Alternative Minimum Tax

Post on: 16 Март, 2015 No Comment

Understanding the alternative minimum tax

Chemistry/ Photographer’s Choice/ Getty Images

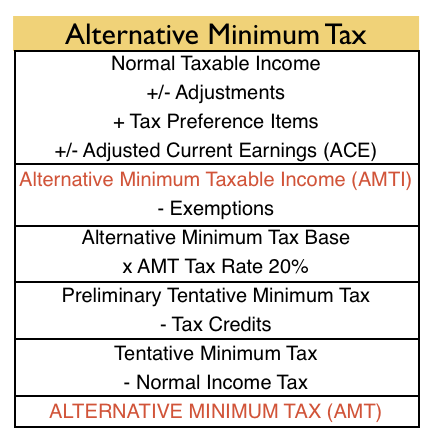

The Alternative Minimum Tax. or AMT. is a parallel tax system. Every taxpayer is responsible for paying the higher of the regular tax or the minimum tax. The difference between the two tax calculations is calculated on IRS Form 6251 (pdf) and using Instructions for Form 6251. If the minimum tax is higher, the difference between the two tax rates is added to your Form 1040 as an additional tax called the alternative minimum tax.

The AMT has a completely different set of calculations than the regular tax. For the regular tax, you add up your total income, subtract out various deductions to find taxable income, then calculate the tax. Against the regular tax you can claim various credits to reduce your tax even further. The AMT, however, has a different base of taxable income and different tax rates. Taxable income for AMT purposes does not allow the standard deduction, personal exemptions, or certain types of itemized deductions. Also some income which is not subject to the regular tax is added for AMT purposes. Your tax under AMT rules may be higher than your tax under regular tax rules.

AMT Adjustments

When calculating the alternative minimum tax, various adjustments are made. Some income is added which is not subject to the regular tax. Some deductions are adjusted downwards or eliminated entirely. These adjustments function to re-calculate taxable income, the base on which the alternative minimum tax is calculated.

The following tax items are added back to taxable income for AMT purposes. If any of these deductions are significant, this can trigger an AMT liability.

This list is not comprehensive, but reflects the typical adjustments I see that can trigger an AMT liability.

Typically, the alternative minimum tax eliminates most or exactly all of the regular tax savings from the above-mentioned deductions.

For a comprehensive discussion of all the AMT adjustments and tax planning strategies, see chapter 23 of J.K. Lasser’s Your Income Tax. Another top-notch resource is chapter 14 of the PriceWaterhouseCoopers Guide to Tax and Financial Planning which provides a checklist of fourteen strategies for minimizing the AMT.

AMT Exemption Amount for 2015

- $53,600 for single and head of household filers,

- $83,400 for married people filing jointly and for qualifying widows or widowers, and

- $41,700 for married people filing separately.

AMT Exemption Amount for 2014

- $52,800 for single and head of household filers,

- $82,100 for married people filing jointly and for qualifying widows or widowers, and

- $41,050 for married people filing separately.

AMT Exemption Amounts for 2013

- $51,900 for single and head of household filers,

- $80,800 for married people filing jointly and for qualifying widows or widowers, and

- $40,400 for married people filing separately.

AMT Exemption Amounts for 2012

Legislated as part of the American Taxpayer Relief Act:

- $50,600 for single and head of household filers,

- $78,750 for married people filing jointly and for qualifying widows or widowers, and

- $39,375 for married people filing separately.

AMT Exemption Amounts for 2011

Legislated as part of the 2010 Tax Relief Act:

- $48,450 for single and head of household filers,

- $74,450 for married people filing jointly and for qualifying widows or widowers, and

- $37,225 for married people filing separately.

AMT Exemption Amounts for 2010

- $47,450 for single and head of household filers,

- $72,450 for married people filing jointly and for qualifying widows or widowers, and

- $36,225 for married people filing separately.

AMT Exemption Amounts for 2009

Congress revised the AMT exemption amounts for 2009 as part of the American Recovery and Reinvestment Act. The revised exemption amounts are higher than they were scheduled to be, thereby preventing approximately 28 million middle-income filers from having to pay the AMT. The AMT exemption amounts for 2009 are:

- $46,700 for single and head of household filers,

- $70,950 for married people filing jointly and for qualifying widows or widowers, and

- $35,475 for married people filing separately.

AMT Exemption Amounts for 2008

The AMT exemption amounts increased slightly for 2008. As a result, fewer taxpayers may be subject to the alternative minimum tax than in 2007. The AMT exemption amounts for 2008 are:

- $46,200 for single and head of household filers,

- $69,950 for married people filing jointly and for qualifying widows or widowers, and

- $34,975 for married people filing separately.

AMT Exemption Amounts for 2007

The AMT has standard exemption amounts. For 2007, the exemption amounts are:

- $44,350 for single and head of household filers,

- $66,250 for married people filing jointly and for qualifying widows or widowers, and

- $33,125 for married people filing separately.

AMT Tax Rates

The exemption amounts mean that this amount of AMT taxable income is not subject to the AMT. Income over these amounts may be subject to AMT. Unlike the ordinary tax rates, the AMT has only two tax brackets of 26% and 28%. The AMT tax rate is assessed only on AMT income over the exemption amount.

For 2015. the threshold where the 26% AMT tax bracket ends and the 28% AMT tax bracket begins is:

- $92,700. for married filing separately, and

- $185,400. for any other filing status.

For 2014. the threshold where the 26% AMT tax bracket ends and the 28% AMT tax bracket begins is:

- $91,250. for married filing separately, and

- $182,500. for any other filing status.

For 2013. the threshold where the 26% AMT tax bracket ends and the 28% AMT tax bracket begins is:

- $89,750. for married filing separately, and

- $179,500. for any other filing status.

Quick Check to See if You are Subject to AMT

The Internal Revenue Service has an online calculator to help you figure out if you are subject to the alternative minimum tax. It’s called the AMT Assistant for Individuals .

There’s also a fairly quick worksheet in the Instructions for Form 1040. You can use this worksheet to determine if you’ll need to fill out the longer Form 6251 to compute your alternative minimum tax.

Most software will compute the alternative minimum tax automatically. Individuals should review the actual tax form to understand which income or deductions are causing the AMT liability. For many taxpayers, deductions for state income tax, property tax and home equity interest and income from incentive stock options are the main causes.

AMT Tax Planning

Devising tax strategies around the alternative minimum tax can be tricky, since the AMT often adjusts for various deductions and credits. In general, tax professionals recommend the following planning tips.

Seek reimbursements from your employer for business expenses incurred as an employee. These expenses are part of the miscellaneous itemized deductions, which are added back to your income for AMT purposes. Having your employer reimburse you for those expenses, by contrast, is a tax-free event to you, and prevents a higher AMT adjustment.

Review your state tax withholding so that you pay in enough so you don’t owe but not enough that you substantially overpay. This will keep your state tax deduction to as low as possible, thereby keeping your AMT adjustments as small as possible.

Pay your property taxes when due instead of prepaying your next installment by the end of the year. Again, this will keep your deduction for state and local taxes as low as possible.

Sell exercised incentive stock options in the same year you exercise them. When you exercise & sell incentive stock options in the same year, you’ll be subject to the regular tax on the income but not the AMT. However, if you exercise but not sell, the value of the exercised options because income for AMT purposes.