Apple As An Example Of How to Use a Bull Call Spread to Trade

Post on: 12 Апрель, 2015 No Comment

ASK NEWS:

- The Case Against the Case Against Tesla — Bloomberg

Tesla CEO Elon Musk and Prada boss among world’s most-searched. — South China Morning Post

03/4/2015 — 9:10 am | View Link

Nasdaq closes above 5,000 for 1st time in 15 years — Business Insider

BING NEWS:

The earnings calendar is packed this week. Those looking to join the stampede might want to consider a Feb $114/$120 bull call spread. At the close of trading on Friday, this trade was offered at $2.06, or $203 per pair of contracts.

01/26/2015 — 2:00 am | View Link

He can therefore purchase 20 Apple shares, assuming the price is $100. Lets keep the price target of $135 on long positions (35% profit) and $80 on the downside (20% loss). Trade Apple stock through. loss of $14). A bull call spread will be ideal.

01/23/2015 — 1:06 pm | View Link

Last year’s trade idea for AAPL was to buy the Jan 2014 $400/500 bull call spread at $52.50 and sell the 2015 $350 puts for $38.50, for a net $14 entry on the spread. Today that spread is net $91.20, up 551% in less than a year beating the S&P by 20x!

12/24/2013 — 12:10 am | View Link

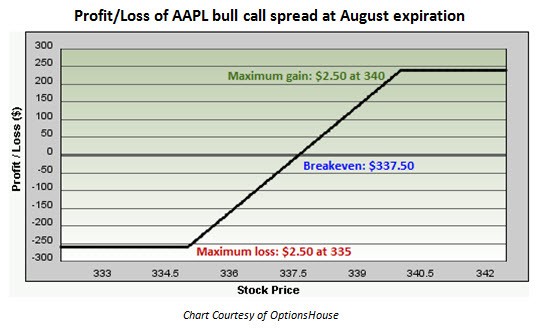

To illustrate, let’s compare a four-lot bull put spread to a nine-lot bull call spread in IBD 50 constituent and market heavyweight Apple (AAPL) using the July contracts. The two bull verticals share a couple common traits, they’re both out-of-the-money.

06/8/2012 — 10:22 am | View Link

But I think this specific strategy, and an example, can show how this can be done fairly easily. Its called a bull call spread. The bull call spread, or vertical call spread, is when you buy call options at a specific strike price while also.

BING SEARCH:

2014 Apple River Summer Events and Concerts. At Float Rite Park, we offer concerts and events all summer long! Check out what we have planned for Summer 2014!

03/11/2015 — 10:45 am | View Website

Description. A bull call spread is a type of vertical spread. It contains two calls with the same expiration but different strikes. The strike price of the short call.

03/10/2015 — 11:11 pm | View Website

Apple designs and creates the iPhone, iPad, Mac notebooks and desktop computers, iOS 8, OS X, iPod and iTunes, and the new Apple Watch.

03/10/2015 — 7:36 pm | View Website

The vertical spread is one of our favorite strategies on the site. A vertical spread, involves buying and selling a call, a call spread, or buying and selling a put.

03/10/2015 — 4:37 pm | View Website

Global Equities Securities sticks with an Overweight rating and lofty $385 price target on Tesla Motors (TSLA-0.3%) as part of a new research report on the company.