About Money Market Funds

Post on: 5 Июнь, 2015 No Comment

By MoneyRates Team | Money Rates Columnist

Money market funds, also called money funds, are liquid funds that invest in short-term debt securities. Money funds can be purchased by individuals from mutual fund companies or brokerage firms. Money funds are required by the SEC to keep the average maturity of their holdings below 60 days.

The difference from deposits

Although money funds have a long history of safety, they differ from the savings accounts, checking accounts, CDs and money market accounts offered by FDIC-insured banks. Technically, money funds are classified as a type of mutual fund with a price that, in theory, can fluctuate. With a few exceptions, money funds have been able to maintain their stable $1 net asset value.

Money funds have achieved price stability by holding liquid short-term investments such as high-rated commercial paper, government-backed financial instruments and U.S. Treasury securities. SEC regulations now require that money fund managers hold in their portfolio short-term debt obligations and cash instruments with a weighted average maturity of 90 days or less.

In addition, the SEC requires money funds to hold at a minimum 10 percent of their assets in securities that can be sold for cash within a day and at least 30 percent of their assets must be able to be converted into cash within a week.

SEC rules also require public disclosure of money fund portfolio holdings. These rules helped alleviate some of the concerns over the safety of money funds that cropped up in 2008 after well-publicized problems with a few funds that were hit with the losses associated with the bankruptcy of Lehman Brothers. On the downside for investors, the rules have made it harder for portfolio managers to find ways to boost money fund yields.

Money funds have a long history of maintaining their $1 share price. This stability was last threatened in 2008 when the commercial paper issued from a bankrupt Lehman Brothers suddenly became worthless. A few funds had to break the magical $1 share value to compensate for their investment loss.

About money funds

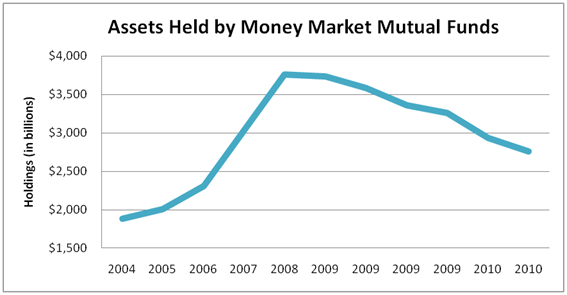

Money fund assets typically increase when political tension crops up around the world as investors look for safe havens for their cash. Money funds can have important cash-management features even though yields are extremely low. Many companies use money funds to help manage their operating and cash accounts. Individual investors can use money funds as a place to park cash in their brokerage accounts as they wait for investing opportunities.

Money funds do not serve as a good replacement for a checking account at a bank. Withdrawals are limited by regulation and the yields on money funds may not match today’s best rates on checking accounts .

Rules from the Securities and Exchange Commission regulate how mutual fund companies can invest money for their money market funds. Another regulation requires funds to disclose their holdings every month on their website. This disclosure rule should make it easier for analysts to identify potential risk in funds, with the goal of preventing exposure to low-rated commercial paper.

While money funds can be a safe addition to your portfolio, you may find it wise to examine deposit accounts, which feature the added benefit of FDIC insurance. and other conservative investment options before you invest.