A 401(k) Plan Your Key to Success

Post on: 2 Октябрь, 2015 No Comment

A 401(k) Plan: Your Key to Success

Because employees are becoming increasingly savvy about planning for the future, one of the key benefits they look for in an employer is a good retirement plan. They value the opportunity to work for a company that provides employee benefits such as access to special financial programs like 401(k) plans. In fact, employee benefit programs like these can be a key factor in recruiting and retaining the best employees.

The Oasis Outsourcing, Inc. 401(k) Plan has it all—a flexible customized plan design, dozens of investment options supported by the Lincoln Financial Group (an experienced and knowledgeable third party administrator) and no administrative expense or burden to our PEO clients. The Oasis Outsourcing, Inc. 401(k) Plan allows you to tailor a plan to help meet your personal and business retirement goals. You can select your own eligibility criteria, vesting provisions, matching contribution and profit sharing formulas, including integration and new comparability.

The Lincoln Financial Group provides the investment options for the Oasis Outsourcing, Inc. 401(k) Plan. The Lincoln Director, a group variable annuity, offers a strong lineup of investment options from multiple fund managers. Fund advisors include Fidelity, Janus, AIM, American Funds, Delaware Investments, Goldman Sachs, Franklin Templeton, Neuberger/Bergman, MFS and more.

Your employees can monitor and manage their investment account through toll-free telephone access or online 24 hours a day, seven days a week. They can also see their 401(k) information when they log on to the Oasis Employee Services website at www.oasisadvantage.com.

As part of the Oasis Outsourcing, Inc. package, a Lincoln representative will help you design a plan that will suit your needs. They will also conduct an employee enrollment meeting to explain your specific 401(k) plan features and provide investment education. (With so many investment options, this is particularly important.)

Speaking of Options

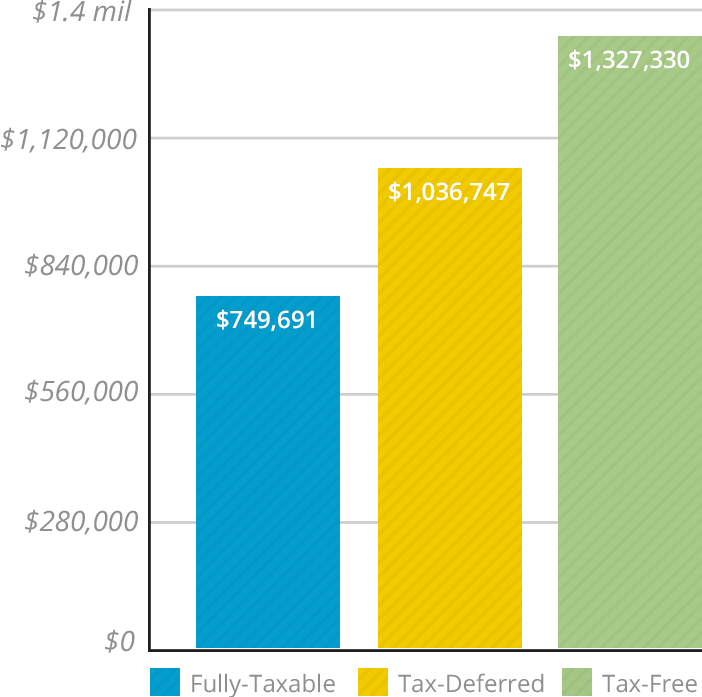

Have you heard about the Roth 401(k)? Similar to Roth IRA contributions, Roth 401(k) contributions must be made with after-tax dollars. In addition, Roth contributions to a 401(k) plan have higher contribution limits, and the Roth IRA limitations on who is eligible to contribute do not apply. Roth 401(k) contributions do not reduce taxable income like traditional 401(k) contributions do, but they do provide the potential for great long-term benefits, such as tax-free withdrawals and no income tax for beneficiaries.

If you believe this option would be a beneficial retirement planning tool for your employees, you’ll be happy to know that Oasis Outsourcing recently added the Roth 401(k) option to our platform. Based on the popularity of Roth IRAs, it is expected that the ability to make Roth contributions to a 401(k) plan will be a popular plan design.

Helping your employees plan for retirement through one of these plans is one of the best ways to show them that you care about their success now as well as in retirement.