A quick tip for reducing the impact of the confirmation bias on your investing returns Value

Post on: 10 Июнь, 2015 No Comment

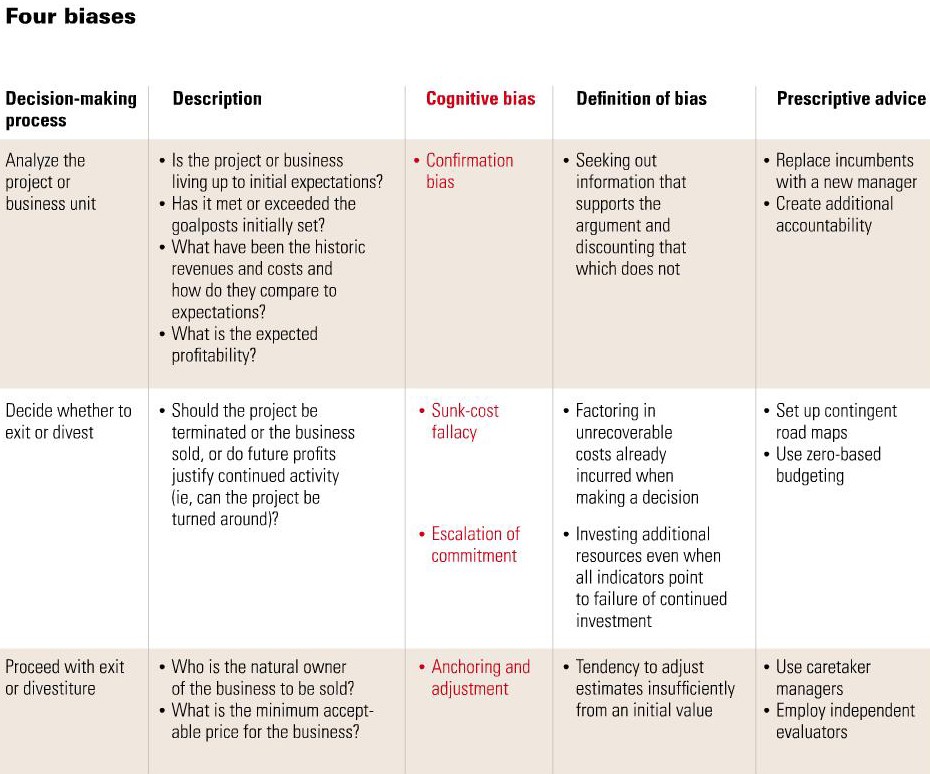

Briefly, the confirmation bias occurs whenever individuals deliberately search for information that corroborates whatever decision they have either made, or would like to make.

This is clearly hazardous to the investing process because it means that investors may really like a company for some inexplicable reason that is completely unrelated to the attractiveness of the investment opportunity in question (perhaps they love the product, or they they love the CEO, or they find the industry to be particularly exciting). Whatever the reason, the confirmation bias can easily lead investors to overpay for investments that they want to make.

Any process or action that reduces the influence of the confirmation bias on your decision making will act as a rubber band whereby the more it is stretched, the greater the pull it exerts to get back to its equilibrium state. This rubber band effect of cognitive debiasing will limit systematic overvaluation of investments you like and will also limit systematic undervaluation of investments you dislike therefore bringing your valuation more in line with reality.

Here is one such actionable tip I picked up from a lecture given by the value investor and president of ABC Funds, Irwin Michael:

When I look at an annual report I look at it backwards. I look at the notes to the financial statements first, then I go to the front. Because as you know, the first two pages are the presidents report and naturally he may own one or two percent of the company and hes going to try to feather his own nest. Hes going to tell you all the good things that are happening in the company and hes not going to talk about all the bad things that hes doing and why should he? Hes got stock options and he wants to ensure that he stays in power.

Simple cognitive tricks like this add up and can make an enormous difference to the way one approaches the investing process. By reading the the annual report backwards you can avoid colouring your interpretation of the financial results based on the optimism and biased opinions of what the president has said.

Thanks for reading and I hope this tip helps you in your own investing. If you are interested in learning more about how to reduce the impact of cognitive bias in the investing process check out this post on curing investment bias.

This article comes from Mike Mask. You can follow Mike on twitter at @contrarianville

My Notes: In addition to Irwin Michaels suggestion, which is excellent, I recommend investors spend more than half their time reading the Management Discussion and the Risk Factor sections of any financial report. Risk Factors tend to be a standard fare on most reports, but they are always customized to reflect the actual market forces that the company is operating against. While some of these risks may never materialize, these are great lenses to view the business through, as management actions are driven through these considerations. Management Discussion and the associated footnotes paint a better picture of the business and can provide a context through which the financial statements should be interpreted.