7 ETF Rules to Mind

Post on: 16 Март, 2015 No Comment

All News:

Its natural to feel exuberant about exchange traded funds (ETFs); theyre fantastic tools to use when you want exposure to the markets various sectors and asset classes. But dont let your excitement lead you toward misuse, because like anything, ETFs still come with risks.

As of June 21, ETFs have more than $834 billion in assets and counting. [What You Should Know When Investing in ETFs. ]

Sheryl Nance-Nash for Daily Finance has five rules commonly broken by users of ETFs are you one of them? Weve outlined the rules below and tossed in a few of our own, too.

- Forgetting About Slow and Steady. There are few get rich quick schemes that actually work. The liquidity of ETFs may lead some investors toward undisciplined trading practices, such as selling too soon or buying on speculation. This will quickly rack up commissions and, worse, lead to losses that come as a result of simply not having a strategy.

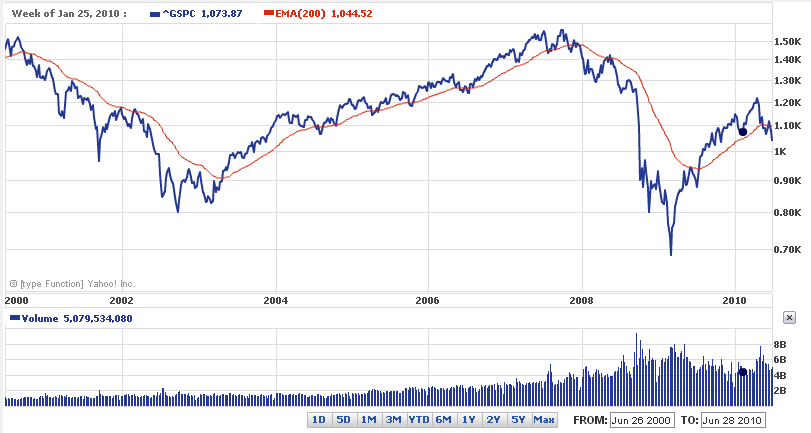

- Buy-and-Hold? Not Always. Buy-and-hold has long been touted as the way to go, but this is no longer the case. Were seeing more ups and downs in the markets, and look at the S&P 500: its below where it was 10 years ago. If youve been holding it in that time, youve lost money. These days, investors should be watching their portfolios closely and incorporating stop losses into their investment discipline. A simple strategy we use is trend following, which you can learn all about here .

- Leveraged and Inverse ETFs. Leveraged and inverse ETFs have lots of benefits they allow investors to capitalize on short-term market moves or hedge current positions without having to sell them. But heres the thing: they arent for everyone and they need to be understood and monitored. Theyre not anything you put into your portfolio and forget about. [Everything You Need to Know About Leveraged and Inverse ETFs. ]

- Getting Diversity. Diversity is key to investing success. Yet with ETFs there can be faux diversification. Because ETFs are a basket of shares, buying three or four in the same sector can be giving you more exposure to one company or country than you think. You may be doubling your existing position, or getting over-exposure to one share. To avoid this, look under the hood and know what your ETF owns.

- Ignoring Costs. Many new ETFs at first dont attract a huge amount of assets or trading volume, which means that they arent as liquid as other heavily traded funds. This can result in wider bid/ask spreads, which increases transaction costs. Further, lower liquidity leads to ETFs often nor representing their true underlying net asset values. Watch these numbers. By doing so, you can avoid over-paying for a fund. [How Derivatives Affect Your Investment. ]

- Investing in the Unknown. Just because something is available doesnt mean that its right for you. ETFs provide access to very complex market strategies that were once only available to professionals. Commodities, currencies and leveraged funds are examples. Dont invest in what you dont fully understand. [How to Use Currency ETFs. ]

- Not Having a Strategy. Buying willy-nilly, selling because you suddenly became frightened and using your neighbor as your sole source of investment advice are things that will cost you big-time. Instead of letting your emotions guide you through your investing choices, have a simple strategy at your disposal. As we mentioned above, trend following is one of them. Whatever you choose, though, make sure its a simple discipline that you can stick to. [How to Find the Best ETF Strategy. ]

Do you want to read more stories to help you navigate the maze of ETFs? Drop by our ETF Education section by clicking the Education tab, clicking education central and selecting a subject from one of four different categories:

For more stories about ETFs, visit our ETF 101 category .

Tisha Guerrero contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.