Approach Trading Like a Professional

Post on: 22 Май, 2015 No Comment

Author: Gail Mercer

What is the difference between a professional trader and other traders? You may assume the pros have more experience or better indicators; the truth is they are dedicated — they live and breathe trading. Other traders are typically trading more with the mindset of a hobbyist. Let’s look at the differences in mindset between a professional and a hobbyist.

Professionals understand:

- That practice makes perfect

- That they should expect profits

- There is always something new to learn and accept learning as their responsibility

- It isn’t always about winning — sometimes you have to lose to achieve better results in the future

- Endurance is the key to continuing in the field

In other words, they have a plan and, although they may update it, they abide by it — day in and day out.

Hobbyists tend to:

- Schedule around their occupational hours with no consistency

- Bounce around from one technique to another (never really perfecting any one aspect)

- Limit their expenditures because there are no profit expectations

- Think that endurance is not a factor because it’s just for fun

- Play the blame game — you didn’t tell me, doesn’t work, I didn’t know, etc.

In other words, they have no plan. Instead, they play it by ear — if they have time or if it fits in their schedule.

Now, let’s look at why it makes a difference.

Joe Namath, a quarterback for the New York Jets back in the late 1960s and 1970s, was elected to the Hall of Fame in 1985. What set him apart from all the other quarterbacks at his high school or college?

First, sports were his passion. Every free moment was spent playing either baseball (his first choice), basketball or football (not only if he felt like playing, or only when he could fit it into his schedule).

Although he received offers to play baseball from the Yankees, Mets, Indians, and others teams, he opted for football so he could get a college degree (profit expectation).

In November 1964, Namath was the first drafted player in the National Football League (NFL) and American Football League (AFL). Namath opted to go with the Jets for a salary of $427,000 (again profit expectation).

Did he start out a winner? NO. In 1965, the Jets did not win their first six games and only won five of the last eight games for the season. Although Namath wanted to win every game, he knew he may not and he accepted it. He looked for ways to improve, to up his end game.

And, he didn’t quit. He endured. He perfected his skills (passing and running the ball).

And, in 1969, the Jets won Super Bowl III and Namath was named Most Valuable Player (MVP) of Super Bowl III, a game that is still regarded as the greatest upset in NFL history. Of course, he went on to win other awards and accolades but it was his persistence and dedication to his field that made him the pro that he was.

Professional traders have the endurance exhibited by Namath — they are in it for the long haul. Namath didn’t use his knee injury as an excuse for not winning (he injured his knee while playing college football and still made it to the Orange Bowl). He pushed through the pain to achieve his expectations of winning.

Professionals do not try to fit trading into their schedule — it’s automatically there (just like meal time).

Instead of saying: IF ONLY I COULD ACHIEVE (no winning expectation)

They say: I WILL ACHIEVE (winning expectation)

Namath and his coaches more than likely reviewed every game over and over — to look for weaknesses in the other teams and to improve their own performance.

Professional traders also review their trades and look for ways to improve their trade execution or profit taking procedures (improving their performance).

Hobbyists, if they record their trades and few do, may look at their trades but with different purposes — do the indicators work, does this timeframe work, is this the right market to trade? The difference here is the hobbyist is transferring the performance expectations to the indicators, timeframes and markets instead of where it needs to be (on the trader).

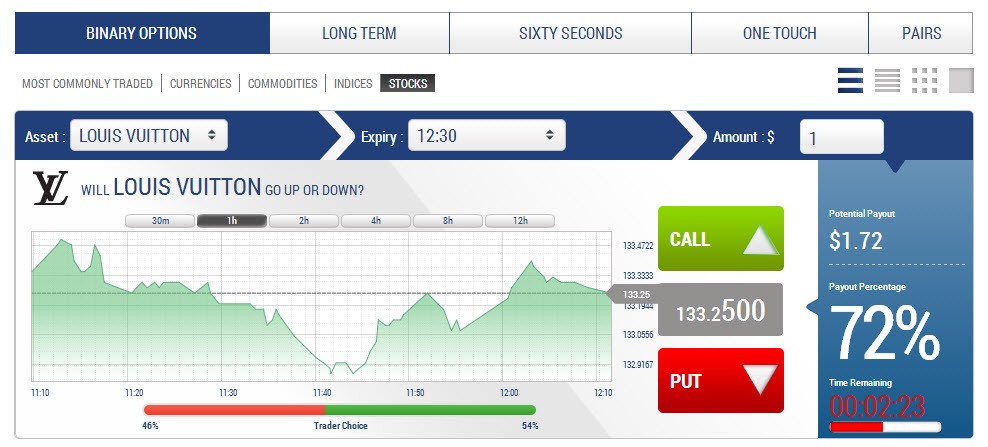

While some could argue that it was easy for Namath with a salary over $400k, but remember he started small (college scholarship) and worked his way up. New traders can replicate this technique by using Nadex Binary Options. which provide a safer trading environment with risk/reward known up front on every trade. This allows traders to build their skills (just like pros do) while capping their risks. Then they can move up in size once they are comfortable with binary options trading strategies.

Watch a short video to learn more about binary options trading:

The traits that make a professional trader are the same traits that make any pro a PRO. The question is:

Are you trading as a hobbyist or a professional?

Check out what people on Wall Street have to say about binary options.

Futures, options, and swaps trading involves risk and may not be appropriate for all investors.

This Content Is Not Associated With TheStreet Editorial Team