AllAboutAlpha Hedge Fund Trends Alternative Investment Analysis Alpha Hunters Today s Post

Post on: 15 Май, 2015 No Comment

Alpha Hunter Jeff Joseph on Taking Funds to Market

The financial crisis has changed the landscape for any industry wishing to attract and retain investors. By the end of 2009, most investment managers were essentially in survival mode, dealing with dramatic declines in asset prices across the board and a wave of redemptions from accounts. Never ones to be defeated, and supported by positivity within the markets and a lack of other investment options the first quarter of 2012 saw global assets under management by the hedge fund industry reach US$2.13 trillion.

Even with this buoyancy of inflows, fund managers have been faced with challenges on a number of fronts. Not only has the hedge fund industry suffered a brand-crisis, but managers are faced with rapid changes in regulations and routes to market.

To learn more about the changed face of fund distribution, we spoke to Jeff Joseph, Managing Partner of Prescient Capital Partners (joseph@4prescient.com )

Jeff co-founded Prescient Capital Partners, a merchant banking boutique with Dr. Ron Weiss in 1999 when they began making direct angel and venture capital investments in early- and mezzanine-stage healthcare, life sciences, Internet, technology, entertainment/media, retail and hospitality companies. In 2007, Joseph founded Prescient Advisors to provide strategic marketing consulting services to private fund issuers looking to refine their messaging, build distribution, raise capital or increase assets under management.

Prior to 2007, he was the managing director of Alternative Strategies for Rydex Investments, where he was responsible for investment product origination, development and distribution of the firm’s proprietary institutional alternative trading strategies. The alternative investment products that his team developed included the mutual fund industry’s first multi-strategy absolute return fund and the first managed futures fund offering daily liquidity. Joseph’s new product slate attracted billions in new assets. Prior to Rydex, he held managing director positions at Hedgeworld Capital Markets in Rye, NY, and Hedge Fund Research in Chicago, IL. Jeff maintains a prominent blog (www.venturepopulist.com) for family offices, angel investors, investment advisers and entrepreneurs that addresses a variety of topics relating to private venture investment, finance and alternative investments.

AllAboutAlpha.com : What are the different channels and routes to market available for hedge fund distribution?

Jeff Joseph: For the most part, hedge fund interests are sold through the efforts of dedicated in-house sales representatives or via non-exclusive engagements with third-party marketers. Recently, these efforts have been focused on institutional investors who have proved to be considerably more resilient than ultra-high-net-worth investors and family offices in terms of coming back to the hedge fund table after the most recent fallout. That means that hedge fund platforms for wealth managers and HNW investors have been a less than robust source of new assets under management. Likewise, hedge funds of funds have been less relevant and active as allocators in recent years as both institutional and individual investors have come around to seriously challenge and question their value propositions. Nevertheless, institutional investors are predominately responsible for the fact that total hedge fund assets under management have recently breached all-time highs.

And things may get even better for the hedge fund industry as we are on the verge of a material shift in the landscape for the distribution and marketing of privately issued alternative investment product. Title II of the JOBS Act, signed into legislation by the president on April 5 this year, contains the Access to Capital for Job Creators provision which discards Depression-era restrictions that have prevented private issuers from engaging in general solicitation advertising of their offerings made pursuant to Rule 506 of Regulation D to prospective investors. The SEC is still drafting guidelines on this provision that shell likely be published soon after their August 22 meeting on this topic. Regardless of how the SEC drafts guidelines in its interpretation of the Congressional mandate, the ability for hedge funds and other private investment product to advertise is certainly a big deal that will have lasting impact on the manner which these products are distributed and marketed, which in turn, will likely reawaken dormant high net worth investor with respect to consideration of hedge fund investments.

What you can expect is that the investment managers of these products will become more visible; more network, cable, online and print interviews.

You will see hedge fund display ads in business and investment print publications, as well as online portals. The visibility of hedge fund managers, particularly star managers of large and/or successfully performing funds, will increase to a larger and broader audience in the same manner that mutual fund managers became celebrities in the 1990s. This, in turn, will increase the competition among hedge funds for assets under management. Yet, at the same time, it will increase the amount of inbound inquiries received at firms running private investment product. The old adage hedge funds are bought, not sold will likely need to be revisited. Likewise, firms will be forced to adapt and evolve their infrastructures to process and pursue inbound inquiries from prospective investors.

AllAboutAlpha.com : From a fund-marketing perspective, what do investors look for?

Jeff Joseph: Well, of course it depends on the investor. Institutional investors have distinctly different (and admittedly more sophisticated) sets of criteria and due diligence protocol than most family offices or other high-net-worth investors. Moreover, institutional investors are most frequently driven by an alternative asset-allocation mandate, such as identifying the best accessible manager for a particular investment strategy. In this instance and for these investors, performance consistency is critical for modelling an asset allocation purposes.

Generally speaking, family office and high-net-worth investors are more willing to consider managers and products across a broader variety of investment styles and strategies. Likewise, these investors often tend to be more likely to be attracted to a compelling narrative about a manager’s personal story or a fund’s unique investment strategy, or symmetric-side-biased performance particularly during market dislocation.

Institutional investors are decidedly more process-oriented in their due diligence, with a quantitative focus, while their non-institutional counterparts generally have a more qualitative approach and require fewer data points in the course of their due diligence.

… Of course these are generalizations…but they are fair.

AllAboutAlpha.com: Are you finding that the nature of messaging to prospective investors is changing?

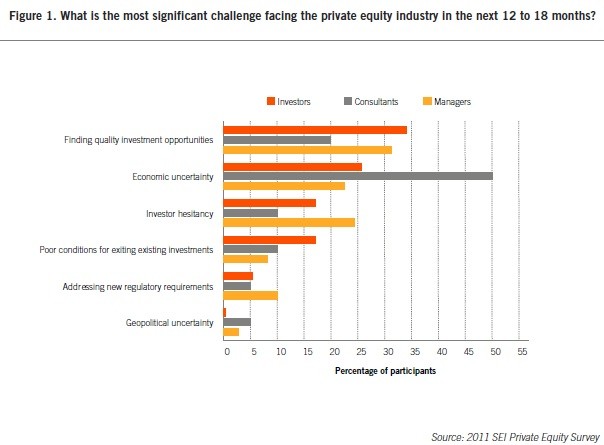

Jeff Joseph: Not as fast as it should be. Institutional investors allocate because they have to. Its their mandate to invest other peoples money, their raison detre. Individual investors can choose to sit on the side-lines… And with respect to hedge funds, they have as of late. Smaller and emerging hedge funds seeking to grow their firms assets will be refining their messaging in a manner that addresses the primary concerns of non-institutional investors—uncertainty .

Investors are uncertain of a host of financial matters global macro geopolitical, as well as domestic, local and personal. Hedge fund products are perceived by most investors as another potential uncertain outcome. Effective marketers should take such pervasive paranoia into account by proactively positioning their products as potential solutions to prospective financial market uncertainties.

Many firms failed to properly segment their institutional and individual investor marketing and sales initiatives. In light of the distinctions mentioned above, it is a mistake to apply the same marketing approach to both types of investors. Such that their due diligence process focuses on different data, that should be taken into consideration in the development of their respective marketing materials. Moreover, there should be acknowledgment in consideration of the distinctly different sales cycle of the two investor groups. The decision cycle is materially different the longer for institutional investors. Ironically, the longer and institutional investor is engaged in due diligence, the greater the probability is for a favorable outcome and subsequent allocation. To the contrary, the longer the non-institutional investor engages in due diligence, the less likely the process will result in an allocation.

Overpromising is a greater potential problem for firms that placed the marketing emphasis on returns as opposed to risk.

AllAboutAlpha.com : What is the market like for new fund entrants?

Jeff Joseph: Tough, very tough. The scale required for new funds to be viable business models is greatly hampered by compliance and regulatory requirements. New entrants and smaller funds simply cannot afford the infrastructure required to be compliant. I am excited about a new product from InCompliance LLC that provides a new turnkey program for start-ups and boutique asset managers seeking simple and cost effective compliance solutions. Innovative product offerings like this, and new marketing opportunities and distribution channels that will likely emerge as a result of the JOBS Act, provide good reason for smaller funds to be optimistic.

AllAboutAlpha.com : How can fund managers build trust with investors?

Jeff Joseph: Education of the manner in which the manager implements the investment strategy. Transparency with respect to the execution of that strategy, Frequency with respect to investor communication, and of course, Consistent delivery of performance objectives.

Of course, these are the obvious ways. Those hedge funds and other private issuers of best product that truly seek a competitive advantage towards growing their assets under management need to be more progressive, if not disruptive, by positioning their products in a more favourable manner to broader market. This could be accomplished by revisiting fund the structures, as well as, investor liquidity provisions.

Implementing a more competitive fee structure and dropping illiquid lockup and gate provisions invariably increases of fund’s prospective investor universe.

AllAboutAlpha.com : How has the financial crisis impacted fund marketing and advertising?

Jeff Joseph: Immediately after the crisis allocation came to a standstill. Thats over now as institutional investors have come back to the table in record-setting fashion. Thats not the case with non-institutional investors. For the most part, they remain deer in the proverbial headlights. They are far more skeptical about the capital markets in general. They are particularly skeptical about the ability of traditional investment manager to add value commensurate with their fee structures. There skeptical about the global economy and certainly question the entire notion of the equity premium. This represents a very distinct opportunity for investment products that provide seductive alternatives to long-only vehicles and, in turn, increases the potential impact of the loosening of marketing and advertising restrictions under the JOBS Act.

Digital marketing opportunities created under the JOBS Act will become another catalyst towards democratizing transparency and access to information. All firms will increase their digital presence—from their own websites to participation in online marketing platforms and portals. A big win for investors—and a new opportunity for firms seeking to grow their businesses.