A Beginners Guide to Fuel Hedging

Post on: 16 Май, 2015 No Comment

A Beginners Guide to Fuel Hedging — Swaps

This post is the second in a series where we are addressing the fundamentals of fuel hedging. You can access the first post, which explored hedging fuel with futures, via the following link: A Beginners Guide to Fuel Hedging — Futures. In subsequent posts we will be addressing the fundamentals of fuel hedging with options as well as more advanced hedging structures such as collars, basis swaps and spreads involving options.

A swap is an agreement whereby one party exchanges their exposure to a floating (often referred to as spot, index or market) fuel price for a fixed fuel price, over a specified period(s) of time. Swaps are available for nearly all types of fuel including bunker fuel, diesel fuel, gasoline, heating oil, jet fuel, fuel oil, etc. Swaps received their name as the buyers and sellers of swaps are “swapping” cash flows, floating for fixed and vice versa.

Large fuel consumers in numerous industries utilize swaps in order to hedge their fuel price risk by fixing or locking in their fuel costs. Similarly, many fuel marketers and refiners utilize swaps to hedge their inventory and production related fuel price risk. Many fuel marketers also trade swaps to hedge their exposure to fixed price sales of physical fuel.

In addition to fuel, swaps are also utilized by companies seeking to hedge their exposure to foreign exchange, interest rate and agricultural commodity price risks as well.

As an example of how one can utilize an fuel swap, let’s assume that you’re an airline who wants to lock in a fixed price for a portion of your anticipated jet fuel exposure, in Asia, for a specific month.

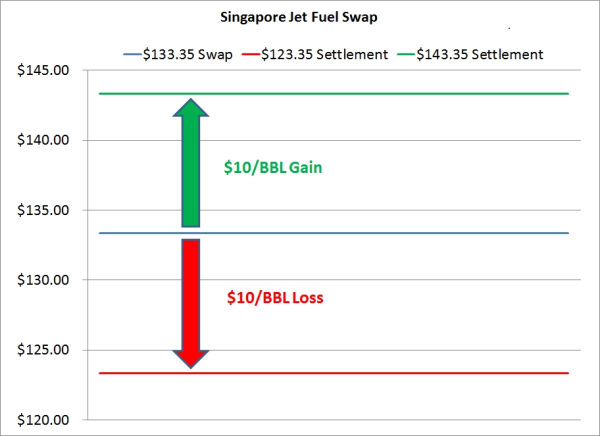

For sake of simplicity, let’s assume that you need to hedge 5,000 barrels of your anticipated fuel consumption in October 2012. In order to do accomplish this you could purchase an October Platts’ Singapore jet kerosene swap from one of your counter-parties (often the commodity trading group of a bank or major oil company). If you had purchased this swap yesterday at the prevailing market price, the price would have been (approximately) $132 per barrel.

Now let’s examine how the swap will impact your fuel costs if Singapore jet kerosene prices during October average both higher and lower than the price at which you paid for the swap, $132/BBL.

In the first scenario, let’s assume that Asian jet fuel prices in October are higher and that the average price for Singapore jet kerosene (as published in Platts’ Asia Pacific/Arab Gulf Marketscan ) for each business day in October is $145/BBL. In this scenario, your hedge would result in a gain of $13/BBL ($145 – $132 = $13) or $65,000 ($13/BBL X 5,000 BBLs = $65,000). As a result, you would receive a payment of $65,000 from your counter-party, which would offset the increase in your actual fuel costs by $13 per barrel.

In the second scenario, let’s assume that Asian jet fuel prices are lower in October and that the average price for Singapore jet kerosene for each business day in October is $120/barrel. In this scenario, your hedge would result in a loss of $12/BBL ($132 – $120 = $12) or $60,000. As a result, you would have to pay your counter-party $60,000, which would offset your actual fuel cost by $12 per barrel.

As this example indicates, purchasing a jet fuel swap allows airlines to hedge their exposure to unpredictable jet fuel prices. If the price of jet fuel increases, the gain on the swap will offset the increase in their actual fuel cost. Similarly, if the price of jet fuel declines, the loss on the swap will offset the decrease in their actual fuel cost. As a result, regardless of whether jet fuel prices increase or decrease, the airline will have “fixed” their fuel costs thanks to the swap.

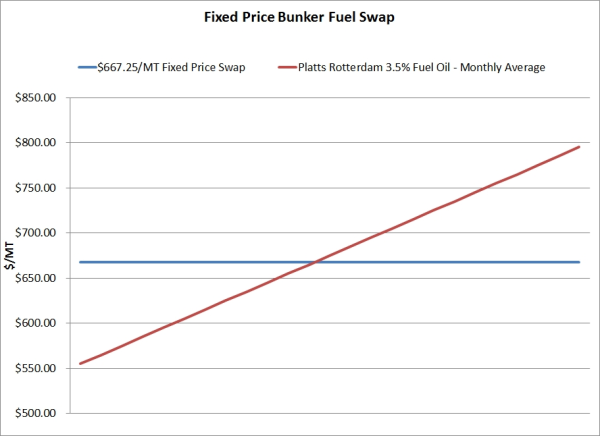

While this example examined how an airline can utilize swaps to hedge their exposure to jet fuel prices, the same methodology can be used to hedge bunker fuel, diesel fuel, gasoline, heating oil, fuel oil and many other commodities.

As previously mentioned, fuel marketers and refiners can also employ swaps to hedge their exposure to fuel prices as well. As an example, a refiner who needs to hedge their exposure to potentially declining diesel fuel costs could do so by selling diesel fuel, heating oil or gasoil swaps.

If you would like to learn more about hedging your fuel price risk with swaps, or any other fuel hedging instrument, please contact us. we would be glad to assist you.

UPDATE: This article is the first in the series titled A Beginners Guide to Fuel Hedging. The subsequent posts in the series can be found via the following links: