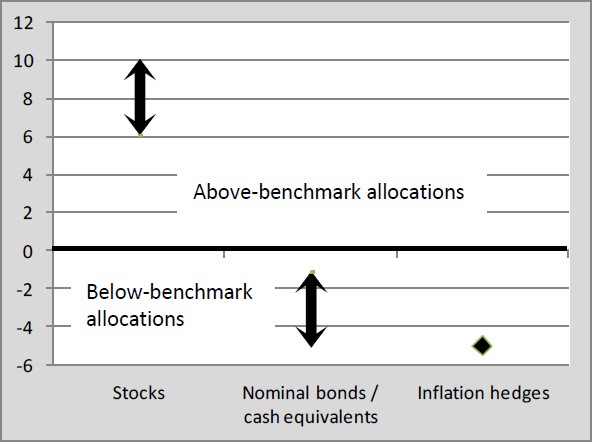

Most investors understand the need to diversify their investments, but don’t have the time or knowledge to do it on their own. Since studies show that asset allocation is one of the factors with the greatest impact on investment portfolio results, many investors seek expert help in achieving an appropriate asset mix. 1

Investment companies have developed a variety of asset allocation products to meet this need. One of the most common and comprehensive forms of these is a fund-of-funds; that is, a mutual fund made up of shares of other mutual funds that provide asset class diversification. You may have heard these funds referred to by such names as:

- Lifestyle, Life Stage, or Lifecycle Funds

- Target-date funds

- Target-risk funds

Whatever you call them, hundreds exist in the marketplace, and it is important to know that they are not all created equal. Their strategies and investment processes may be quite different.

Target-Risk (Lifestyle) Solutions: Principal Strategic Asset Management (SAM) Portfolios

Target-risk portfolios tailor a solution to the client’s investment profile by taking into consideration his or her goals, risk tolerance, and time horizon. The Principal Strategic Asset Management Portfolios are five target-risk solutions that are continually monitored and reallocated in response to changing economic and investment conditions. Learn more .

Target-Date Solutions: Principal LifeTime Funds

Target-date funds are geared toward a specific date, most often the year you expect to retire. With the Principal LifeTime Funds you can choose among eleven different funds by simply selecting the target date that most closely matches your time horizon. Allocations are set by investment professionals and regularly adjusted by experienced professionals. Learn more .

1 Financial Analysis Journal, May/June 1991. Study results confirmed, April 1999.

The Principal LifeTime Funds, which are target-date funds, invest in underlying Principal Funds. Each Principal LifeTime Fund is managed toward a particular target (retirement) date, or the approximate date the participant or investor starts withdrawing money. As each Principal LifeTime Fund approaches its target date, the investment mix becomes more conservative by increasing exposure to generally more conservative investment options and reducing exposure to typically more aggressive investment options. The asset allocation for each Principal LifeTime Fund is regularly re-adjusted within a timeframe that extends 10-15 years beyond the target date, at which point it reaches its most conservative allocation. Principal LifeTime Funds assume the value of the investor’s account will be withdrawn gradually during retirement. Neither the principal nor the underlying assets of the Principal LifeTime Funds are guaranteed at any time, including the target date. Investment risk remains at all times.

Asset allocation/diversification does not guarantee a profit or protect against a loss.