Advanced Options Trading Strategies The Options Spread Strategy

Post on: 25 Июнь, 2015 No Comment

An Example Regarding How To Use The Options Spread Strategy

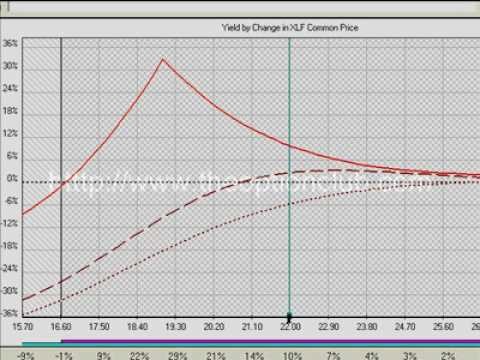

While each of the options spread strategies serves a different trading purpose, the following example of a bull call spread options spread strategy provides an example regarding how options spread strategies can be used to reduce options trading risk while potentially still booking a decent options trading profit.

A bull call spread is placed when a trader buys call options at a strike price that is close to the current trading level of a stock or commodity and then sells (goes short) the same amount of call options at a higher strike price to offset the cost of the purchase of initial call option. Both options must have the same expiration date for the bull call spread strategy to work.

For example, if Apple Computer’s stock AAPL is trading at $450 per share, an options trader looking to put on a bull call spread using AAPL would buy call options close to the $450 price level for $15 per option, and then sell call options at a higher price level (say $475) and pocket $10 per option sold at the higher price level. This means that the bull call spread in AAPL cost the trader $5 to establish ($15 to buy call options, minus $10 earned by selling call options at a higher price point), but is limited to a $20 profit if AAPL trades above $475 per share before the options expire. If AAPL trades above $475 per share, the $450 call option will be worth approximately $25, which results in a $20 per option contract profit after the $5 cost of purchasing the option is factored in. A quadrupling of value of the AAPL call options bought at the $450 strike price, from $5 per option cost to $20 is an outstanding trading profit, but that is the maximum amount of profit that can be earned in this bull call spread example, because the call options sold at $475 put a cap on additional profits, if AAPL’s stock price moves higher than $475.

The nice thing about a bull call spread is that if AAPL were to fall instead of rise, and closed below $450 on the day the option expired, the loss would be limited to the $5 paid to set up the bull call spread. An options trader in this AAPL bull call spread example would be risking $5 per option to make $20, if the trade works as expected and AAPL rises above $475. Not a bad risk reward ratio.

The bull call spread options spread strategy is just one of many options spread strategies. These advanced options trading strategies are somewhat complicated, and should only be used once a trader thoroughly understands how to trade options. A good way to try out advanced options spread strategies without losing any money is to do a number of paper trades without real money, and become comfortable with implementing options spread strategies.

Stay up to date on how to use the options spread strategy by getting on our FREE eMail list !

By clicking ‘Submit’, you agree to our Disclaimer and Privacy Policy. We are 100% Anti-Spam and will never share or sell your information!