American Depositary Receipts

Post on: 9 Апрель, 2015 No Comment

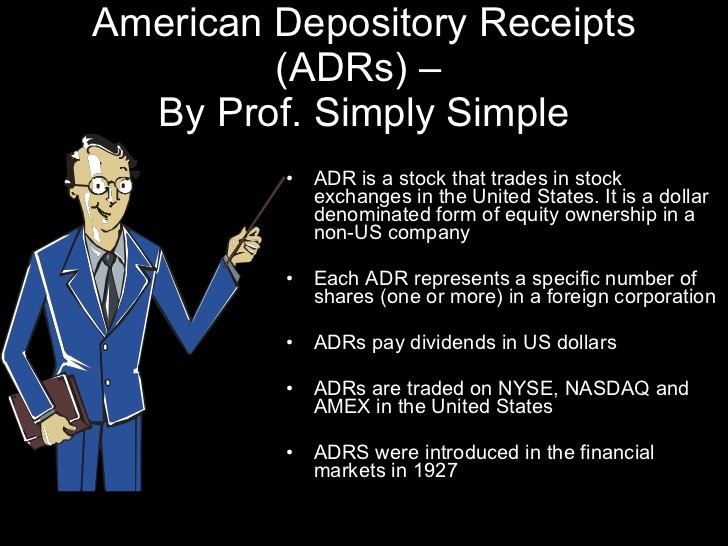

An American depositary receipt (ADR) is a negotiable certificate that trades like a common stock and is issued by a U.S. bank; it represents shares of a non-U.S. publicly traded company. ADRs are priced in U.S. dollars, and dividends are paid out in U.S. dollars. The actual shares of the foreign company are held by a custodian bank in the company’s home country, subject to the terms specified on the ADR certificate.

Foreign Investing Options

An investor has multiple options when choosing to invest in foreign securities. Investing in mutual funds that buy foreign stock is the simplest way, but what about investors who want to pick and invest in individual stocks? One option is to buy shares on a foreign exchange. However, the transactions are denominated in the exchange’s home currency, you or your broker must have access to that foreign exchange in order to place trades, and you have issues of international settlement, global custody, foreign brokerage, currency conversions and multi-currency accounting. This method can be cumbersome and costly.

A handful of foreign companies list their stock on U.S. exchanges, but the number of companies that do this is small due to high costs and strict regulations. The New York Stock Exchange, for instance, allows non-U.S. companies to be listed on the exchange if the company meets all requirements both for the exchange and the SEC, pays a dual-listing fee, and produces frequent reports in English for traders.

ADRs allow U.S.-based investors to bypass these obstacles when investing in foreign stocks.

How It Works

ADRs are foreign shares deposited with a U.S. bank, which then issues certificates representing the shares to investors. The ADR is issued by the bank after underlying shares have been deposited in a local custodian bank. Some ADRs represent several foreign shares (for example, a 100 share lot) or partial shares in order to prevent unusual share prices due to exchange rates. The goal is to package and therefore price the ADR at a level similar to a typical U.S. stock.

A depositary receipt certificate states any stipulations of the investment, such as payment of dividends and shareholder voting.

All ADRs are denominated in U.S. dollars and any dividends are also paid in U.S. dollars.

When an investor wishes to sell the ADR, it is either sold to another U.S. investor or it is canceled and the underlying shares are sold to a non-U.S. investor.

Types

There are two main types of ADRs: sponsored and unsponsored. An unsponsored ADR is created without the company’s involvement and is typically traded through the over-the-counter (OTC) market.

An ADR created with a company’s involvement is called a sponsored ADR and classified into one of three levels:

- A Level I ADR means a company does not meet SEC regulation and reporting requirements and is traded only in the OTC market.

ADRs that are listed on U.S. exchanges provide shareholders with the same level of information as any U.S. security. Typically, trading information is readily available, the company’s financial reports conform to U.S. accounting standards, and the SEC regulates the company’s disclosure of information to investors, with annual reports and other materials provided in English.

Information on ADRs that are traded over-the-counter is more limited, company financials do not conform to U.S. standards and the SEC does not require companies to communicate with shareholders on a regular basis.

How to Trade

SPECIAL OFFER: Get AAII membership FREE for 30 days!

Get full access to AAII.com, including our market-beating Model Stock Portfolio, currently outperforming the S&P 500 by 4-to-1. Plus 60 stock screens based on the winning strategies of legendary investors like Warren Start your trial now and get immediate access to our market-beating Model Stock Portfolio (beating the S&P 500 4-to-1) plus 60 stock screens based on the strategies of legendary investors like Warren Buffett and Benjamin Graham. PLUS get unbiased investor education with our award-winning AAII Journal. our comprehensive ETF Guide and more – FREE for 30 days

Investors can always use a broker to purchase ADRs.

Some ADRs offer direct purchase plans as well as dividend reinvestment plans: The former allows investors to purchase initial shares directly from the company and the latter allows automatic purchases of new shares with any dividends received. A multitude of banks allow investors to trade these shares, such as Bank of New York and JP Morgan Chase.

When selling an ADR, it trades just like a U.S. stock and can be sold to another U.S. investor.

Investor Suitability

Investing in foreign stocks can be risky. Foreign markets can be volatile, reacting to economic, political and social news from the country and surrounding countries, and U.S.-based investors can see a decline in the dollar value of their holdings due to currency fluctuations.

Tax Consequences

Any dividends paid by the ADR are generally taxable, just like dividends on U.S. shares. In addition, taxes may be withheld by the ADR company’s local government. Depending on individual circumstances, foreign taxes withheld might be applied as a credit against U.S. taxes, or tax reclaim opportunities may be offered. A tax advisor can help with any confusion.

Also, as with U.S. stocks, when ADR shares are sold, any capital gains are taxed.

The Pros

- Foreign Diversification: Investing in ADRs allows U.S.-based investors to further diversify their individual stock holdings while avoiding many of the problems associated with direct foreign investment.

The Cons

- Lack of Diversification: While many foreign companies do offer ADRs, they still only represent a portion of the overseas market. Companies issuing ADRs tend to be larger in size. This may lead to an under-diversified international portion of an overall investment portfolio if ADRs are the only foreign holdings.

Additional Information

Bank of New York

The Bank of New York is a major issuer of ADRs. The site offers an overview of ADRs, a glossary, and tips on how to purchase ADRs. You can search for ADRs and access links to additional research.

The Bank of New York also offers a direct purchase and dividend reinvestment program for ADRs.