Asset Allocation Models Are The Only Way Forward For 401k s

Post on: 23 Апрель, 2015 No Comment

By Neil Plein

As an introduction, there are a few main points that will outline this article. First. the majority of participants are not engaged in their 401k plan. Second. this realization has recently influenced a substantial movement in the industry to simplify investment management for participants. Third. the industry response has been primarily target date funds which have increased in popularity and inclusion as a result of the first two points; though they fall very short of being the best solution for plans and participants.

If any of those above assertions shook you, here is the hard data. Last month, at the Dimensional Fund Advisors (DFA) Annual Defined Contribution Conference, distinguished MIT professor Robert C. Merton. delivered a presentation which showed that only 41% of participants were actually engaged with their 401k plan. This is to say that the majority of participants are un-engaged. With a statistic like this, it is no surprise to learn that target date fund assets have risen more than 82% in the past 3 years .

The primary objective of such funds is ease and simplicity; both extremely positive developments. Target date funds deliver to the majority of 401k participants an investment vehicle which allows them to be un-engaged and still receive something better than not participating in their plan or attempting to determine investment decisions on their own; participants receive professional investment management for both the short and long term.

Managers in the target date funds make minor changes to the mix and weighting of investments in the short term while making more major changes to the overall asset allocation mix of the funds in the long term. Allowing these things to happen automatically for participants is a great step forward. Prior attempts at delivering professional investment direction from pre-designed models delivered through some medium (print or online) required engagement which as the DFA data shows, fails to address the needs of most participants (the un-engaged).

These aspects, coupled with the heightened attention on 401k plans from fee disclosure debates, have created a momentum of change within the industry; something which could be very good for participants provided things head in the right direction. Here are some general principles for plan design which should be considered in the evolution:

1.) Participants who choose to be un-engaged (the majority) should receive the best default solution

2.) Participants who do choose to become engaged (the minority) should have a meaningful experience which results in a benefit exceeding the option to be un-engaged

The popularity of target date funds clearly demonstrates the strong demand from participants for a simplified, un-engaged solution. This benefit does not come cheap, however. According to Morningstar. the average target date fund costs participants 1.02%. So in this regard, target date funds are not yet the ideal solution for addressing the surging demand for ease within 401k plans.

Cost is not the only concern, however. But cost is the starting point of what has been deemed “the equation for retirement success- cost, compounding and contribution- the 3 C’s .” Cost should be low, so participants can keep as much money in their accounts as possible to grow for retirement. The growth of this money comes from compounding returns which should be good (the popularity of target date funds demonstrates the preference for such compounding to come from professional management rather than participant self-direction of investment selection). And finally, contribution; even with the lowest cost investments and best returns, participants will not reach their retirement goals unless they are contributing enough. Of these “3 C’s,” target date funds are only designed to address compounding, which makes them fall short of being an ideal option for participants.

With this macro schema in mind to deliver retirement plan success (cost, compounding and contribution) and the general principals outlined for plan design evolution to meet the needs of engaged and un-engaged participants; where does the solution exist if target date funds have been ruled out on the basis of cost?

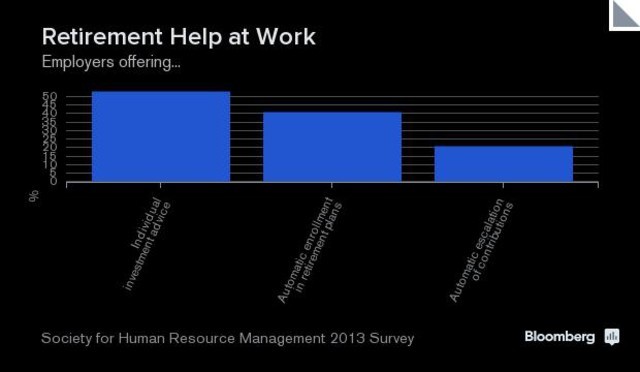

The answer is asset allocation models. designed by professionals to be age based and built using low-cost investment options- Exchange Traded Funds (ETFs). These could also be used as qualified default investment alternatives (QDIA’s) if managed by the right type of ERISA investment manager, such as a §3(38). This solution addresses cost and compounding but not contribution, for a very practical reason; contribution rate is at the discretion of a participant. Even with auto-enrollment, auto-escalation and company match, determining whether the contribution rate is sufficient requires engagement form the participant. With this in mind, cost, compounding and contribution can be distributed amongst the general principles for plan evolution in this way:

1.) Participants who choose to be un-engaged (the majority) should receive the best default solution- Low cost investments managed by professionals (Cost and Compounding )

2.) Participants who do choose to become engaged (the minority) should have a meaningful experience which results in a benefit exceeding the option to be un-engaged- Clarity of retirement goals and the contribution rate required to reach them (Contribution )

Participants who engage receive the greatest benefit, not simply cost and compounding, but contribution as well because it can only be addressed and understood through engagement. Even if target date funds were low cost, they would not meet the above conditions because they would have no way of accommodating the needs of the engaged; because target date funds hinder the clarity needed to determine contribute rate.

In “Retirement Calculators Threaten the Stability of Your Entire Plan ,” this is examined in greater detail. Target date funds not only have a changing asset allocation over time, but lack the transparency to comfortably understand performance past, present and as a consequence; future. In fact, even if a participant did somehow figure out the rate of return they needed to target, comparing it to what the target date fund would be a nearly impossible task. This further discounts the effectiveness of target date funds as a default option; essentially there is no benefit to becoming engaged in a plan with a target date fund, all they do is target a date and an asset allocation, not a particular income or wealth level- something once established or understood relies on contribution rate to attain. Asset allocation models, on the other hand, as shown below, have the necessary performance history data points to allow the engaged to accurately calculate contribution rate.

Figure 2: Asset Allocatio Model performance history can be used as data points to calculate contribution rate. The asset allocation models and historical returns are for illustrative purposes only.

By using asset allocation models on a platform which allows investment managers to design models for participants, then have these participants move automatically through the models based on age (similar to how participants would automatically receive an adjusted asset allocation in a target date fund), the needs of the un-engaged are best satisfied by low cost investments (cost ) and growth from professional management (compounding ). Likewise, the engaged receive added benefit (contribution ), allowing contribution rate to be easily calculated and presented with clarity. This process can be further enhanced through the use of an integrated retirement calculator (as the primary engagement option) which incorporates payroll data with the long term performance history of each asset allocation model. The result- contribution rate is calculated automatically; no manual entry or external statement reference required. Implementing plans in this way could have an absolutely substantial impact on the ability of participants to develop adequate retirement funds.

Those who stand to gain the most are mid to large sized plans; especially those which are de-centralized. Smaller plans by comparison, often have the benefit of working closely with an advisor in a cost effective manner. This same level of attentiveness is neither feasible from a cost standpoint nor realistic from a simple geographic perspective in the mid to large plan market; the area where the highest level of target date fund inclusion is taking place as a solution, according to DFA. 80% of plans with assets exceeding $5 million offer a target date fund feature, whereas only 47% of plans with less than $5 million in assets make such funds available. Given the inadequacy of target date funds to fully serve the needs of their markets, as has been established here; asset allocation models are the only way forward .