Abolish TaxFree Municipal Bonds Bloomberg Business

Post on: 22 Июль, 2015 No Comment

By Josh Barro

In 2011, 35,000 taxpayers making more than $200,000 a year paid no federal income tax. As Matthew O’Brien notes at The Atlantic, 61 percent of those avoided tax for the same reason: their income consisted largely of interest on tax-exempt municipal bonds.

As Washington looks for options to broaden the tax base, and particularly to eliminate tax preferences for the wealthy, why not eliminate this exemption?

It’s important to note that most of the value of the municipal bond interest exemption goes to the municipal bond issuers. Buyers want the tax advantages of muni bonds and have to accept much lower pre-tax interest rates to get them. The Congressional Budget Office estimates that issuers receive about 80 percent of the value of the tax preference. Still, that means about 20 percent of the muni bond subsidy — about $36 billion over the next five years — is being captured by bondholders.

Nearly all of those bondholders are either for-profit corporations or individuals with high incomes. The higher your tax bracket, the greater the value of the tax preference, so it generally only makes sense to buy tax-free munis if you are in, or close to, the 35 percent federal tax bracket. You also need to be subject to U.S. income taxes to make it worth your while. There’s no reason for nonprofits or foreign individuals or corporations to buy tax-free munis.

It doesn’t have to work this way. We can reform subsidies for municipal borrowing so that 100 percent of them actually go to municipalities, and so that municipal issuers have access to a broader bond market than one consisting of domestic corporations and wealthy individuals. We should also question whether we should subsidize municipal borrowing as much as we do.

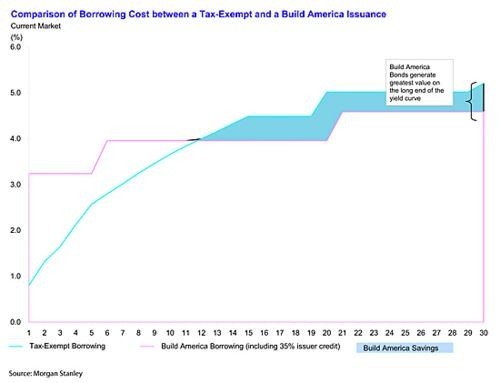

There is a ready model for reform. For 2009 and 2010, states and municipalities were allowed to issue so-called Build America Bonds. These bonds were taxable, but the federal government made 35 percent of the interest payments. These bonds can be sold to individuals, but are also attractive to investors who can’t take advantage of a tax preference, such as pension funds and foreign entities.

That program gave municipal governments access to a deeper and more liquid bond market. Because essentially any bond-market participant can purchase them, the limited set of buyers who benefit from tax preferences can’t use their special position to claim a portion of the subsidy.

In 2011, Congress let the Build America Bonds program expire but kept traditional tax-free munis. It would be better to do the opposite: Abolish the municipal bond tax preference and allow a direct subsidy for municipal borrowing. Rather than simply resurrecting the Build America program, however, the subsidy structure that was used for it should be tweaked and restricted.

Traditional muni bonds have an unfortunate feature that was shared with Build America Bonds: Under both, subsidies are linked to the interest rate. That means issuers who must pay higher interest rates get more valuable subsidies. Perversely, the worse a municipality’s credit, the greater incentive it is given to borrow more money.

Instead of setting the subsidy as a percentage of interest, it should be a percentage of bond principal. There should also be a cap on bond yields at the time they are issued, so that issuers who can only borrow at high interest rates don’t get subsidized. If the markets are judging an issuer to be highly risky, we don’t want to encourage it to borrow more.

Congress should also further restrict the projects that can be financed with subsidized debt. The rationale for a subsidy for municipal borrowing is that otherwise towns and cities will underinvest in capital projects, because some benefits of those projects go to people who pay taxes in other jurisdictions.

That’s certainly true for certain capital investments, such as transportation links. But some other projects are of purely local value, with no reason to believe that federal encouragement is needed. Congress should target specific categories of investment that produce regional and national benefits and restrict bond subsidies to financing those. And it should especially tighten restrictions so that states can’t use subsidized bonds to finance for-profit enterprises, as many places have done in recent years.

The size of the subsidy should also be evaluated. The level of the Build America Bonds subsidy was chosen to match the top income tax rate. But that’s an arbitrary amount, and because some municipal bond buyers aren’t in the top bracket, it meant a bigger subsidy than for traditional munis. Given the long-term budget gap in Washington, a smaller subsidy is called for.

Conservatives tended to revile the Build America Bond program, which was part of the 2009 stimulus bill. But a reform that restructures and tightens the municipal borrowing subsidy, instead of simply expanding it as happened in 2009, should be palatable to the right. The left should be happy that, under this reform, all of the subsidy goes to municipal governments, not wealthy individuals. Even in today’s polarized Washington, it sounds like an idea that Democrats and Republicans can agree on.

(Josh Barro is lead writer for the Ticker. Follow him on Twitter.)

Read more breaking commentary from Josh Barro and other Bloomberg View columnists and editors at the Ticker .

-0- Jul/10/2012 16:33 GMT