Accounting for StockBased Compensation A Simple Proposal

Post on: 5 Апрель, 2015 No Comment

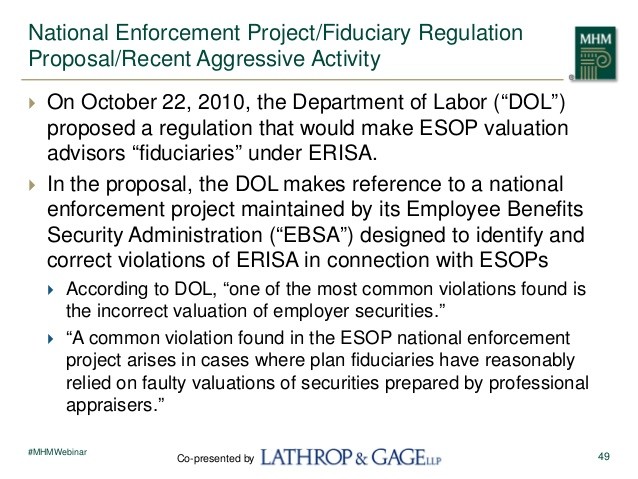

On March 31, 2004, FASB issued its long-awaited exposure draft, Share-Based Payment, an amendment of SFAS 123 and 95. As expected, this controversial draft sparked proposed legislation and campaigns by various groups to prevent, or at least limit, the effects of the proposed rules. By mid-June, FASB had received more than 4,000 comment letters on this matter.

The proposed statement requires the recognition of the cost of employee services received in exchange for equity instruments in the financial statements. For public companies and those nonpublic companies that so elect, that cost is based on the fair value of the employees right to purchase stock at a set price, which is evidenced by the issuance of a financial instrument, the stock option. Fair value is determined by either observable market prices or an option pricing model that must contain certain specified elements. The drafts option pricing models are complex and require computer software to apply. After determining the fair value, the draft requires the reporting entity to recognize compensation expense over the requisite service period. Generally, the requisite service period begins at the grant date and ends when the stock options are fully vested. Entities will no longer be able to account for stock options using the intrinsic method in APB Opinion 25, Accounting for Stock Issued to Employees.

The basis for recognizing the issuance of stock options as an expense is the value attached to these instruments by both employers and employees. Many employees willingly accept a lower cash salary in return for stock options having perceived future value in excess of the forgone cash compensation. The employer also benefits by incurring lower current cash-compensation costs.

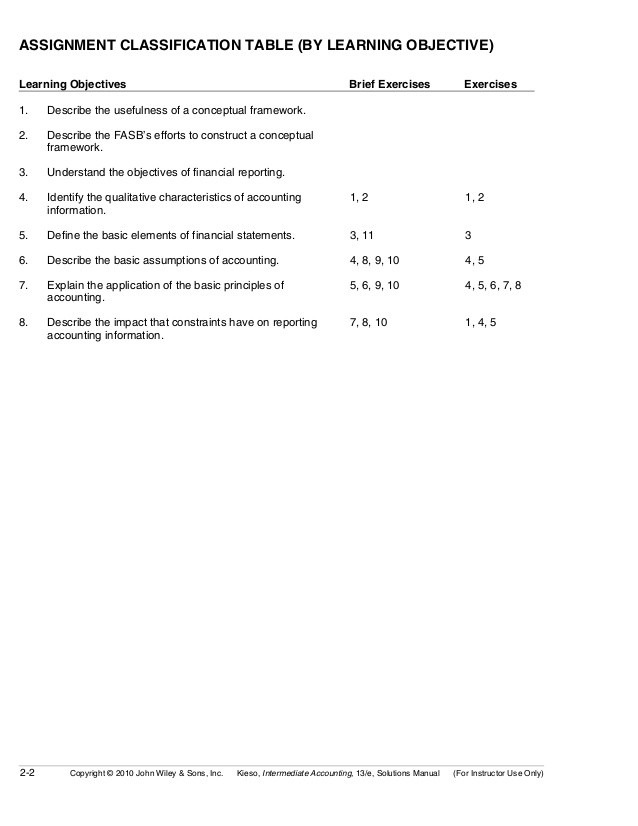

Although stock options clearly have some perceived value at the grant date, the exposure draft proposes measurement models that neither reflect the economic substance of every stock option transaction nor meet certain qualitative characteristics of accounting information under FASB Concept Statement 2, Qualitative Characteristics of Accounting Information. Specifically. the draft fails to demonstrate that the measurement models are representationally faithful and verifiable.

The author recommends that FASB develop a method that reflects the economic substance of the transaction and is also representationally faithful and verifiable. This method should be based on the presumption that the ultimate cost of stock-based compensation equals the cash proceeds forgone at the exercise date. This approach will be easier to apply than that proposed by the exposure draft, which, at 213 pages, is very difficult to understand.

Economic Substance of Stock Options

Whatever perceived value employees attach to stock options, the principal financial accounting issue is how to measure what they cost the reporting entity. The issuance of employee stock options is a hybrid transactionthe exchange of equity instruments for employee services. An important consideration is whether issuing stock options is a capital or an expense transaction. The classification is important because if they are classified as equity instruments, stock options cannot be revalued after issuance. This appears to be the drafts basis for limiting any revisions to the estimated expense. The problem with this position is that, if the issuance of stock options is a capital transaction, no expense should be recognized, because an entity is generally precluded from recognizing gains and losses on trading its own securities.

On the other hand, because the intent of the employer is to compensate employees for services performed, the issuance of stock options should be classified as an expense transaction. Accordingly, the value of the stock options should be based on the actual cost to the reporting entity, and the accounting standards should reflect the definition of expenses and liabilities presented in the concept statements. According to Concept Statement 6, Elements of Financial Statements. paragraph 80, expenses are outflows or other using up of assets or incurrences of liabilities (or a combination of both) from delivering or producing goods, rendering services, or carrying out other activities that constitute the entitys ongoing major or central operations. Thus, a reporting entity measures the cost of a transaction by considering the assets used and the liabilities incurred, as opposed to the value perceived by the counterparty. Otherwise, retailers would write up the carrying value of their inventory to reflect retail sales prices.

The ultimate economic cost of stock-based compensation to the reporting entity, in terms of assets used, is the cash proceeds forgone when the option is exercised. This amount represents the market value of the stock at the exercise date, less the exercise price. This view is consistent with the description of expenses in paragraph 80 of Concept Statement 6 (discussed above), and paragraph 81, which further asserts that expenses represent actual or expected cash outflows (or the equivalent) that have occurred or will eventuate as a result of the entitys ongoing major or central operations. The exposure draft also reflects this view by requiring that the measurement models include such factors as the exercise price and the current price of the underlying shares (paragraphs 19 and B13).

Rather than ultimately value the transaction at the amount of cash forgone at the exercise date, the exposure draft asserts (in paragraph C13) that the assets given up are the employee services, which are exchanged for the stock options. The classification of employee services as an asset stretches the commonly understood meaning of asset and distorts the intent of Concept Statement 6, paragraph 31, which notes that personal services are received and used simultaneously and can be assets of an entity only momentarily [emphasis added]. The classification of personal services as assets may set a dangerous precedent in that entities may use this reasoning to capitalize personal services as assets, however temporary, for periods of time longer than momentary.

Problems with the Recommended Measurement Models

The measurement of any accounting information should reflect the qualitative characteristics presented in Concept Statement 2. Such characteristics include reliability, defined as the quality of information that assures that the information is reasonably free from error and bias and faithfully represents what it purports to represent. Reliability has a number of components, such as representational faithfulness and verifiability. Concept Statement 2 defines representational faithfulness as correspondence or agreement between a measure or description and the phenomenon that it purports to represent. The phenomena to be represented are the economic resources and obligations and the transactions and events that change those resources and obligations, which in the case of stock options is the amount of cash forgone by exercise. Concept Statement 2 defines verifiability as the ability through consensus among measurers to ensure that information represents what it purports to represent or that the chosen method of measurement has been used without error or bias.

Representational faithfulness. The proposed stock-based compensation measurement models do not meet the representational faithfulness characteristic because they do not reflect the actual resources given up (i.e. forgone cash proceeds). In essence, the exposure draft substitutes the actual settlement of the instrument with a computer model. The draft does not define the ultimate economic cost of stock-based compensation to the reporting entity, upon which a determination whether the actual estimate is representationally faithful could be based. Nor does the draft present evidence that its required measurement models reflect or have any other relationship with the ultimate economic cost of stock-based compensation to the reporting entity. Such evidence could have included comparison of the computer-estimated costs with the amount of cash proceeds forgone at the exercise date, in order to evaluate the effectiveness of the software. In lieu of the computer models, the draft permits the comparison of the employee stock option to a similar equity or liability instrument on active markets. Such a comparison is rarely possible, because such instruments do not exist for substantially all stock options. Substantially all employee stock options are restricted and cannot be traded. Finally, the proposed measurement models do not reflect changes to the estimated cost that inevitably arise when new events occur, more experience is acquired, or additional information is obtained.

The exposure draft requires the recognition of an expense calculated at the date of grant and severely limits the recognition of any changes in estimated exercised options. Paragraph 26 (see Authors Note ) requires the recognition of compensation cost at the date of grant, based on the number of instruments for which the requisite service is rendered or expected to be rendered. Although paragraph 26 notes that the effect of a change in the number of instruments is a change in estimate, the draft limits the recognition of any changes in estimates to the reversal of compensation expense if a service condition or performance condition is not met (paragraph 17) and if the estimated number of forfeitures change (paragraph B63 in Illustration 4 of the exposure draft). The recognized compensation cost cannot be reversed if the option is not exercised or converted, particularly when the expired options are for services already received (paragraph 26B); if the entity settles the instrument for cash less than the recognized expense [Illustration 12(d), paragraph B121]; when subsequent events prove the original estimate to be incorrect (paragraph B121); or when a modification in stock option terms results in no issuance of options [Illustrations 13(a) and (b), paragraphs B121127].

The exposure draft notes that estimates reflecting future events are an inherent component of financial statements and presents examples in paragraph C22 (e.g. loan loss reserves, valuation allowances for tax assets, and pensions and other postretirement benefit obligations). Unlike the proposed estimated stock-based compensation costs, these examples are subject to periodic review and revision to reflect events occurring subsequent to the estimate, pursuant to APB 20, Accounting Changes. paragraph 31. Such revisions also are appropriate to the accounting for stock options.

The estimated number of stock options exercised changes over time to reflect subsequent events not deemed probable at the grant date. Once stock options are issued, the entity has little control over the exercise of such options and the incurrence of the related economic cost. Options are exercised only when certain legal requirements, such as vesting, are met, as well as when certain favorable market conditions encourage the exercise of options. In other words, the employees value of such options, based on perceived market conditions, drives the ultimate cost to the reporting entity. At the grant date, the exercise price may exceed the market price of the stock, but the employee perceives the instrument as having future value contingent on future events. Employees will not exercise their out of the money instruments, which they perceive as having no current value; in fact, the employee may never exercise their options. Thus, market conditions will affect the number of exercised options and the amount of cash forgone upon exercise. These conditions are difficult, if not impossible, to predict. If no options are exercised, the entity does not forgo any cash proceeds and therefore has effectively received employee services at a lower cost than originally contemplated. As a rule, accounting does not require the recognition of an amount that the entity should have paid rather than what it actually paid.

The examples in paragraph C16 are also not convincing in their support of the exposure drafts computation of fair value. APB 14, Accounting for Convertible Debt and Debt Issued with Stock Purchase Warrants. paragraph 16, requires the allocation of the proceeds of debt issued with stock purchase warrants between the debt principal and the fair value of the warrants, based on the relative fair values of the two securities at the date of issuance. Thus, the recorded value of the warrants is not their total value, but a value limited by the amount of cash proceeds and the value assigned to the debt instrument. APB 14s treatment differs from the exposure draft, which requires the computation of a fair value with an uncertain relationship to the amount of cash ultimately received. The second example in C16, pertaining to the issuance of stock or stock options for goods or services, is not applicable to stock options. Most goods and services have a known market value (either as a range or as a single estimate) that can serve as a basis for valuing the stock option. The vendors or service providers accept the stock or stock options as part or all of the consideration for providing such goods and services. Their motivations are different from employees receiving such options as an employee benefit.

Verifiability. Nor do the measurement models in the exposure draft satisfy the characteristic of verifiability as defined in Concept Statement 2. The option models presented in paragraphs B13 to B30 are based on very subjective information reflecting future events and, accordingly, are unverifiable at the grant date. The expected volatility, as required by paragraph B25, is premised on managements ability to estimate future stock prices. (Paragraph B25 specifically prohibits the exclusive use of historical volatility except to estimate expected volatility.) Removing periods of extraordinary volatilitycalled mean-reverting tendencies in paragraph B25dfrom the calculation of fair value is an invitation to manipulate historical volatility. Entities can claim almost any adverse direction as outside the mean. An adverse event can include events that temporarily drive stock prices up and therefore increase expenses. Finally, the credit risk consideration is not explained sufficiently to include in a quantitative calculation. Thus, the measurement models do not meet the verifiability characteristic, because their outputs are based on generally unchangeable subjective estimates of future events made at the grant date.

FASB should recognize the increased importance of reliability, representational faithfulness, and verifiability to preparers and auditors of financial statements filed with the SEC. Sarbanes-Oxley Act section 302 requires officers, including the CEO and the CFO, to certify, among other things, that the financial statements and other financial information included in filings with the SEC fairly present, in all material respects, the financial condition, results of operations, and cash flows of the registrant as of and for the periods presented. In addition, auditors have come under greater oversight by both the SEC and the PCAOB.

Recommended Accounting for Employee Stock Options

This author recommends that stock-based compensation costs be estimated at the grant date based on the expected obligations incurred by the reporting entity, which is the amount of cash forgone when stock options are exercised. Estimated compensation expense should be recognized during the period the services are being performed, from the grant date and over the vesting period. Such an estimate, however, would be revised to reflect options that are no longer expected to be exercised or converted. Revaluation of the options themselves would not be necessary unless certain triggering events, such as significant changes in the market value of the stock, greatly increase the expected cost to the entity. The estimate would ultimately be adjusted to equal the actual cost to the reporting entity, as measured by forgone cash proceeds. As noted above, this approach is consistent with the accounting for estimates. The entity would also record, as an offset, a separate equity line item reflecting an obligation to be settled with common stock, as covered in SFAS 150, Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity.

Whatever its faults, this method would reflect the economic substance of stock option transactions more accurately than do the measurement models proposed by the exposure draft. The value of the intrinsic method is recognized by the exposure draft, which permits it as an alternative method when fair value cannot reasonably be determined (paragraphs 22 and C67) and for options issued by nonpublic entities (paragraph 25B). In addition, the authors method would eliminate much of the exposure drafts subjectivity and complexity in determining compensation cost, as discussed below.

Estimated volatility. The exposure draft proposes a single method of estimating volatility to be used by all companies, ignoring any differences between thinly traded and actively traded entities. Many small businesses do not have extensive historical experience on which to base the volatility estimates necessary to develop fair value measurements. Comparing a volatility assumption to that of similar entities, as discussed in paragraph B16, is not an option for small and medium-sized businesses. Those companies are distinguished by the quality of their management and business plans, which vary widely, making comparisons generally invalid. In addition, many small and medium-sized businesses may not have sufficient historical data to implement the binomial lattice model, which paragraph B18 considers preferable for purposes of a change in accounting principle. As a result, many small and medium-sized businesses will be forced to apply a closed-form model, such as the Black-Scholes-Merton formula, which paragraph C23 notes may not necessarily be the best available technique for estimating the fair value of employee share options.

Requisite service period. Paragraph 25E of the exposure draft requires the recognition of compensation expense over the requisite service period, which can be explicit, implicit, or derived. This information would be necessary in estimating the compensation cost at the grant date. While the guidance regarding explicit service period is valid, small and thinly traded companies lack both historical information and experience in estimating the implicit and derived service periods. Thus, small and thinly traded companies would either use the explicit service period or apply very subjective and unverifiable information in estimating implicit or derived service periods.

Income tax effects. The authors recommended approach also would simplify the guidance in accounting for income taxes: The recorded expense would be a temporary difference to be reversed upon exercise or expiration.

Different rules for nonpublic and small business issuers. The authors recommended approach would eliminate many differences in accounting for stock options between public and nonpublic companies, thus avoiding the complexities of complying with different measurement standards for small and medium-sized companies. The lack of comparability, plus the possible perception that little GAAP is inferior, could cause many small and medium-sized companies to not apply alternative standards for fear of being penalized by the market. However, it should be noted that the intrinsic value of nonpublic companies securities is not readily available in the absence of a market for their securities. Many entities would be reluctant to expend resources on appraisals to value their outstanding equity.

Cash flows. The exposure draft requires that excess tax benefits be reported as a financing cash flow rather than a reduction of taxes paid. The income tax effect is related to the expense portion of the stock option transaction and, accordingly, is properly classified as an operating activity.

Robert A. Dyson, CPA. is a director of quality control at Friedman LLP and chair of the NYSSCPAs Financial Accounting Standards Committee. He can be reached at rdyson@nyccpas.com .

Authors Note: Paragraph references to the exposure draft without alphabetic prefixes, such as paragraph 25D, refer to Appendix F, Clean Copy of Statement 123 (As Amended by This Statement).