ArbitrageFree Pricing

Post on: 5 Июль, 2015 No Comment

Most financial engineering models are what are known as relative pricing models. They price instruments based on prices of other instruments quoted in the market—an instruments price is determined relative to other prices quoted in the market.

Financial theorists and economists often use what are known as absolute pricing models. These price instruments without regard for other prices quoted in the market. Instead, they base prices on economic theory, assumptions about the preferences of economic agents, supply and demand, etc.

Most absolute pricing models are what are known as equilibrium pricing models. They calculate at what prices a market will reach equilibrium—where supply and demand balance and the market clears. A shortcoming of many equilibrium models is the fact that they cannot be calibrated to current market prices. They calculate hypothetical equilibrium prices that generally dont match actual prices currently observed in the market. Because this violates the law of one price. such models are useless in a trading context. Equilibrium models are largely theoretical tools. Sharpes capital asset pricing model is an equilibrium pricing model.

Most relative pricing models employed by financial engineers are based on the theory of arbitrage-free pricing. Prices are determined relative to other prices quoted in the market in such a manner as to preclude any arbitrage opportunities.

An arbitrage condition is a relationship that must prevail between certain prices if they are to be arbitrage-free. Examples of arbitrage conditions are:

- interest rate parity for forward exchange rates;

- put-call parity for European options;

- cash-and-carry arbitrage conditions for forward commodity prices.

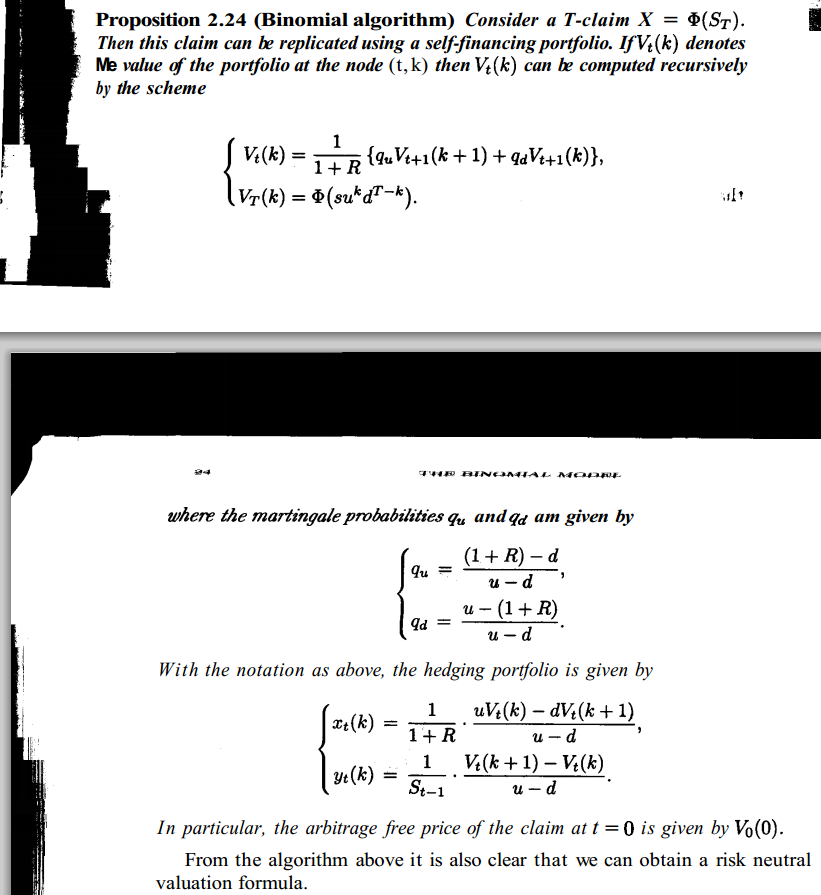

With arbitrage-free pricing, financial engineers apply arbitrage conditions to prices that are observable in the market in order to determine other prices that are not. Standard formulas for pricing forwards, swaps and debt instruments are all derived using such arbitrage arguments. In complete markets, arbitrage-free pricing can be used to uniquely determine a price for any instrument. In incomplete markets, it may only place bounds on certain prices.

The groundbreaking Black-Scholes (1973 ) approach to pricing options is based on arbitrage-free pricing. Black and Scholes identified an arbitrage condition that, given certain simplifying assumptions, must hold between the price of an option and the value of a corresponding replicating portfolio. Based upon this, they were able to price options. That same approach, modified in many different ways, underlies essentially all models used today for pricing options and other derivative instruments in complete markets. In essence, much of financial engineering is little more than aggressive and creative use of arbitrage-free pricing.