ADX Indicator Formula Excel

Post on: 8 Апрель, 2015 No Comment

ADX Indicator Formula Excel

ADX Indicator Formula Excel

The average direction index, or ADX indicator for short, acts as a guide to confirm the signals produced by other technical indicators. The average direction index is an indicator for measuring the strength of the trend. For example, it can measure whether the uptrend or downtrend is slowing down or swing.

ADX Indicator Formula Excel is a combination of positive directional indicator (+ Di) and negative direction indicator (-Di). The + DI follows the trend of growth stocks, and follow-Di downward trend. ADX indicator combines the two and produce a single indicator of trend strength.

ADX indicator is an oscillating indicator, ranging from 0 to 100, with 0 indicating a flat trading, and 100 indicating either high or plunging shares. The ADX only indicates the strength of this trend, and does not indicate its direction.

However, it is unlikely to see the ADX Indicator Formula Excel values ​​above 60, because such high values ​​indicate a trend that usually occurs only in the long bull run or long recessions. Usually, each value ADX above 40 is considered a strong trend, and ADX any value below 20 indicates that the shares are trading range.

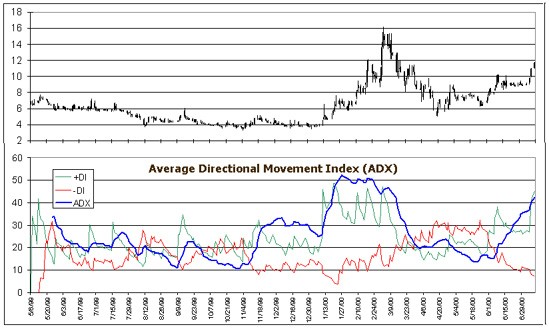

In the table below, + DI is shown as thin green line, and-Di is shown as thin red line. ADX indicator is a thick black line.

From the table, the ADX Indicator Formula Excel indicates that from late February to mid April, the stock market is a strong trend, in this case an upward trend. For this park, do not go indicator ADX below 20, indicating that there is a period when the stock was trading flat. This is quite true, because it can be seen from the price of shares in the first 3 months was uptrend and the last 3 months downtrend.

The average direction index (ADX) indicator reflects the strength of the trend, and do not differentiate between the uptrend or downtrend. ADX indicator values ​​above 40 indicate a strong trend, the ADX values ​​below 20 indicate a sideways trading range.

As for the signals produced by the average direction index (ADX) indicator, a move below 40 above indicates that this trend is slowing. Since most option strategies rely on large price movements in short periods, slowing trend is bad. Therefore the ADX moves below 40 will show that it is time to close our positions.

In contrast, the ADX Indicator Formula Excel ranges from below 20 indicates that the trading side is completed, the new trend is developing. This would indicate that it is time to move, either bullish or bearish.

In the table above, the ADX indicator produce a signal in mid-April shows that the trend (in this case up) vanishes. In early July, the ADX indicator briefly touched 20 of the above and immediately turned back. This indicates the dynamic lift and a new trend (in this case down) is forming.

Also, you can get alerts by looking at where the positive direction index DI + (green) and negative direction index-Di (red) lines between each other. When the + DI crosses above-Di down, it’s bullish signal, as in early February. When-Di + DI crosses above the bottom, it is bearish, as the end of April.

We again emphasize that basing your investment decisions on just one indicator is not recommended. It is best to use with one or two additional indicators of different types in order to confirm the signals and prevent false alarms.

ADX moving below 40 from above shows the trend slowing. An ADX is above 20 from below indicates a new trend forming.

We hope you enjoyed this guide, and the way we described the concepts of technical analysis. There are many technical indicators out there. We chose to cover these 5 indicators to give you a sense of different kinds of existence. It is good practice to 2 or 3 different types of indicators, and using signals from all of them to make decisions.

For more information on technical analysis, you can check Stockcharts.com education part or ChartFilter.

And if you would like to learn stock options and various option strategies, visit our Option Basics Guide for more basic option trading information, and our advanced options strategies Guide for more complex option trading positions.