An Introduction to Frontier Markets

Post on: 16 Март, 2015 No Comment

The Emerging World of Frontier Markets

You can opt-out at any time.

You may have read that frontier markets are the next hot investment idea. You may have read that frontier markets offer more upside than their emerging market and developed market cousins. But what are these frontier markets, what are the risks of frontier markets, and how can you invest in these frontier markets?

What Are Frontier Markets?

The term “frontier markets” was coined by the International Finance Corporation (IFC), a private sector arm of the World Bank Group, in 1992 to reflect a subset of emerging market economies. In 2000, Standard & Poor’s (S&P) bought the IFC Emerging Markets Database and has continued to use the term “frontier markets.”

If frontier markets are considered a subset of emerging markets, what are emerging markets? Emerging markets (a term coined by the IFC in 1980) are countries with economies and stock markets showing signs that they are in the early phases of economies and stock markets in developed, industrialized countries. The frontier markets are a subset of these emerging markets that are smaller and less liquid than the more advanced emerging markets.

What Countries Are Considered Frontier Markets?

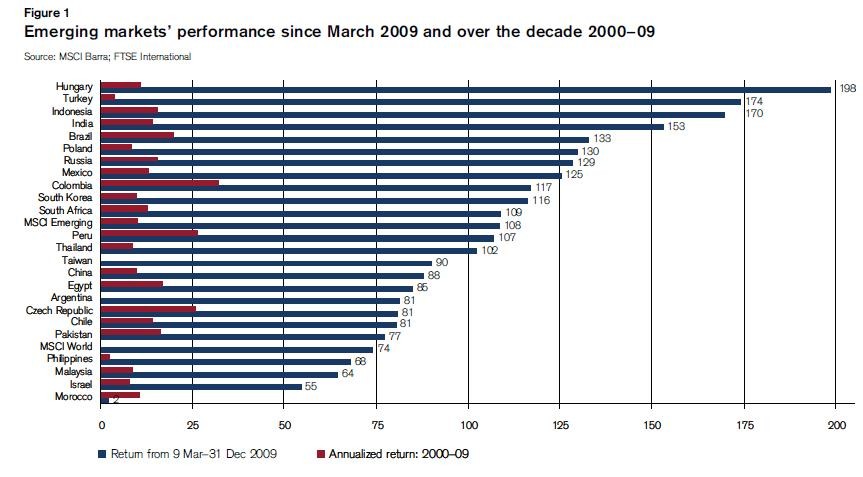

Since S&P’s entrance in the world of frontier markets, there have been several other index providers that have emerged in this space. Each index provider, including S&P and the two newest entrants in the world of frontier markets (MSCI Barra and FTSE), defines and classifies frontier markets in a different manner.

While considered a subset of emerging markets, the countries within each frontier markets index, are not included in their related emerging markets index (i.e. MSCI’s emerging markets index does not include the countries within the MSCI frontier market index).

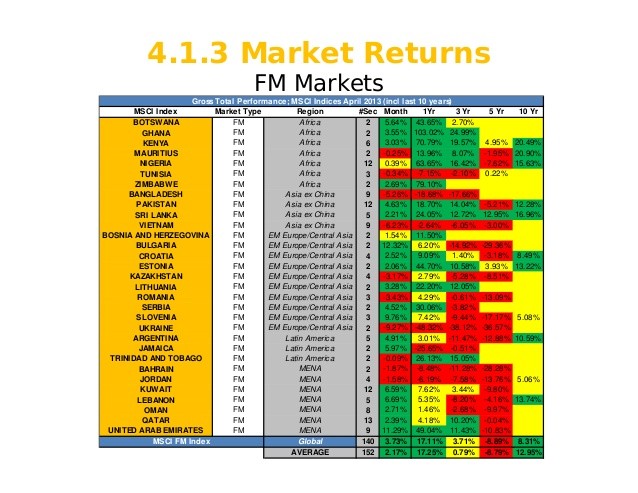

The countries within each index provider’s version of their frontier markets index may differ slightly, but they each have 20 to 35 countries and may be classified according to several factors that consider each country’s regulatory environment, market liquidity, and transparency.

The list of countries in each frontier markets index changes based on a variety of issues, such as those described above. A complete listing of countries in each frontier markets index can be found at each index provider’s website: MSCI Frontier Markets. FTSE Frontier Markets and S&P Frontier BMI.