A Strategy For Optimal Stock And Bond Allocation Yahoo Finance Canada

Post on: 6 Апрель, 2015 No Comment

Investing & Planning

One of the most difficult elements of investing is to know when to get in and out of specific markets. However, a buy and hold strategy has never been optimal, and even less so in recent years.

Thus, two key questions have to be answered: How can one avoid a major downturn and improve performance? And how can one ensure that, to the greatest possible extent, one is optimally invested in the best asset classes? One way of doing this is to restrict oneself to stocks and bonds and use a proven and effective strategy known as the best of two.

How the Strategy Works

The basic idea is to use past trends to determine a sound investment balance for the future. However, this does not mean trying to predict the future from the past. Indeed, it is just the opposite. The allocation to stocks and bonds works according to fixed mathematical rules and criteria without active management in the usual sense. There is no stock picking, with the stocks and bonds being held in the form of index investments such as exchanged-traded funds. Given the dangers of stock picking and of trying to predict the markets, this is a sound basis for a strategy.

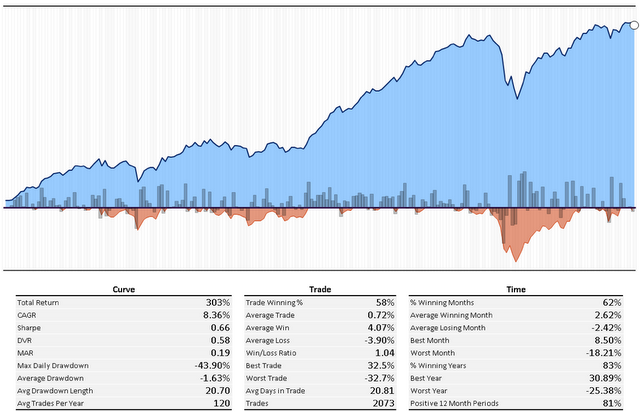

At the start of each calendar year, there is a 50/50 allocation which is reviewed monthly and adjusted as necessary. The aim is to systematically overweight the better performing asset class and vice versa. If the stocks are performing badly, they will be underweighted and bonds overweighted. Of particular importance is the fact that within a given year, the allocation to one of the classes can rise to 100% or fall to zero. The portfolio is always fully invested, such that the stock and bond proportions total 100% at any point in time.

More on the Mechanics

Option price theory is used to calculate how to allocate the funds to the two asset classes. Because no suitable and standardized options are available and OTC ones have some serious disadvantages, a replication is used. This enables an investment in the two asset classes in the right proportions. Monte Carlo simulations have also indicated that a monthly adjustment is sufficient. The full details are too complex to be explained here.

Who Should Go for the Best of Two?

The strategy is ideal for people who like the idea of relying on a fixed formula, says Dr. Ulrich Stephan, the chief investment strategist of the Deutsche Bank in Germany. Naturally, the strategy wont perform as well as a pure equity investment in a bull market, but in a bear market, there is a fair amount of protection. Furthermore, the strategy generally works better over time than a rigid equity-bond allocation. Also, it is straightforward in that it just has stocks and bonds, both of which work in terms of indexes. So it is appealing for those who like simplicity.

From a time perspective, at least five years is recommended, so that the strategy can maximize its potential over various market phases.