Actively Managed ETF

Post on: 7 Апрель, 2015 No Comment

Actively Managed ETFs — The Best of Both Worlds?

You can opt-out at any time.

Please refer to our privacy policy for contact information.

It’s a war that has stood the test of time with no clear winner. No, not good vs. evil, the real war is ETFs vs. Mutual Funds. However, a treaty might be in the works. The Treaty of Actively Managed ETFs.

How is An Actively Managed ETF like a Mutual Fund?

Actively managed ETFs bring one of the best advantages of mutual funds to the table…active management. A normal ETF is created to emulate an index or underlying investment like a commodity. The assets in the ETF aren’t frequent to change except on the occasions when assets in the correlating index change (with exception to ETFs that consist of derivative products like futures and options ). Also, an ETF is designed to track an index, not outperform it. Therefore an ETF does not require much (if any) management.

A mutual fund is designed to outperform. Mutual funds are actively managed in order to beat the market or another investment. Fund managers manipulate the fund on a daily, if not hourly (even minutely) basis in order to improve performance, react to market conditions, and increase profits. For this optimization to occur, a manger has to be active within the mutual fund; constantly monitoring, reacting, and trading.

Therefore this new innovation in ETF construction will have the traditional structure of an ETF, but the assets within the ETF will be actively managed by an advisor. So the goal of this type of ETF will be to outperform its correlating index or asset. And while most of the new ETFs will be limited to a theme or act similar to a style ETF. they don’t necessarily even have to track an index or financial product.

How is An Actively Managed ETF like an ETF?

One of the biggest disadvantages of mutual funds (to an investor, not a manager) is the lack of transparency. Fund managers put a lot of effort and research in the maintenance of their mutual funds in order to make them sound investments. Therefore, they do not like to divulge their methods to the rest of the investing world. Why give away secrets? In that regard, mutual funds are not very transparent – meaning you don’t always no exactly what’s in your mutual funds on a real time basis.

However with ETFs, the holdings are transparent. Since ETFs trade on active markets, traders need to know what they are buying or selling at all times. The information is public knowledge.

So in the case of actively managed ETFs, the holdings are going to have to be public in order to maintain the ETF asset classification. That’s the biggest hurdle for actively managed ETFs and the solution seems to be that the holdings will be transparent at least at the end of each trading day. The SEC has given them some freedom in that regard to make the new investment product work.

How are ETFs Better than Traditional ETFs and Mutual Funds?

An actively managed ETF is designed to combine the best elements of both investments. You have an asset that has all the advantages of an ETF like the tax benefits. liquidity (in some cases) and transparency, as well as the advantages of mutual funds, which is managed in order to outperform other correlating investments. An ETF that eats like a meal.

Are There Any Disadvantages of Actively Managed ETFs?

Actively managed ETFs are not the end-all be-all investment. While there are advantages as we discussed, there are disadvantages as well.

These new ETFs will have higher fees than traditional ETFs due to the management aspect, but the hope is that the cost will still competitive. Also, while the goal is total transparency, the level of transparency will fall somewhere between traditional ETFs and mutual funds. It’s tough to gauge the level of liquidity and investor interest in these new assets. And of course, these are new innovations, so actively managed ETFs are not completely evolved investments. There will be some obstacles as firms continue to improve their structure.

Actively managed ETFs are a great start to giving investors a product that has a lot of diversity, flexibility and advantages. And they may just be the very thing that ends war.

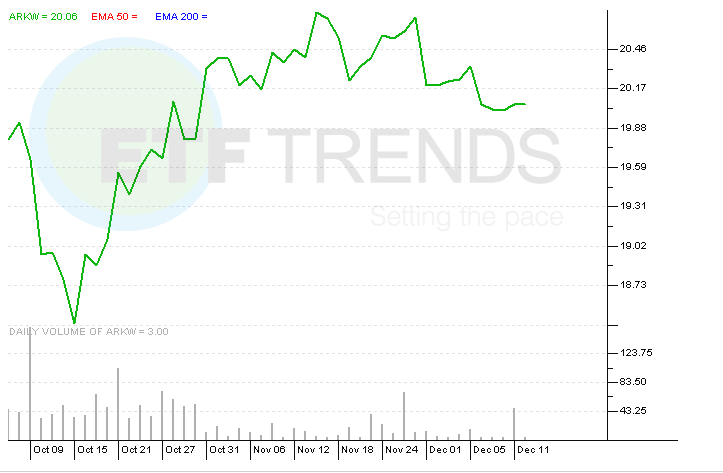

In the meantime, if you want to see some of these types of ETFs in action, look no further than my list of actively managed ETFs .