Annuities as Long Term Investments

Post on: 15 Июнь, 2015 No Comment

People make short-term investments when they want to know that their savings can be accessed easily and withdrawn. However long term investments are a different matter. They are essentially meant for growth purposes and usually to create a retirement plan for yourself; so when you retire you dont have to worry about changing your lifestyle too much. Long-term investments should ideally be considered and made by all working professionals, as they are perhaps the only way to make your money work as hard as you do.

Annuities offer investors great investment options. And because there are so many different types of annuities you can select the one that suits you best. Annuities are financial products offered by insurance companies that assure their investors a guaranteed rate of return on their investment. An annuity may be bought with a single payment or by making paying several premiums. Annuities are long term investments that allow you to save during your working years and reap the benefits close to your retirement years. The earlier you start investing in annuities the sooner you can consider retiring or switching to a line of work or hobby that truly fascinates you. Money is the stabilizing factor in all our lives and with growing life expectancy and inflation is a cause of worry. Buying an annuity can help you plan the financial security of your retired years.

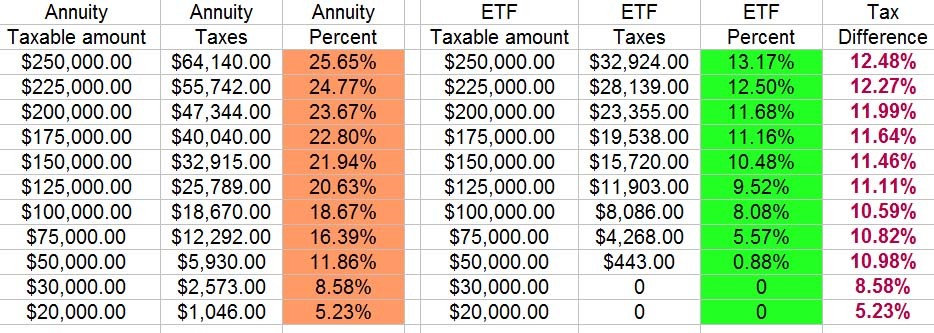

Annuities are tax deferred and simply put, this means that you dont pay tax on the gains from the investment on a yearly basis but in fact the tax is deferred until you get income from the annuity or make a withdrawal. Thus the investment compounds due to the tax deferred. In turn the longer the investment period the better the investment grows. If you are still looking for reasons why you should invest in annuities as long-term investments, here are some excellent ones:

- Most of us have trouble saving even a small part of our income and investment in an annuity can ensure that a certain amount of your income is regularly put away as savings.

- It is important that the financial product that you invest in offers you terms and conditions that suit you. You can choose from the several types of annuities available in the market today, such as the deferred annuity, fixed rate annuity and lifetime annuity. You can invest in ways that are apt for you and even receive income in the manner in which you choose. Also you have the option of deferring income payments from the annuity.

- The rate of interest offered by annuities is better than for other long-term investments such as CDS.

- Tax deferred investments are always a better option as compared to taxed investments.

Investing in annuities as long-term investments can leave you without any worries about your financial future, particularly for your retired years.