Accurate Market Analysis with Candlestick Signals Traders Library Blog

Post on: 16 Март, 2015 No Comment

February 17, 2012

Accurate Market Analysis with Candlestick Signals

Guest post for Stephen W. Bigalow.

Positive results of an investment portfolio are a function of being positioned in the correct direction of the general market. This may seem like an oversimplification but most investors have a difficult time analyzing which direction the general direction of the market indexes. The majority of investors participate in a market uptrend well after the uptrend has been established. Most investors remain in positions,  that are going down, well past the time it was appropriate to sell. Many investors have a difficult time maintaining a position that is profitable because of the fear of giving back profits. Fortunately, candlestick analysis has some basic elements built into each individual candlestick signal that  greatly alleviates the guesswork of which direction the market is going to move.

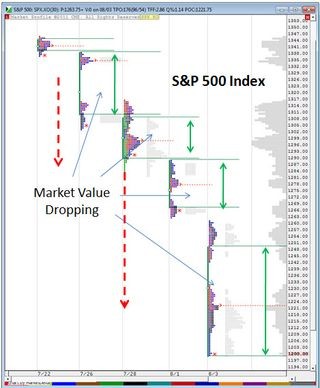

The longer an uptrend persists, the more compelling the candlestick reversal signal and the close between the T- line needs to be established. Fridays trading, February 10, showed a ‘selling’  day in the Dow. The selling closed the Dow below the T line. This now creates the question of whether the uptrend is over and it is time to close out long positions. There are some very simple analytical elements that can be applied to the overall market trend. Analyzing the Dow, the NASDAQ, and the S&P 500 with candlestick signals provides a more  clear picture of what is occurring in the overall market trend. Although the Dow closed below the T line on Friday, with a large dark candle, the NASDAQ revealed a different story. The uptrend remains in progress until all the indexes reveal sell signals and a close below the T-line.

Fridays market results showed the Dow was down 90 points and the NASDAQ was down 23 points. Those numbers would reveal market weakness to most investors. The candlestick investor comes away with a slightly different viewpoint. The dark candle in the Dow revealed obvious selling. The NASDAQ revealed a different story. Although the NASDAQ was down 23 points, it forms a Doji. This represents indecisiveness. There did not seem to be any continued selling in the NASDAQ once it had opened. Additionally, the small white body of the Doji illustrated there was buying occurring from where the NASDAQ initially opened. The indecisive trading of the NASDAQ also did not close below the T line. Until the NASDAQ can close below the T line, it has to be considered to be in an uptrend.

The S&P 500 traded lower but it did not close below the T line. When the Dow was providing some evidence of a possible reversal, the NASDAQ and the S&P 500 were showing weakness but nothing that would indicate the sellers had yet taken control. It is important to be able to analyze what the market trend is about to do. Fridays trading, although showed much weakness, did not show there had been a change of investor sentiment. Candlestick analysis refines an investors assessment of a trend, whether the market in general is being analyzed or an individual stock is being analyzed.

The added information built into each individual candlestick signal creates an evaluation tool that produces much more accurate analysis. The combination of signals  evaluated  in each of the market indexes makes for a better analysis of investor sentiment for the whole market. This information helps investor stay in positions or close positions at the appropriate times.

www.candlestickforum.com>. the leading website on the Internet for providing information and educational material about Japanese Candlestick investing.  Over 28 years of extensive study and utilization of candlestick analysis has produced an array of easy-to-learn educational material about Candlesticks. As one of the leading Candlestick experts in the nation, Mr. Bigalow, through consulting with major trading firms, has developed multiple successful trading programs from the day-trader to the long-term hold investor