Alternative Minimum Tax & Stock Options

Post on: 15 Апрель, 2015 No Comment

Talk to a Local Income Tax Attorney

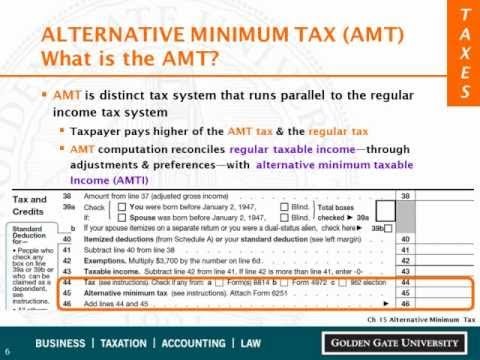

Each year, more and more taxpayers have to pay the alternative minimum tax (AMT). The AMT is a second tax scheme that’s designed to make sure taxpayers can’t avoid paying income taxes by taking a lot of deductions and exemptions.

Exercising certain stock options could make the AMT kick in, too. Before you exercise a stock option, you should know how the AMT might impact your tax bill.

Stock Options & Tax Basics

Generally, a stock option gives you the right to buy stock, usually at a certain price and for a set period of time. There are two main types:

Non-qualified stock options can be given to anyone. Two major tax issues come with these options:

- You have taxable income when you exercise the option — you buy the stock — if the stock price went up between the times you got the option and exercised it

- The income is taxed at the regular tax rates, which can be as high as 35 percent for 2010. It may be higher in 2011. The income doesn’t qualify for the lower capital gains tax rate, which is why they’re called non-qualified options

An incentive stock option (ISO) is much different. First, it can only be given to employees. Also, the main tax issues for ISOs are:

- You don’t pay regular taxable income when you exercise the option

- If you hold the stock for two years after you were given the option and one year after you exercised it, any gain you have qualifies for capital gains treatment, which why ISOs are called qualified options. The capital gains rate is capped at 15 percent through 2010, and it may go up for 2011

- You have to complete the AMT form and report as income the difference between the option price and the exercise price

For example, say in 2005 you got a stock option to buy 100 shares of your employer’s stock at $10 per share, and the option lasts for 5 years:

- If the option is non-qualified and you exercise it in 2009 when the stock is trading at $15 per share, you have $500 of taxable income that’s taxed at the regular rate

- If the option is qualified, you have no regular taxable income, but you have to include $500 as income when you calculate your AMT — the spread between the option price and the exercise price

Avoiding the AMT

Only ISOs are subject to the AMT (non-qualified stock options are subject to the regular tax rates). If you have to pay AMT, the tax rate is 26 percent for taxable income up to $175,000, and 28 percent for any amount over $175,000. So, the AMT can result in a large tax bill for you.

For example, your ISO is for 5000 shares of your employer’s stock at $10 per share, and you exercise the option when the stock is trading at $100 per share. For AMT purposes, you have to report income of $450,000 — the difference between the option and the exercise prices. Your tax bill will likely be over $100,000, in large part because of the ISO.

How can you exercise an ISO without having to pay the AMT? It’s not easy. After all, the AMT is meant to prevent taxpayers from avoiding taxes. There are some things you can do, however.

For one thing, in the same year that you exercise the option, consider selling some of the ISO stock to get enough money to pay the AMT tax. Or, make sure you have other assets on hand to cover the AMT.

If the stock price falls shortly after you exercise the option, you should consider selling all of the stock in the same year as you exercised the option. That’s because under the federal tax code, you can calculate gain for AMT purposes using the sales price (not the exercise price) if you sell in the same year.

For example, say you have an ISO for 100 shares at $5 and you exercise it when the stock is selling for $20. Later in the same year, the stock drops to $15. If you sell before the end of the year at $15, you’ll have no AMT taxes, but will have $1,000 of taxable income (($15 — $5) x 100) that will be taxed as ordinary income. On the other hand, if you hold the stock for the right amount of time, the AMT will kick in and your tax will be calculated based upon the spread between the option and exercise prices, or $1500 (($20 — $5) x 100).

Get Some Advice

The AMT can be complicated, and even more so if you’re thinking about exercising an ISO. Before you do, consider talking to a professional tax preparer or a tax lawyer before you file to see how you can steer clear of a big tax bill.

Questions for Your Attorney

- Is there any reason why I would want an incentive stock option? It sounds to me like it’s a huge tax burden.

- Are there any tax consequences if I change jobs without exercising my ISO?

- Can I sell my ISO to another employee, and if so, will I be taxed on the sale?