Arbitrage financial definition of arbitrage

Post on: 28 Май, 2015 No Comment

Arbitrage

An investment practice that attempts to profit from inefficiencies in price by making transactions that offset each other. For example, one may buy a security at a low price and, within a few seconds, re-sell it to a willing buyer at a higher price. Arbitrageurs can keep prices relatively stable as markets try to resist their attempts at price exploitation. Arbitrageurs often use computer programs because their transactions can be complex and occur in rapid succession.

arbitrage

The simultaneous purchase and sale of substantially identical assets in order to profit from a price difference between the two assets. As a hypothetical example, if General Electric common stock trades at $45 on the New York Stock Exchange and at $44.50 on the Philadelphia Stock Exchange, an investor could guarantee a profit by purchasing the stock on the Philadelphia Stock Exchange and simultaneously selling the same amount of stock on the NYSE. Of course, the price difference must be sufficiently great to offset commissions. Arbitrage may be employed by using various security combinations including stock and options and convertibles and stock. See also basis trading. risk arbitrage .

Arbitrage.

Arbitrage is the technique of simultaneously buying at a lower price in one market and selling at a higher price in another market to make a profit on the spread between the prices.

Although the price difference may be very small, arbitrageurs, or arbs, typically trade regularly and in huge volume, so they can make sizable profits.

But the strategy, which depends on split-second timing, can also backfire if interest rates, prices, currency exchange rates, or other factors move in ways the arbitrageurs don’t anticipate.

arbitrage

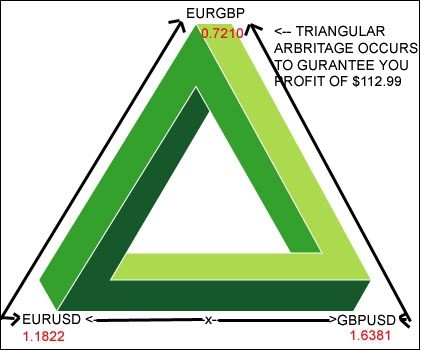

The simultaneous purchase in one market and sale in another market of a commodity, security,or monies,in the expectation of making a profit on price differences in the differing markets. Generally thought of as involving foreign currency exchanges,in which one enters contracts to buy euros and sell yen and hopefully make money in a moment in time when the exchange rates work out in one’s favor (this is highly risky).

Arbitrage

What Does Arbitrage Mean?

The simultaneous purchase and sale of an asset to profit from a difference in the price; a trade that creates profit by exploiting price differences in identical or similar financial instruments in different markets. Arbitrage is the result of market inefficiencies; it is a mechanism that helps ensure that prices do not deviate substantially from fair value for long periods.

Investopedia explains Arbitrage

Arbitrage is not a long-term investment strategy but a short-term trading strategy to exploit short-term pricing inefficiencies. Arbitrage helps ensure that prices do not deviate too far from an asset’s fair value for long periods.