Adjusting Tax Withholding From Your Paycheck

Post on: 16 Март, 2015 No Comment

How to Accurately Calculate Your Withholding for Federal Income Taxes

PhotoAlto/Eric Audras/Brand X Pictures/Getty Images

After finishing up your tax return, it’s a smart idea to do a little planning ahead for next year. Your income or deductions may be changing, and you may want to adjust your withholding to avoid having too large of a refund or a significant balance due. Finding just the right level of withholding can be tricky, especially if you anticipate significant changes to your income or deductions.

Disregarding Your Withholding Can Be Taxing

Calculating a level of withholding that is just right can sometimes take as much time as preparing a tax return. As a result, some people are inclined the skip the math. For those who want to keep things as simple as possible, the easiest course of action is for taxpayers to claim either Single or Married with one withholding allowance on Form W-4 (pdf). This usually results in a refund for most people. However, there are situations in which claiming one withholding allowance is not sufficient to cover tax liabilities. This seems to be the case in which a person has significant investment income or higher taxes due to the Alternative Minimum Tax. So even people who want to keep things simple and count on a refund should review their withholding at least periodically.

Calculating Withholding More Accurately

The more accurate way to adjust your withholding is to create a projected tax return for this year. You can do this by using the same tax forms you used last year, but substitute the current tax rates. For example, you could calculate your income and deductions based on what you expect for 2014, and use the 2014 tax rates to find out what your projected tax will be. You can also use the worksheet found in Form 1040-ES (pdf), which has formulas for calculating taxes for the current tax year.

After figuring out the tax liability, I then use the withholding calculator found on the IRS Web site to see what the suggested withholding allowances might be. You can also do the math by hand by using the worksheets provided with Form W-4 .

What’s a Withholding Allowance?

Withholding allowances do not solely pertain to dependents or to the personal exemption amount, though withholding allowances are related. A withholding allowance is a way for your payroll department to use the look-up tables provided by the IRS to figure out how much tax to withhold from each paycheck. Roughly, a withholding allowance represents your total tax deductions divided by the personal exemption amount. This results in a ratio, and this ratio is how many withholding allowances you should claim. For further explanation please refer to the example below:

Example: Mary is a single parent, qualifies as head of household. and has one dependent. Let’s further assume that her deductions will consist of the standard deduction and two personal exemptions (one for herself and one for her child. The math for her withholding allowances would look like this (all figures below are for the 2014 tax year):

- Standard deduction: 9,100

- Personal exemptions: 2 x 3,950 = 7,900

- Total tax deductions: 9,100 + 7,900 = 17,000

- Deductions divided by one personal exemption amount: 17,000 / 3,950 = 4 .304

In this example, Mary would claim Single and four withholding allowances on her W-4 Form. (It’s advisable to round down the ratio to avoid having too little tax withheld from your paycheck.) In other words, Mary would check the Single box on line 3 of the Form W-4 and would write 4 on line 5 of the Form W-4 where it asks for Total number of allowances you are claiming.

This is a simplified method for finding withholding allowances. For a longer method, see the document, How to Fill out Form W-4 .

Seeing How Your New Withholding Allowances Will Impact Your Future Pay Checks

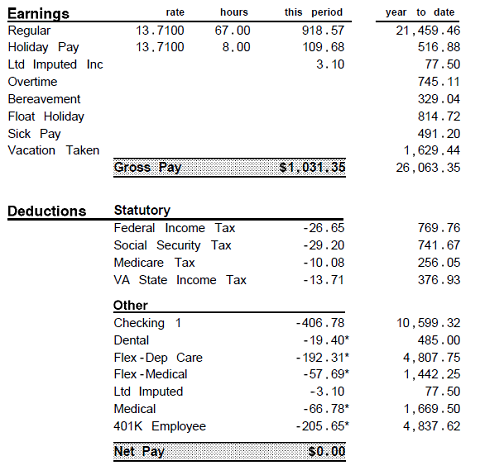

Now that you have figured out your withholding allowances, you can use this figure to see what the tax impact is on your next paycheck will be. You just take the newly calculated withholding allowances and plug them into a payroll calculator. Be sure to have your recent paystub handy so you can use your actual income amounts.

Calculating Your Total Withholding for the Year

To see what your total withholding will be for the entire year, take your new withholding amount per pay period and multiply this by the number of pay periods that are remaining in the year. To this figure add in how much federal income tax has already been withheld so far for the year-to-date. This amount represents approximately how much total federal tax will be withheld from your paycheck for the year. You can now compare your total withholding to your tax liability projection. If your withholding amount is larger than your tax liability, that’s how much of a federal tax refund you might be receiving. If your withholding is smaller than your tax liability, that’s how much federal tax you might have to pay when you file your tax return. Remember, these amounts are approximations.

If the withholding is too high or too low, go back to the payroll calculator to fiddle with the withholding allowances. Try Single instead of Married, or try changing the withholding allowances by one point at a time. (For example if you used Single-4 the first time, try a new calculation with Single-3.) Re-extrapolate the annual numbers and compare.

Repeat this process until you find the withholding level that will be just right for you. I try to get the withholding to produce a refund in the range of $500 to $1,000, figuring that gives my clients enough room so that any changes in income or deductions will not result in owing very much.

I find it’s best to keep track of all of this math on a spreadsheet. This makes it easier to build alternate scenarios and projections. A spreadsheet also makes it easier to analyze the impact of changing your tax withholding mid-year (which is when most people make these sorts of changes).

You can do the same projections with your state taxes as well.