Advantages of TRIX Triple Exponential Average

Post on: 8 Апрель, 2015 No Comment

How is it used?

Essentially, there are three interpretations of the TRIX indicator, all of which are very similar to that of the MACD. These are:

- Signal line crossovers;

- Zero line crossovers; and

- Bullish and bearish divergences

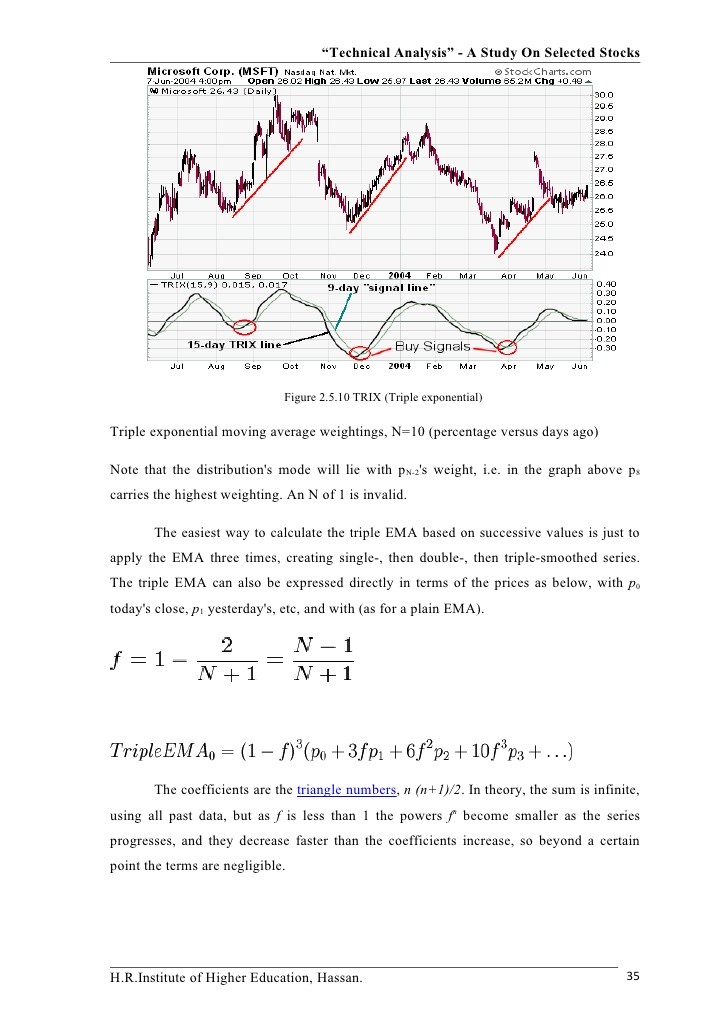

A signal line crossover indicates a turning point in the TRIX. A bullish crossover occurs when the TRIX crosses up over its signal line and a bearish cross over occurs when the TRIX crosses down over its signal line. These crossovers usually suggest a trend reversal.

As the TRIX indicator oscillates around a zero line it provides a zero line or centerline crossover signal. When the TRIX cross up over the zero line, it turns positive. This indicates that the trend has turned bullish. When the TRIX cross down over the zero line, it turns negative. This indicates that the trend has turned bearish.

The TRIX also indicates divergence when the TRIX creates a peak or a valley that does not confirm a peak or valley in the price action of the underlying security. A bullish divergence occurs when the price of the underlying security makes a lower low while the TRIX makes a higher low. This indicates that the downtrend is losing momentum and a bullish price reversal is probable. A bearish divergence occurs when the price of the underlying security makes a higher high while the TRIX makes a lower high. This indicates that the uptrend is losing momentum and a bearish price reversal is probable.

Wealth Warning

Trading equities, options, derivatives, currencies, commodities or any other financial security can offer significant returns BUT can also result in significant losses if the market moves against your position. It requires a strong commitment to skill development, knowledge acquisition, and emotional control. It should be treated as a business with a clear business plan, a risk analysis, and set of attainable goals. The risk associated with trading the vagaries of the stock markets is probably the most important consideration as it has a profound effect on emotional control. You should not trade the stock markets with money you cannot afford to lose as there is considerable exposure to risk in any stock market transaction.

Furthermore, the past success of any trading method, strategy, or system is only indicative of future success. Under no circumstances should past success be construed as a guarantee of future success!