Advanced Options Trading

Post on: 8 Апрель, 2015 No Comment

There are over 30 different advanced options trading strategies.

Most option strategies are spread trade variations of different options, strike prices, and expiration months that are bought and sold as a “packaged investment.”

When trading advanced option strategies, it is absolutely critical to understand your risk and how you will profit in the trade.

Some of my favorite advanced options trading strategies consist of:

- Short Iron Condors

- Long Iron Condors

- Double Diagonal Spreads

- Skewed Double Diagonals

- Calendar Spreads

- Unbalanced Calendar Spreads

- Long Butterfly Spreads

- Broken Wing Butterfly’s

- Short Vertical Spreads

- Skewed Long Vertical Spreads

- Legging into LEAP Spreads

- Legging into Iron Condors

- Unbalanced Double Diagonals

- Long Stock on Unbalanced Covered Call

- Straddles and Strangles

- Unbalanced Straddle Strangle Swaps

- Short Straddles with a Long Strangle

- Unbalanced Vertical Spread Rolls

- Unbalanced Calendar Spread Rolls

Again, every advanced trading strategy here is going to consist of many different options. Some only deal with calls, others with puts, and some consist of both calls and puts. When you understand that every advanced trading strategy consists of, or is a variation of: a “vertical spread” and/ or a “calendar spread” you will soon master the art of trading advanced option strategies.

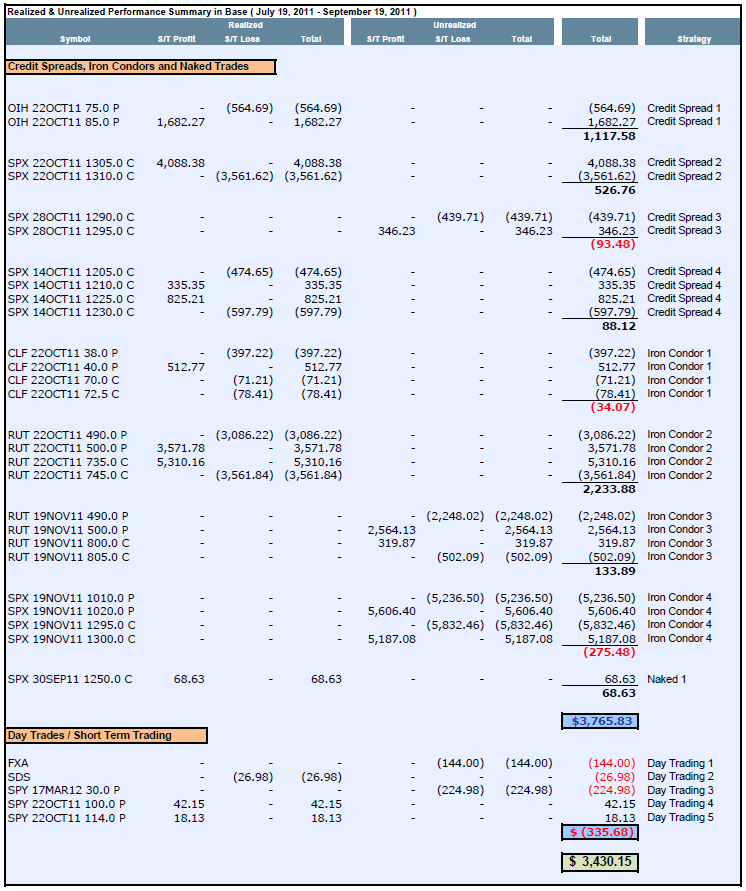

Since trading advanced options is a complex activity, I have decided it is best for my fellow traders to enjoy some free videos I have created of myself trading many of these above mentioned strategies LIVE and with real dollars at stake in my personal trading account.

_______________________________________________________________________________________________________________________________

Discover the Top 10 Secrets Pro Traders Use to Get Consistent Results in the Stock Market! FREE e-Report for Visiting Today ($17.95 value)

Simply enter your first name and email below and the free report will be instantly emailed to you. Inside, youll discover:

* The #1 reason why most traders fail

* How to create a structured and well-balanced portfolio

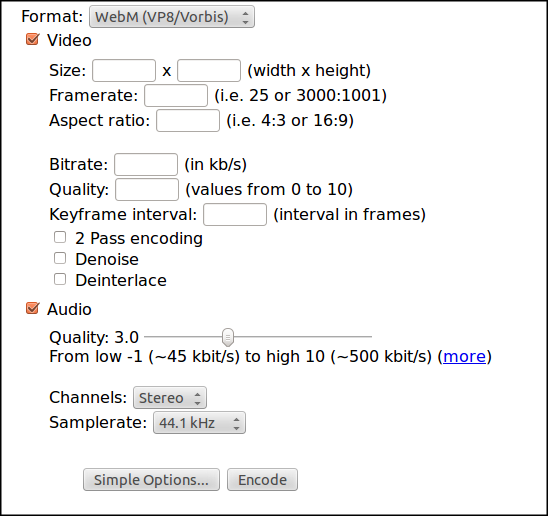

* The tools and technology that professional traders use

* How to leverage capital and mitigate risk

* What to look out for before you enter into a trade

* How to get paid to buy stock you dont ownand much more