A Detailed Overview of Effective Day Trading Strategies

Post on: 25 Апрель, 2015 No Comment

Beginner traders should never be driven by more profits. In fact, day trading strategies used by beginners should only focus on developing certain characteristics, and controlling the risk. Day traders who’re just starting out should not be influenced by the glamor of earning profits every day without understanding the risks involved with day trading.

In order to ensure a steady income, and longevity in the market, it is important for day traders to learn from different trades, and develop the right kind of attitude. While choosing your trading strategy, you need to look for certain characteristics. Some of the most important ones have been discussed below.

Infrequent Day Trades According to industry experts, beginners should never trade frequently. For traders who’re still learning new things and grappling with the trading edge, it is better to trade less. Trading more will only lead to higher risks. Infrequent trading can be considered a form of risk control.

Day Trading Strategies

Infrequent trading will also provide you with more time to learn many new things from your trades. Thus, you will be able to develop better awareness of your feelings and emotions to keep them in control. Handling dozens of trades frequently will only cloud proper analysis, and fuel certain feelings of greed and fear. You should use these tips to trade infrequently :

● Avoid scalping day trading strategies

● Trader some higher time frames. For instance, instead of using 5 second charts, you should use 5 minute charts

● Try to be selective, and take only best trades

Day Trade with Changing Trends Day traders always love to be proud of picking the low of the day or top of the day. When you finally catch the bottom or top of the trend, you might feel like a hero. On the other hand, when you don’t, you simply feel like a loser trying to fight hard against the stream. Moreover, it seems to go on forever.

Trading is not just about being a hero. It is about persistence and patience. A day trader should always be patient. He needs to wait for a new trend to develop. Similarly, a day trader should be persistent in taking some trades with the trend. He should never be tempted to pick the bottom or top. Trading with changing trends always helps a beginner to focus on the right attitude for consistent profitability.

Passive Position Management A beginner day trader should set the stop, and focus on the target for each trade before leaving them alone. You should never adjust your targets and stops. This is simply because a beginner day trader may be prone to adjusting his targets and stops emotionally.

Such a trader makes adjustments because he’s affected by the blinking loss and profit figures on the screen. This should only be done by experienced and confident traders who can properly manage trades on the basis of an objective analysis.

Instead of meddling with a particular position when you neither have control on your emotions nor confident in your technique, you should leave the target and stop alone. In fact, you can assume what you would have done if you were actively involved and write it down on a piece of paper. This is an excellent way to learn from your mistakes.

Once you have a good sample, preferably over 30 trades, you should compare the standard results of your passive management as compared to what would have happened with active management. This will allow you to learn more about your own characteristics. It will help you understand why you should just leave the target and stop alone.

Basics of Day Trading Strategies

There are some good rules which can help you achieve a steady income and ongoing success. This is possible even when you’re a beginner trader. In fact, these rules apply to all kinds of day trading strategies. The most important rule is to avoid all emotions while trading. Your decisions should never be ruled by your emotions. Emotions don’t have any place in a successful day trading strategy. Your ’so-called’ gut reactions will only lead to more trouble.

The primary reason why emotions are considered to be bad news is because they can make you deviate from an appropriate strategy. In fact, this is also an important rule to follow. You should never deviate from your game plan. Regardless of the day trading strategy you’re following, you need to stick to it. Persistence is always the key.

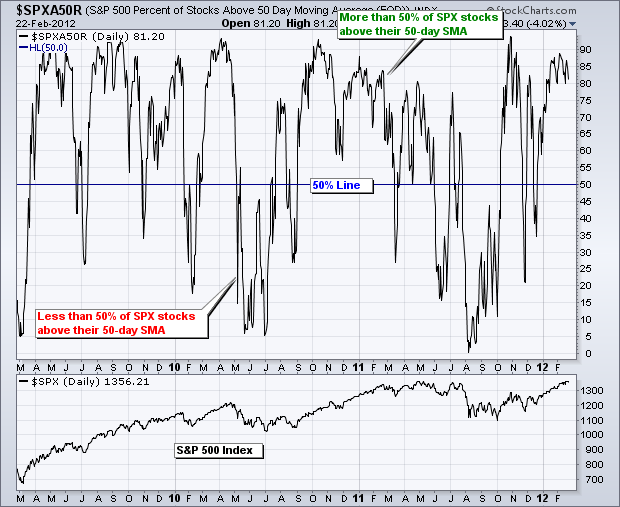

Last but not the least, you need to be able to understand and recognize various trading indicators. Otherwise, it would be impossible to rapidly achieve success with even the most effective strategies.

Some of the Most Effective Strategies for Day Traders

There are many different day trading strategies used by traders. However, you should avoid being overwhelmed by many different options, and use some basic strategies in the beginning. Here is an overview of 4 basic strategies you should use.

News Trading When there’s a major news event affecting the stock market, traders always spring into action. Thus, using this strategy is a very simple way to keep updated with the changing trends and market. You need to stay in touch with news stories and buy or sell quickly.

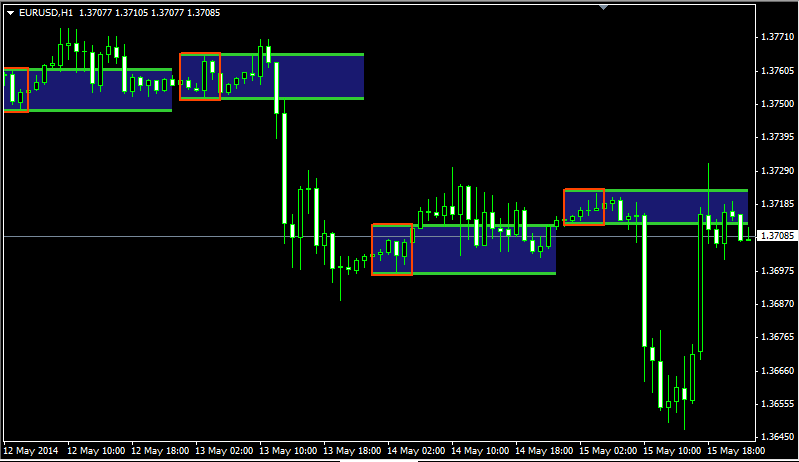

Range Trading With this strategy, you need extensive research and patience. If you focus on this strategy, hardwork will definitely pay off. You need to learn more about the low and high range of a particular stock, and trade with it.

Pairs Trading As the name suggests, this specific strategy needs pairing. You need to choose a particular category, go short on quite a weak stock, and go long on a very strong one. When you make such trades simultaneously, you increase the chances of generating more profits.

Contrarian Trading Regardless of what the momentum of stock suggests, this particular strategy requires a trader to trade against it. Most beginner traders struggle with the contrarian trading strategy. It can be an excellent way to make some good money.

As time passes by, you will gain more experience as a trader. It will allow you to learn many new day trading strategies, including some variations on the ones discussed above. You will be able to work with a wide range of trading strategies to achieve long term success.