Adjusting Iron Condors

Post on: 7 Апрель, 2015 No Comment

It happened again. I read an article tonight about Adjusting Iron Condors and I saw some mistakes in the article written by Gavin McMaster. In general, McMaster’s article was good, but he had a few incorrect statements and he implied that there are only six ways to adjust an iron condor. I think there are many more than he suggested.

First let’s define the iron condor

An iron condor is the combination of bullish and bearish vertical spreads. Typically you use credit spreads as you don’t have to buy them back if you let them expire worthless. In practice, good iron condors traders rarely let these option expire. They buy back the spreads cheaply ($0.10-$0.20 for example) to take risk off the table and free up trading capital for more productive uses.

The iron condor is a defined risk trade. If the market goes to zero or 1 million, you have a fixed amount you can lose. The Iron Condor is also a defined profit trade. You don’t have unlimited potential profit. This is where McMaster gets into trouble. He says “Potential losses are higher than potential profits.” This is true if the options you sell are approximately 25 or less. If you are selling options closer to at-the-money, your potential profit will exceed your maximum risk.

This dovetails into McMaster’s second inaccurate statement, that these are high probability trades. This is only true if your short deltas are low. The closer to at-the-money you sell your short options, the lower the probability of success is, and the higher the potential reward is!

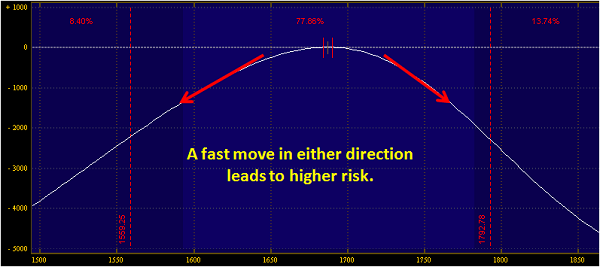

Here’s a chart showing two iron condors. The green iron condor is a typical higher probability that most educators teach, and what McMaster was referring to. The brown iron condor, is a lower probability/higher reward:risk ratio iron condor. This is closer to a butterfly in my opinion, but technically it still is an iron condor.

The most important thing

McMaster is correct in that the most important thing is to control your losses . You can’t wipe out your entire year’s profits with two bad months. Let’s take a look at the adjustments McMaster’s talks about

Not a smart way to trade. This will incur the very large losses occasionally. Large losses are progressively harder and harder to recover from. For example, a 10% loss requires an 11% gain to get back to your original capital. A 20% loss required a 25% to recover. A 30% loss requires a 42.86% gain to recover to break even. A 40% loss requires a 66.7% gain to recover. I hope you can see that letting a loss get too large is catastrophic. DON’T DO IT!

Roll down (up) and out

I don’t have a problem with rolling the bad side of the trade away from danger, but I never roll the good side towards danger. I know traders who do that but I prefer to close the good side when I’ve extracted my profit target. Then I only have to trade a simple vertical spread (the bad side).

There are many ways people use to determine when to roll, how far to roll and whether or not to increase the trade size. Each could be a separate series of articles. These are factors you need to decide BEFORE you enter your trade. Don’t decide in the heat of the moment. Decisions made in battle are usually flawed and will cost you money.

Reposition entire trade

This is something Calendar Spread traders do a lot. I’m not a big fan of doing this for an iron condor because of the commissions, slippage and reduced time premium you get since you’re closer to expiration. I’d rather deal with the side having problems and close the “good” side when I’ve extracted most of the profit from it.

Hedge with the underlying or buy out-of-the-money options

I like this option a lot. Hedging with the underlying isn’t possible with indexes like SPX and RUT. Stocks have large margin requirements to hedge with stock (unless you’re a market maker). This is one of the reasons I like trading futures options. You can buy/sell a future contract to adjust your delta very quickly. It essentially rotates the whole risk graph around the current market price.

Ideally you adjust options with options. An extra long put can be a welcomed friend with a market meltdown. I like to have net long puts on iron condor positions. You can do this by starting out with less short options than long, or by adding the extra long options after you have your iron condor in place. I recommend putting the insurance on with when you initiate the trade as it is cheap then. If you wait until the market has already made a big move, the insurance is much more expensive.

Close the trade

Going to cash is never always prudent if you are worried about your position. Cash is a position you can sleep at night with. If the economic events and news are too crazy, take a break from trading and go to cash.

Other Adjustments

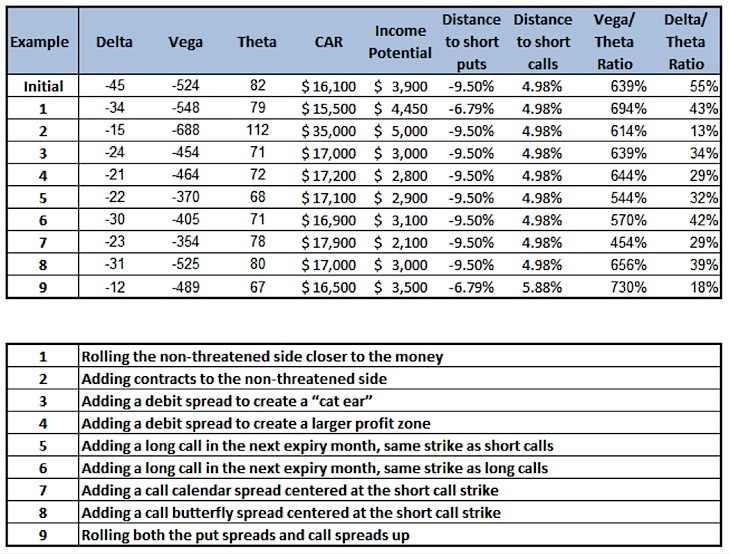

Overall McMaster has a good choices for adjusting. There are many other things you can do to adjust, such as:

Add vertical spreads

Add Calendar spreads

Add Iron Condors

Add ratio spreads

Convert to other positions. For example, close the good side and add another vertical spread opposite of your bad vertical to create a butterfly.

The possibilities are only limited by your imagination. That’s one of the things that’s always attracted me to option trading. The flexibility is amazing. Ultimately you have to test what is comfortable for YOU to use. We all have different risk tolerance, capital available, profit goals and even time horizons for trading. As you get more experience trading, you’ll find the combination that works for you.

Finding that balance goes faster when you have someone experienced helping you learn. That is the advantage of joining a training program. You can learn it on your own but it takes longer.

Comments

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D96&r=G /% Steven says

Great article, Karl. One other thing you can do on a condor adjustment is add a diagnal on the side you are defending.

3A%2F%2F0.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D96&r=G /% ron says

I did an Iron Condor trade on the Nasdaq just recently and made some money, at one point I thought I would have to defend and thats when it becomes harry. I need to know much more and have the knowledge to defend if required. Can you help I trade with TOS if that helps.