As Investors Exit Emerging Markets Valuations Attractive Emerging Markets Daily

Post on: 29 Март, 2015 No Comment

By Dimitra DeFotis

Slow growth and market underperformance in developing markets continues to undermine the resolve of emerging market investors.

It now seems that investors have had enough. In January, EM funds available to U.S. investors registered outflows of $3.3 billion. This is the largest monthly outflow since the Lehman crisis in 2008, write Pavillion Global Market s Pierre Lapointe. head of global strategy and research, and Alex Bellefleur. global macro strategist.

Pavilion Global Markets, MSCI Return on invested capital has declined since 2012 in India, China, brazil and Russia.

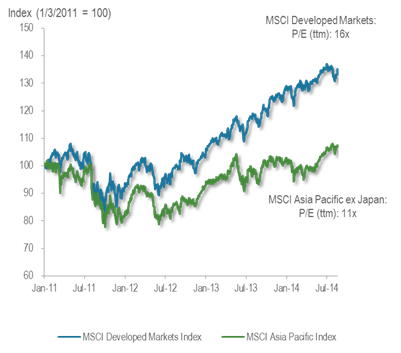

They underscore this is nothing new. Emerging markets have underperformed developed markets for close to five years. But valuations are unattractive, with forward price-to-earnings ratios higher over the past three months in most EMs, and Lapointe and Bellefleur see no reason to jump back into the space. They write:

Emerging markets are highly dependent on foreign money to support economic growth. Unfortunately, it seems that foreigners have thrown in the towel on emerging markets. In January, emerging market countries saw the largest mutual fund outflows since the credit crisis. We also see evidence of significant outflows in Brazil, Russia and China. In India, the situation is not as dire. Foreign portfolio investment inflows have stopped, but we have yet to see outflows.

The resilience might be explained by the fact that of all BRIC countries, India exhibits the highest return on invested capital (ROIC). When capital is scarce, companies have to become more efficient to attract investors. By comparison, the ROIC at Brazilian companies is severely lagging other BRIC countries. To gain back the favor of foreign investors, companies in Brazil will have to become more efficient.

The iShares MSCI BRIC ETF (BKF ) is down 0.8% today, but is up 8% over the past year. The iShares MSCI Brazil Capped ETF (EWZ ) is down 2.5% today following a Moodys debt downgrade; the ETF is down 11% over the past year. The Market Vectors Russia ETF (RSX ) is flat today, down 30% in the past year. The iShares MSCI India ETF (INDA ) is up a point today, and up 37% over the past year. The broadest and largest measure of emerging markets, the Vanguard FTSE Emerging Markets ETF ( VWO ), down 0.4% today, is up 10% over the past year.

Other options: EGShares Beyond BRIC s (BBRC ) is flat today and over the past year. The addition of frontier markets to portfolios hasnt boosted overall returns: the Global X Next Emerging & Frontier ETF (EMFM ), up 0.3% today, is down 3.6% over 12 months.