Are VIX ETFs Right For You

Post on: 11 Март, 2016 No Comment

Fear and greed are powerful motivators on Wall Street. They often dictate investment decisions that would otherwise lead to more carefully structured research or opportunistic timing. While greed is often manifested in momentum stocks or use of leverage, the fear side of the spectrum can be summed up with the CBOE Volatility Index (VIX).

According to the CBOE website. the VIX is calculated by using real-time S&P 500 Index options quotes. This leads to a measure of expected volatility, or “fear”, in the market that can be a guide for current investor sentiment.

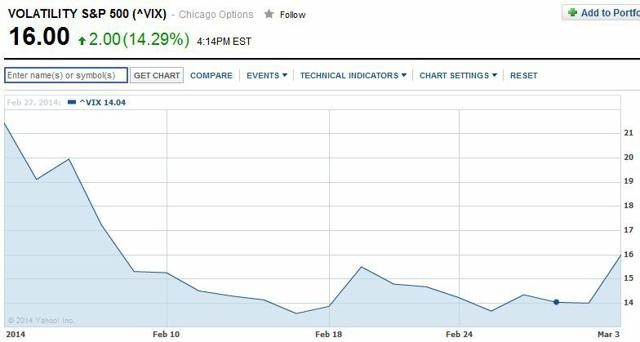

As a general rule, the lower the VIX reading, the lower the fear investors are factoring in to the current market environment. This is often times seen as a dangerous sign of complacency. Conversely, spikes in the VIX often coincide with sharp declines in stocks or whipsaws in the market that lead to traders hedging their bets with defensive options plays.

Because the CBOE publishes the VIX index as a daily market indicator, several ETFs have been developed to take advantage of this non-traditional strategy .

The iPath S&P 500 VIX Short-Term Futures ETN (VXX ) is designed to provide access to equity market volatility through CBOE Volatility Index futures. This exchange-traded note has garnered over $1.2 billion in total assets of investors looking for a vehicle to moderate market volatility.

While that may seem like a straightforward objective, the results of VXX over the last three years have seen its price mired in a perpetual downtrend. During bullish or relatively calm markets like we have experienced in recent memory, VXX tends to bleed off capital as it consistently rolls to the next futures contract. VXX lost 66.56% in 2013 and has recently fallen to new lows this year as well.

VXX

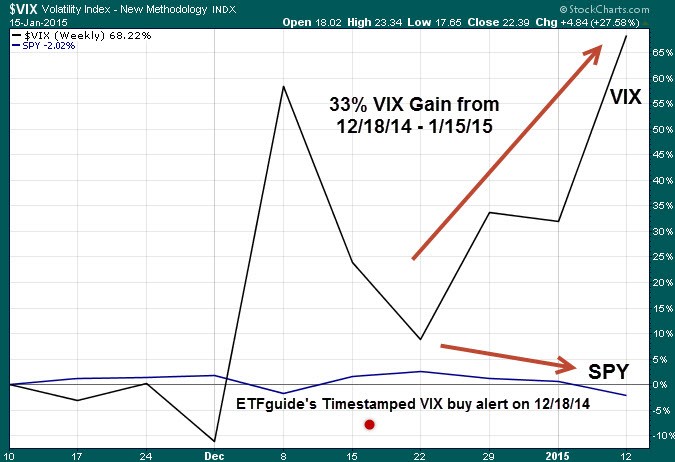

There have certainly been brief spurts of volatility that have offered opportunistic short-term trades in VXX. However, the long-term thesis for holding this vehicle may not measure up to most investors objectives given its non-correlated nature.

On the flip side, the VelocityShares Daily Inverse VIX Short Term ETN (XIV ) seeks investment results that correspond to an inverse relationship with the CBOE VIX Index on a daily basis. Simply put, this ETN will rise when the CBOE VIX Index is falling.

XIV gives traders an additional edge to pick directionality of volatility given the outlook for the U.S. equity markets. However, in my opinion, investors should be careful about using these sophisticated trading vehicles without fully understanding the risks involved in VIX futures contracts.

One potential method of reducing this risk is to use the VIX as a small component of an otherwise long equity portfolio. The PowerShares S&P 500 Downside Hedged Portfolio (PHDG ) seeks to achieve positive returns in both rising and falling markets by dynamically shifting its asset allocation between equities, volatility, and cash. Currently the rules-based strategy is 97.5% equities and 2.5% VIX futures.

The built in hedge in the PHDG portfolio can be expanded when volatility begins to increase as a method of controlling downside risk. The caveat is that this strategy may experience periods of underperformance in a traditional bull market when the volatility component drags on total return. For conservative investors, that may not be a big concern if your primary objective is capital preservation.

As a general rule, I would caution most investors against using VIX-related exchange-traded products without a healthy working knowledge of options volatility and a disciplined investment objective. These vehicles face unique opportunities and risks that may not apply to traditional equity or fixed-income positions.

However, that does not mean they can’t experience periods of strength given the right circumstances. Often times these vehicles can be most advantageous during periods of extreme fear or greed that resolve in an inflection point and reversal price.