A Bear Market For Bonds

Post on: 31 Июль, 2015 No Comment

A Bear Market For Bonds?

July 5, 2011 Tom Lydon

The Treasury bond and related exchange-traded fund (ETF) markets rose rapidly after the surge in market volatility following the financial crisis. As volatility spiked, investors jumped into the relative safety of Treasury bonds, disregarding the record low yields. Now there is concern about the potential bursting of a bubble in Treasury bonds.

For the past 30 years, interest rates have been steadily declining and, consequently, bond returns have been rising. As we begin to transition out of record low interest rates, bond prices should fall and yields rise. This new environment calls for advisors to review their fixed-income holdings and devise a strategy to protect these positions.

Current Interest Rate Environment

From 1981 to 2007, fixed-income investors did quite well as they bought Treasurys in a decreasing interest rate environment. However, in the past two years, the Federal Reserve has lowered rates down to zero for the first time in history to stimulate growth.

Between 2008 and 2010, $268 billion shifted out of equity funds and $655 billion moved into bond funds as investors moved toward perceived safety.

The yield on the 10-year Treasury has recently moved back above 3% after hitting lows of close to 2%. As the yield rises and the economy strengthens, the risk of holding Treasurys also rises.

A low interest rate environment can’t remain low forever. With quantitative easing in play, better economic numbers and confidence growing in the market, it is more likely the Fed will boost rates sooner rather than later. It may not happen tomorrow or next week, but it will happen. When interest rates rise, Treasurys decline in value. The Treasury bear market may finally be here, says Joe Leary, the U.S. Treasury rates strategist at Citigroup Global Markets.

This doesn’t take into account credit concerns about the current Treasury debt limit that could be priced into Treasurys as Congress cogitates about raising the debt ceiling.

If We’re In Bubble Territory, What Now?

Yields have not been great, but advisors were looking for safety during a rough economic time.

Now they want to enhance their yields and find ways to earn money in their client portfolios.

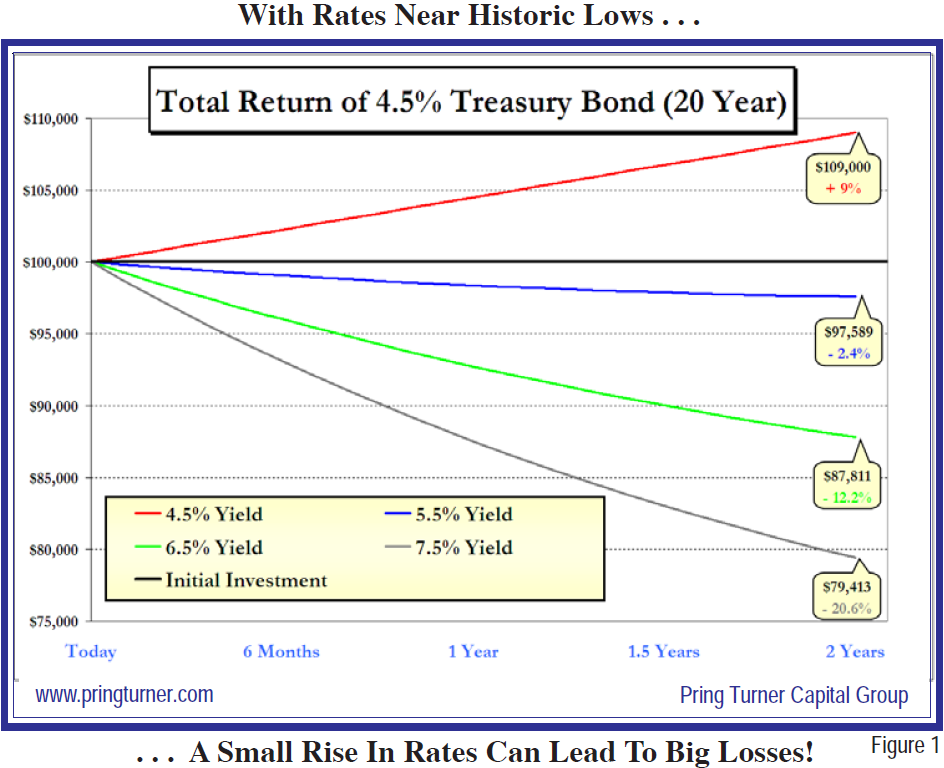

If clients are sitting in long-term Treasurys, you need to be prepared to act. When the Fed raises rates, prices will fall, yields will rise and principal will be at risk. In a recent presentation, Daniel O’Neill, president and chief investment officer of DirexionShares, said a 1% rate hike could drop the value of a 30-year U.S. Treasury bond by 14.5%.

Advisors can offer several options for clients. One of which is to do nothing. Clients could also reduce their exposure to fixed income or reduce exposure to interest rate volatility by moving to shorter-term maturities.

Another option to hedge against the bubble bursting is to go short on longer-term Treasurys with exchange-traded funds (ETFs).

There are specific ETFs that seek daily results corresponding to the inverse of the daily change in the index they track. So if the index goes down, then the fund is designed to go up that amount, before fees and other costs.

Direxion Daily 7-10 Year Treasury Bear 1x Shares (TYNS): inverse exposure to the NYSE 7-10 Year Treasury Bond Index;

Direxion Daily 20+ Year Treasury 1x Shares (TYBS): inverse exposure to the NYSE 20+ Year Treasury Bond Index;

ProShares Short 7-10 Year Treasury (TBX): inverse exposure to the Barclays Capital 7-10 Year U.S. Treasury Index;

ProShares Short 20+ Year Treasury (TBF): inverse exposure to the Barclays Capital 20+ Year Treasury Index.

Like all inverse and leveraged ETFs, these are not for everyone. Returns can diverge from the underlying index as a result of compounding, so be prepared to monitor such ETFs daily when you own them. These ETFs are not necessarily meant for buy-and-hold strategies, but with some understanding of how they work and an understanding of interest rate risk, they could be an excellent hedging vehicle.