AAPL options Options Blog

Post on: 12 Апрель, 2015 No Comment

February 19, 2015

Your Overall Option Delta

Delta is probably the first greek an option trader learns and is focused on. In fact it can be a critical starting point when learning to trade options. Simply said, delta measures how much the theoretical value of an option will change if the stock moves up or down by $1. A positive delta means the position will rise in value if the stock rises and drop in value of the stock declines. A negative delta means the opposite. The value of the position will rise if the stock declines and drop in value if the stock rises in price. Some traders use delta as an estimate of the likelihood of an option expiring in-the-money (ITM). Though this is common practice, it is not a mathematically accurate representation.

The delta of a single call can range anywhere from 0 to 1.00 and the delta of a single put can range from 0 to -1.00. Generally at-the-money (ATM) options have a delta close to 0.50 for a long call and -0.50 for a long put. If a long call has a delta of 0.50 and the underlying stock moves higher by a dollar, the option premium should increase by $0.50. As you might have derived, long calls have a positive delta and long puts have a negative delta. Just the opposite is true with short options—a short call has a negative delta and a short put has a positive delta. The closer the option’s delta is to 1.00 or -1.00 the more it responds closer to the movement of the stock. Stock has a delta of 1.00 for a long position and -1.00 for a short position.

Taking the above paragraph into context, one may be able to derive that the delta of an option depends a great deal on the price of the stock relative to the strike price of the option. All other factors being held constant, when the stock price changes, the delta changes too.

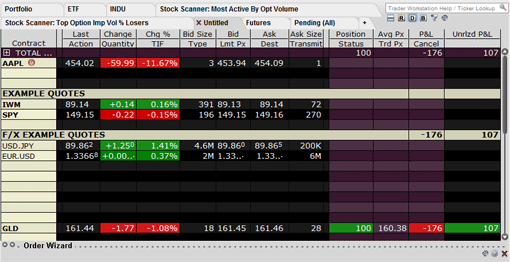

What many traders fail to understand is that delta is cumulative. A trader can add, subtract and multiply deltas to calculate the delta of the overall position including stock. The overall position delta is a great way to determine the risk/reward of the position. Let’s take a look at a couple of examples.

Let’s say a trader has a bullish outlook on Apple (AAPL) when the stock is trading at $128 and purchases 3 March 130 call options. Each call contract has a delta of +0.40. The total delta of the position would then be +1.20 (3 X 0.40) and not just 0.40. For every dollar AAPL rises all factors being held constant again, the position should profit $120 (100 X 1 X 1.20). If AAPL falls $2, the position should lose $240 (100 X -2 X 1.20) based on the delta alone.

Using AAPL once again as the example, lets say a trader decides to purchase a March 130/135 bull call spread instead of the long calls. The delta of the long $130 call is once again 0.40 and the delta of the short $135 call is -0.22. The overall delta of the position is 0.18 (0.40 0.22). If AAPL moves higher by $3, the position will now gain $54 (100 X 3 X 0.18) with all factors being held constant again. If AAPL falls a dollar, the position will suffer a $18 (100 X -1 X 0.18) loss based on the delta alone.

Calculating the position delta is critical for understanding the potential risk/reward of a trader’s position and also of his or her total portfolio as well. If a trader’s portfolio delta is large (positive or negative), then the overall market performance will have a strong impact on the traders profit or loss.

John Kmiecik

Senior Options Instructor

What is an Option Strangle?

An option strangle is an option strategy that option traders can use when they think there is an imminent move in the underlying but the direction is uncertain. With an option strangle, the trader is betting on both sides of a trade by purchasing a put and a call generally just out-of-the-money (OTM), but with the same expiration. By buying a put and a call that are OTM, an option trader pays a lower initial price than with an option straddle where the call and put purchased share the same strike price. However, this comes with a price so-to-speak; the stock will have to make a much larger move than if the option straddle were implemented because the breakeven points of the trade will be further out due to buying both options OTM. The trader is, arguably, taking a larger risk (because a bigger move is needed than with an option straddle), but is paying a lower price. Like many trade strategies there are pros and cons to each. If this or any other option strategy sounds a little overwhelming to you, I would invite you to checkout the Options Education section on our website.

The Particulars

An option strangle has two breakeven points just like the option straddle. To calculate these points simply add the net premium (call premium + put premium) to the strike price of the call (for upside breakeven) and subtract the net premium from the puts strike (to calculate downside breakeven). If at expiration, the stock has advanced or dropped past one of these breakeven points, the profit potential of the strategy is unlimited (for upside moves). The position will take a 100% loss if the stock is trading between the put and call strikes upon expiration. Remember that the maximum loss a trader can take on an option strangle is the net premium paid.

Implied Volatility

The implied volatility (IV) of the options plays a key role in an option strangle as well. With no short options in this spread, the IV exposure is concentrated. When IV is considered low compared to historical volatility (HV), it is a relatively “cheap” time to buy options. Since the option strangle involves buying a call and put, buying “cheaper” options is critical. If the IV is expected to increase after the option strangle is initiated, this could increase the option premiums with all other factors held constant which is certainly a bonus for long option strangle holders.

Example Trade

To create an option strangle, a trader will purchase one out-of-the-money (OTM) call and one OTM put. An option trader may think Apple Inc. (AAPL) looks good for a potential option strangle since at the time of this writing, it is teetering around its all-time high at $120. With IV lower than HV and the trader unsure in what direction the Apple stock may move, the option strangle could be the way to go. The trader would buy both an March 125 call and an March 115 put. For simplicity, we will assign a price of 2.00 for both resulting in an initial investment of $4 (2 + 2) for our trader (which again is the maximum potential loss).

Apple Stock Rallies

Should the Apple stock rally past the call’s breakeven point which is $129 (125 + 4) at expiration, the 115 put expires worthless and the $125 call expires in-the-money (ITM) resulting in the strangle trader collecting on the position. If, for example at expiration the stock is trading at $133 which means the intrinsic value of the call $8 (133 – 125), the profit is $4 (8 – 4) which represents the intrinsic value less the premium paid.

Apple Stock Declines

The same holds true if the stock falls below the put’s breakeven point at expiration. The put is in ITM and the call expires worthless. At expiration, if Apple stock is trading below the put’s breakeven point of the trade which is $111 (115 – 4), a profit will be realized. The danger is that Apple stock finishes between $111 and $129 as expiration occurs. In this case, both legs of the position expire worthless and the initial 4, or $400 of actual cash, is lost.

Maximum Loss

Notice that the maximum loss is the initial premium paid, setting a nice limit to potential losses. Profits and losses can be realized way before expiration and it is up to the trader to decide how and when to close the position. Potential profits on the strangle are unlimited which can be very rewarding but as always, a traders needs to decide how he or she will manage the position.

John Kmiecik

Senior Options Instructor