A REAL OPTIONS PERSPECTIVE TO ENTERPRISE ARCHITECTURE AS AN INVESTMENT ACTIVITY

Post on: 16 Март, 2015 No Comment

A REAL OPTIONS PERSPECTIVE TO ENTERPRISE ARCHITECTURE AS AN INVESTMENT ACTIVITY

Pallab Saha

Institute of Systems Science

National University of Singapore

The ever-increasing expenditure on information technology (IT) is accompanied by an increasing demand to measure the business value of the investment. This has prompted enterprises to take an architectural view of their information systems (IS) and supporting technologies. However, many crucial enterprise architecture frameworks and guidelines are characterized by lack of adequate theoretical or conceptual foundations. Important but inadequately formulated concepts include architectural assessments, governance and architecture maturity models. These, though central to the enterprise architecture development process, remain in their current formulations largely wisdom driven rather than engineering based approaches. Absence of adequate scientific or mathematical foundations for enterprise design and engineering significantly impede enterprise architecture initiatives. The current body of knowledge is limited to reference architectures where the implementation challenges are left to the enterprises themselves.

This paper views enterprise architecture development as largely a process of decision making under uncertainty and incomplete knowledge. Taking value maximization as the primary objective of the enterprise architecture decision-making process, the paper attempts to develop guidelines for value enhancement. The paper assumes that portion of the value of enterprise architecture initiative is in the form of embedded options (real options), which provide architects with valuable flexibility to change plans, as uncertainties are resolved over time. Plausibility of using such an approach to develop a better account of critical enterprise architecture practice is focused on three areas:

• The timing of critical architectural decisions;

• Architecture development for adaptability and change; and

• Phased approach to enterprise architecture maturity enhancement.

I. INTRODUCTION

Enterprise engineering and integration are crucial components in architecting enterprises. Large numbers of enterprise engineering initiatives are (reference) architecture driven. A reference architecture shows the anatomy of the life cycle of an enterprise (logical structure of activities). The common theme in all current reference architectures is the existence of the Enterprise Life Cycle concept [Bernus et. al. 2003]. This allows an enterprise to be conceptualized, conceived, designed, developed, operated, maintained and possibly retired (or renewed). Most reference architecture lifecycle representations revolve around these phases / activities.

A study of all existing reference architectures reveals that many important enterprise architecture (EA) guidelines and best practices lack adequate theoretical or conceptual foundations. This is partly explainable by the fact that most of the developments of reference architectures have traditionally been driven by the industry where quick implementation is preferred over theoretical / conceptual rigor. In order to address such issues there have been a few significant efforts to concretize recommendations and best practices into generalized reference architectural approaches mainly by the International Federation of Information Processing (IFIP) and the International Federation of Automatic Control (IFAC), which proposed the Generalized Enterprise Reference Architecture and Methodology (GERAM) [Bernus and Nemes, 1996]. This proposal was then developed by the IFIP-IFAC Task Force and became the basis of the International Standard ISO 15704: 2000. GERAM defines a toolbox of concepts for designing and maintaining enterprises through their entire lifecycles [Bernus et. al. 2003]. It represents the common (baseline) set of requirements that other above mentioned reference architectures must fulfill in order to be GERAM compliant. All of the existing reference architectures mentioned earlier have been mapped to GERAM requirements [Noran, 2003].

Organizations embarking on an EA journey usually prefer to use one of the available reference architectures to speed up implementation and take advantage of collated best practices [Perks and Beveridge, 2003]. Concepts and guidelines in reference architectures, which are central to the architecture development process, remain in their current forms more heuristical than scientific. In practice, the lack of scientific or mathematical foundations for enterprise architecture significantly impede enterprise engineering for three primary reasons:

• The body of knowledge of the discipline appears informal rules of thumb rather than as principles based on underlying theories;

• It is extremely difficult to justify trade offs and crucial architectural decisions; and

• Recognizing flaws in or boundaries of applicability of informal heuristics is made difficult due to lack of adequate conceptual foundations.

Using Enterprise Life Cycle concept as the base and GERAM requirement of an EA initiative to have a project based and methodology driven approach [IFIP-IFAC Task Force, 1999], this paper takes an integrated view of EA as largely a process of decision making under uncertainty and incomplete knowledge. EA literature stresses the need for EA initiatives to take value enhancement as the primary objective rather than technical perfection [Bernus et. al. 2003]. The traditional return on investment (ROI) expects costs of investment to be returned within the scope of the initiative at hand making it too tactical. Assessing the value of investments in EA, whose impact may not be apparent immediately, requires another measure. Gartner [2002] proposes the use of return on assets (ROA) as an alternative, which focuses more on value enhancement through increases in productivity of their capital assets.

With the above background, the first part of the paper is a brief discussion on the importance of economics in enterprise engineering with the view that enterprise architecture activity is one of investing valuable resources under uncertainty [Perks and Beveridge, 2003] with the goal of maximizing value added. rather than lowering total cost of ownership (TCO). While it is possible to adopt a complex view of value, the paper takes a more limited view of market value added to the enterprise. Economic value of an enterprise is greatly influenced by structure. The reason being that structure dictates behavior (including flexibility) that is displayed by an enterprise in the face of changing and uncertain business environment. Under such conditions flexibility in the architecture development process can provide great value by potential to avoid risks and take benefits of new opportunities as they come by. The paper discusses some of the uncertainties in architecting an enterprise and the traditional approaches to address EA related economics.

The second part of the paper elaborates some of the available approaches to value flexibility and provides a brief overview of options pricing theory which is the basis for real options approach used in this paper. This approach is then discussed in the context of three critical areas: (1) options in timing of important architectural investment decisions; (2) compound options in architecture development process; and (3) options interpretation to architectural maturity levels. Five concrete real options are suggested as an approach to address some of the identified EA initiative risks.

The last and final part of the paper discusses some practical and theoretical challenges and difficulties that organizations may encounter in using the real options based approach to enterprise architecture investment analysis, including some of the factors that either encourage or impede its adoption. The paper concludes with suggestions for further research to address some of the challenges.

II. ECONOMICS-DRIVEN ENTERPRISE ENGINEERING

Traditional enterprise engineering focuses more on structure and technical perfection leading to lower TCO than value added (or asset productivity) [Gartner, 2002]. This paper takes the view that enterprise architecture development initiative is one of investing valuable resources under uncertainty with the aim of maximizing value added to the organization. This view is consistent with one of the documented business benefits of The Open Group Architecture and Framework (TOGAF) which mentions, “better return on existing information and reduced risk for future investments” [Perks and Beveridge, 2003]. While it is possible to adopt a complex view of value, this paper takes a narrow view: that value is measured in terms of asset productivity improved for the enterprise. This view is supported by the fact that according to Gartner, by 2007, IT asset productivity will drive market capitalization.

FROM STRUCTURAL PERFECTION TO VALUE ENHANCEMENT

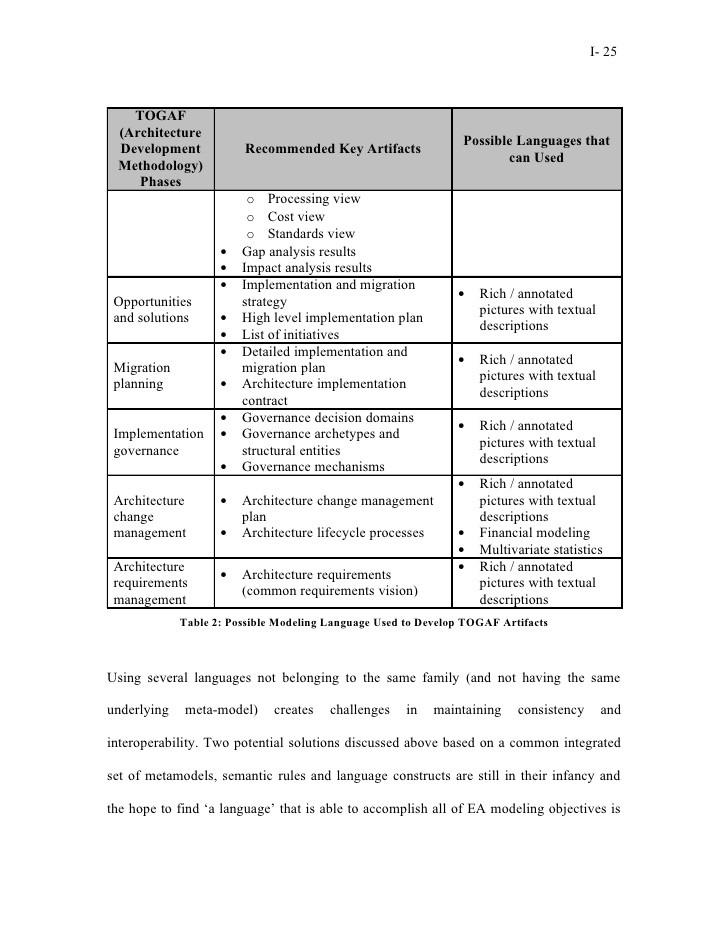

The current heuristical and best practice based approach to enterprise architecture, though useful, has drawbacks. This stems from the facts, which are: (1) the primary focus of most EA initiatives is lowering the TCO, and; (2) the links between architectural concepts and decisions are at most qualitative, weak and subjective. The architectural concepts focus more on “how to structure the enterprise components” rather than “how to increase organizational value”. A look at the GERAM framework components in Figure 1 reveals that there is no component focusing on increasing organizational value [IFIP-IFAC Task Force, 1999]. Even TOGAF Architecture Development Method and Architecture Continuum, mapping to Life Cycle and Life History components in GERAM, respectively, is formulated in structural terms. These define the various groups of activities to be performed (life cycle) or temporality and succession (life history) concepts but with little mention about progressive enhancement of value added to the enterprise. There is currently no clear link between formulation of the architecture development model / methodology to a notion of value maximization.

With respect to timing of architecture related investments, most reference architectures rely on rules of thumb. TOGAF for instance provides a Standards Information Base (SIB) for enterprises to choose from a multitude of products and standards to realize the enterprise architecture [The Open Group, 2003]. However, the need is to have a clear basis for reasoning about the timing of such investment decisions to have a better-founded approach to managing complex enterprise architecture initiatives. This need is driven by the fact that enterprises find it difficult to enhance their IT Investment Management Maturity [U.S. General Accounting Office, 2004] unless IT decisions are based on sound architectural factors.

STRUCTURE AND FLEXIBILITY IN ENTERPRISE ARCHITECTURE

The economic value of an enterprise is often influenced by its structure and methodology used in engineering the enterprise. This is due to the fact that the flexibility the enterprise has in order to incorporate changes depends on its structure. The capability to incorporate changes is necessitated given the changing and uncertain future business conditions. Thus flexibility provides great value to architects and is a desirable characteristic, which can provide both buffer against downside risks and exposure to upside opportunity. The ability to call off an initiative early in the life cycle in light of unfavorable new information minimizes the risk (and downside protection), while the flexibility to adapt the enterprise to take advantage of new business opportunities, by contrast, provides upside potential [Goranson, 2003; The Open Group, 2003]. Flexibility as an organizational capability is gaining increasing importance in areas of Architectural Thinking [Brown and Eisenhardt, 1998; Groth, 1999; Sauer and Willcocks, 2001; Weill and Vitale, 2002; Sauer and Willcocks, 2003]. Further, the need for flexibility is consistent and well in line with the EA Management Maturity Framework (EAMMF) of the U.S. General Accounting Office identifies ‘ability to leverage EA to manage change’ as a highest maturity level characteristic [U.S. General Accounting Office, 2003].

The aim of this paper is to develop a better ‘economics driven’ approach to value and its utility in enterprise engineering and enterprise architecture development. The paper seeks to provide guidance to enterprise architects in deciding when to invest in flexibility of enterprise architecture and ways to exploit it effectively. Architects recognize the fact that during the architecture development process, uncertainty and incomplete knowledge are crucial. Often availability of additional knowledge with time has tremendous impact on architecture development. Aspects that create uncertainties in architecture development could include: cost and schedule, risk of operational failures, future business conditions and environment, future technology and standards development and adoption, technology incompatibility, user needs and value ascribed to those needs, adoption of governance guidelines and others [Perks and Beveridge, 2003]. Typically uncertainties include both endogenous and exogenous factors. The importance of flexibility in enterprise architecture can be seen with concepts like usage of Architectural Building Blocks (ABB) and Partial Enterprise Models (PEM) in assembling adaptable enterprise architectures [IFIP-IFAC Task Force, 1999; The Open Group, 2003]. The Enterprise Engineering Methodology (EEM) as specified by GERAM, requires reference architectures to provide a cyclic (spiral) process oriented phased approach to architecture development [IFIP-IFAC Task Force, 1999]. TOGAF Architecture Development Methodology (ADM), shown in Figure 2, and TOGAF Architecture and Solutions Continuum, shown in Figure 3, conform to GERAM requirements for EEM.