A better risk gauge for options portfolios

Post on: 17 Апрель, 2015 No Comment

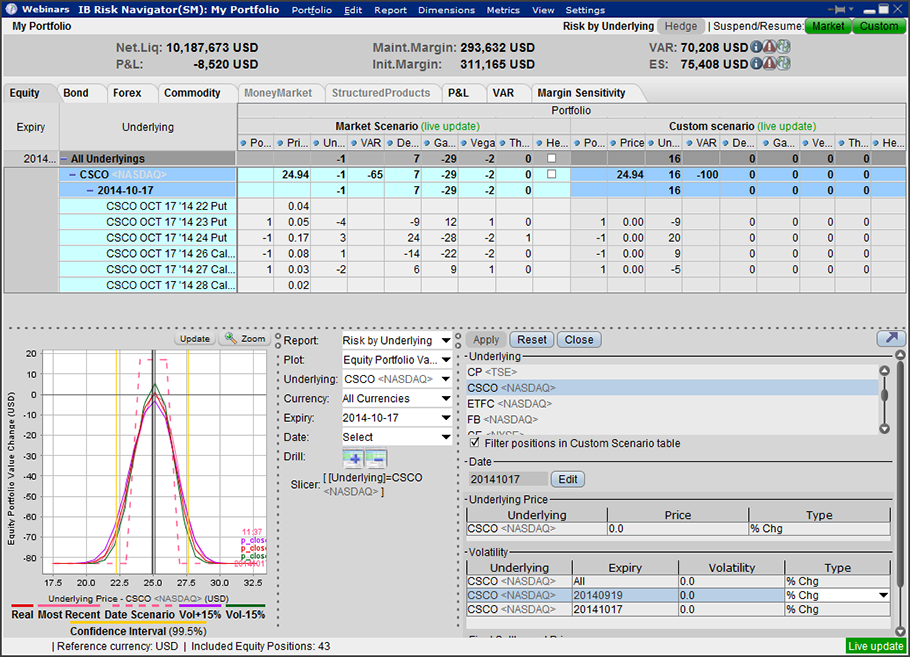

Consider a complex portfolio that includes numerous options combinations corresponding to different underlying assets and created under various options strategies. A proper risk management system requires indicators that forecast risk on the portfolio level.

The common tools used to evaluate risks of options are the Greeks. These measures reflect the extent to which the value of the option responds to changes in variables such as price, volatility, time and the interest rate. These variables can be regarded as risk factors causing option price fluctuations.

The Greeks are calculated as partial derivatives of the option price based on a given variable. Delta is the first derivative of the option price with respect to the underlying asset price. The derivative with respect to volatility is called vega. Theta measures time decay, and rho measures the sensitivity to the interest rate. Derivatives of the second and higher orders also are used.

The risks of option positions on the same underlying asset can be evaluated by mere summation of corresponding Greeks. However, this does not work when the portfolio contains several combinations related to different underlying assets. Because delta and vega are not additive for options corresponding to different underlyings, their summing is impossible here.

The index delta is an alternative risk indicator that measures how much the value of a complex portfolio is likely to change in response to changes in the value of the index.

We can solve the non-additivity problem by expressing the delta of each option as a derivative based on some composite index. This approach will transform delta into an additive characteristic, thereby clearing the way to express the risk of the complex portfolio.

The utility of the index delta is not limited to the evaluation of the portfolio risk. It can be useful for hedging and restructuring complex positions in the course of realizing various dynamic options trading strategies based on delta-neutrality.

The following steps are necessary to compute the index delta:

(1) Select the appropriate index. It can be either ready-made (S&P 500) or an index created by the investor.

(2) Estimate the change in the price of each underlying asset induced by one-point change of the index. This operation is executed using beta.

(3) Determine the fair value of each option, given that the price of its underlying has changed (based on #2). This operation requires application of an option pricing model.

(4) Calculate the index delta, the change in an option price given a one-point change in the index value, for each option in the portfolio. This operation is executed by subtracting the current option price from the value obtained at step 3.

(5) Compute the portfolio index delta by summing individual index deltas obtained at step 4.

THE MODEL

Delta is defined as:

In the above equation, the numerator and denominator represent small changes in the option price and the price of the underlying asset, respectively. Numerous commercial software packages provide solutions for computing delta of separate options. Our task is to express delta as a derivative of the option price with respect to the index:

This can also be presented as

Beta the characteristic widely used to evaluate the relationship between changes in the index and in the given asset can be expressed as:

Thereby, the index delta of a separate option is:

To calculate the index delta of the whole portfolio, we sum up the deltas of separate options based on their weights, with x representing the number of options in the portfolio:

As an example, we will estimate the index delta of a small portfolio of options that involves seven short straddles in different quantities (see Case study, left). The calculations will be based on the S&P 500, though any other index could be used here equally well. A portfolio was created on Jan. 2, 2009, using options with the nearest expiration date (Jan. 16, 2009). The current index value on Jan. 2 was 931.8. Beta coefficients of the stocks were calculated using 120 trading days. Deltas of separate options were derived from the Black-Scholes formula with the risk-free interest rate of 3.3%.

For example, the call on VLO stock has the index delta of 0.0248 ((23.24 * 1.58 * 0.63) / 931.8). Multiplying the index delta of one option by its quantity in the portfolio returns the index delta of the position that corresponds to this contract. Thus, the index delta of the position corresponding to VLO 22.5 Call is -9.93 (-400 * 0.0248). Summing index deltas of all positions gives an index delta of the portfolio, which corresponds to the results obtained by application of equation (3). In this example, the index delta is -0.61.

IS IT EFFECTIVE?

We can analyze the effectiveness of the index delta by measuring the divergence between the risk forecasted by index delta and its actual value realized at some specified future moment (the testing date). To estimate the deviation of forecasted risk from reality, the following indicators have to be calculated.

Realized percent change of portfolio value

The difference between the realized and the expected changes of portfolio value

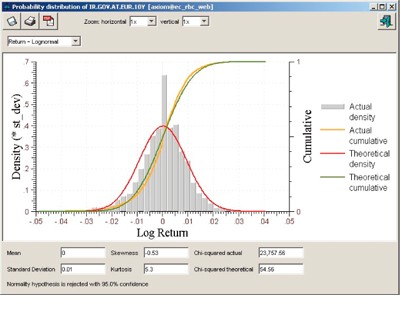

To estimate the effectiveness of the index delta, we used a database containing eight years of price history of options and their underlying assets (from the beginning of 2001 until the beginning of 2009). The index deltas were estimated on the basis of the S&P 500. Accordingly, stocks currently composing this index were used as underlyings for options included in complex portfolios. Each portfolio consisted of short straddles for all the stocks included in the index. Each straddle was created using the strike closest to the current stock price.

The first issue addressed in our study concerned the timing of portfolio creation. The forecasting capacities of the index delta were compared among portfolios created at different time intervals before the expiration date. For each expiration date we created a series of 50 portfolios. These portfolios differed from each other in terms of time left until the expiration. Thus, the most distant of the portfolios was created 50 days before the expiration, the next one, 49 days before, etc. right up to the last portfolio.

Timing of portfolio creation (above) shows average differences between the realized and the forecasted risks. Differences of the portfolios created long before the expiration (30-50 days) were close to zero, though their variability (shown on the chart as standard deviations) was substantial. Therefore, these portfolios allowed for the most accurate estimation of the average risk with relatively high dispersion of individual outcomes.

For portfolios created shortly before the expiration (up to 20 days) the difference between actual and expected changes of portfolio values was high, positive and rather stable (small standard deviations). This implies that index delta underestimates risk of such portfolios, though the value of this underestimation is stable. Thereby, with portfolios created long before the expiration, the effectiveness of index delta can be increased by applying additional risk indicators; in the case of portfolios created just before the expiration, introduction of adjusting coefficients seems to be sufficient.

In the previous example, the index delta was estimated only once, at the moment of portfolio set up. The effectiveness of this estimate was also verified only once, at the expiration date of the options included in the portfolio. Hence, the second issue addressed in our study corresponded to the situation when risk is estimated regularly throughout the whole period of portfolio existence, and the effectiveness of these estimates is tested at different forecast horizons. For each expiration date, we set up a portfolio consisting of short straddles for all 500 stocks composing the index. The moment of portfolio creation was 50 trading days away from the corresponding expiration date. All the other parameters were the same as in the previous study.

Evolution of efficiency shows differences between forecasted and realized risks (mean values and standard deviations) at different stages of the portfolios life. Regardless of the forecast horizon, the index delta was highly effective through the first 15 days after the creation of the portfolio. Afterward, the older the portfolio, the poorer the forecasting capacity of its index delta became. The closer the portfolio approached the expiration, the more underestimated was the risk. The variability of results also increased with portfolio aging, pointing to lower predictability of individual outcomes. The increase in the forecast horizon (from one to five and 10 days) makes these tendencies even more evident underestimation of risk begins earlier and reaches higher values.

Delta is a local instrument indicating the change in the option price under a small change in its underlying. The higher the price change, the less accurate the forecast of price change based on the classic delta. We want to test whether, and by what extent, the effectiveness of forecast based on index delta deteriorates under considerable index changes.

Locality of index delta shows that big index changes induced considerable differences between realized and forecasted risks. The relationship is statistically significant in both cases when the index grows (green) and when it declines (red). In the former case, the correlation was lower than in the latter case.

An important detail in the evaluation of index delta effectiveness is that considerable index changes correspond to positive differences, while small index changes correspond to negative ones. This means that under big index changes, index delta underestimates the risk, while small changes overestimate risk. The maximum effectiveness of the index delta is achieved when the market fluctuates within the limits of 3% to 5%.

HOW IT WORKS

Index delta is a convenient tool suitable for evaluating the risk of complex portfolios consisting of options on different underlying assets. However, its forecasting abilities are heterogeneous and depend on various factors. Particularly, the index delta is highly effective for portfolios created long before the expiration date, yet it underestimates risk of portfolios formed shortly before the expiration.

Furthermore, the effectiveness of this indicator varies at different stages of portfolio life. While it predicts the risk effectively at the early stages of portfolio existence, its forecasting abilities deteriorate as the portfolio advances in age. Besides, the forecast horizon of index delta is limited its predictions remain reliable for a limited period of time only. After several days, the risk forecasted by this indicator becomes increasingly underestimated. Finally, because it is a local characteristic, index delta is appropriate only for forecasting the risk under moderate market fluctuations.

Index delta is a promising tool, and it holds considerable potential for traders who are active in a number of markets simultaneously. Further study is needed, however, in view of these peculiarities, to develop special correction coefficients to compensate for the biased estimation of risk.

Sergey Izraylevich has a Ph.D. from the Hebrew University of Jerusalem. He is the chief investment officer of Hortan SARL in France and chairman of the board of High Technology Invest Inc. Vadim Tsudikman is a director of Hortan SARL and has a background in utilizing genetic optimization algorithms for trading system development. Contact the authors at izraylevich@htinvest.ru