ADRs American Depositary Receipts

Post on: 3 Июнь, 2015 No Comment

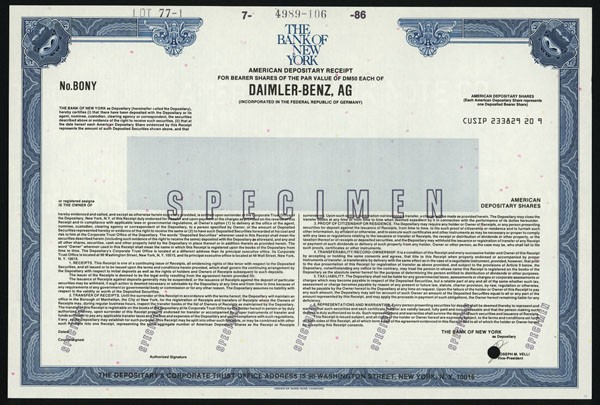

American Depositary Receipts

Because there can be problems in dealing in unfamiliar foreign markets. Depositary Receipts were devised as a method of trading international securities (equity or debt) within the U.S.

This involves depositing the ordinary securities from the foreign market with a bank (called the depositary), who will then issue certificates in the U.S. that represent (and are backed by) the deposited securities.

These certificates are freely traded and are commonly called American Depositary Receipts (or Depositary Receipts for short, or sometimes Global Depositary Receipts for marketing purposes).

The Attractions of ADRs

The main appeal is that they are U.S. securities. This means that they are covered by U.S. securities regulations.

Trade and settlement is similar to any other U.S. security and quoted prices and dividends are in U.S. Dollars.

Because of the above, investment by funds and institutions is possible, where perhaps they would otherwise be prevented from investing directly in foreign markets.

Investing directly in international securities may incur global custodian fees — these are not required with ADRs.

ADR prices and liquidity will track very closely the underlying security as any deviation will be quickly corrected by traders exploiting an easy arbitrage opportunity.

Although ADRs may have been devised originally for U.S. investors, all of their attractions can be equally applicable for foreign investors.

For example, an investor in Kuwait may be interested in buying shares in Telefonica De Argentina, in which case the U.S. traded Depositary Receipts may be more attractive than dealing direct in the Argentine market.

In addition to the advantages above, the investor would be able to look at price history charts and follow real-time prices (as with any other U.S. security), transaction fees could be less and the foreign currency investment may be more competitive than converting funds to Argentine Dollars directly.

The Types of ADRs

A similarity obviously exists between ADRs and covered warrants (or OTC options). As with the latter, there is frequently nothing to stop anybody buying some shares in a company and then issuing Depositary Receipts representing those shares — without consulting, or acting with the accord, of the company.

These are termed Unsponsored Depositary Receipts, and in the early days of the ADR market they were quite common.

Today, however, nearly all ADRs are sponsored, whereby companies sign a Deposit Agreement with a bank acting as the depositary.

There are a few different types (or levels) of ADRs:

Continue to the Next Page