5 Ways to Bridge Impending Talent Gap

Post on: 16 Март, 2015 No Comment

The industry is recognizing the need to leverage data and analytics, and must hire the talent with analytical know-how to improve profitability.

Share This Story

We have a serious issue to address in the insurance industry. According to the U.S. Bureau of Labor Statistics. the industry employs 2.2 million workers, and that number is expected increase with 200,000 new jobs by the year 2020. This should be great news, except that nearly 50% of the industrys workforce will retire in the next 15 yearsand there isnt enough talent stepping in to fill those shoes. If the insurance industry does not work to recruit top talent now, it wont be able to offset the impending skills gap.

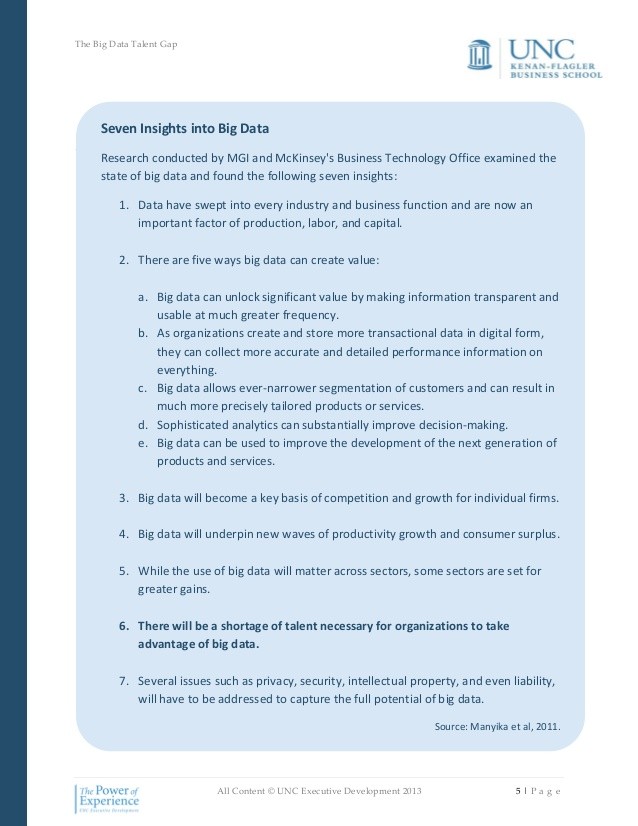

An aging workforce isnt the only driver requiring insurance to recruit new, fresh talent to the industry: Property and Casualty insurers in particular are in a period of flux as they face significant challenges to traditional business models and declining investment returns. As a result, carriers are recognizing the need to leverage data and analyticsand to hire the talent to work with these analytical toolsto improve overall profitability.

The need to fill positions is exacerbated by timingthis problem is hitting at the same moment that carriers are retooling their operations to become more profitable, which will require data and analytics talent within IT, actuarial and underwriting departments.

At a time when demand exceeds supply, what are some steps that secures top talent?

Recognize the Need for Analytics Talent

For many years, insurance companies built their businesses and ensured profitability by focusing on successful investment strategies. The recent financial crisis changed that as investment yields became more unpredictable than ever. As insurance carriers look to the future, theyve been re-organizing their businesses to ensure profitability from their operations rather than relying so heavily on investment yield.

Now, the incorporation of analytical tools has become the standard amongst carriers in order to stay profitable. In a recent Dowling & Partners Research report, the use of tools such as predictive modeling is still a competitive advantage for insurers that use it, but it is beginning to be a disadvantage for those that dont.

A research study by analyst firm SMA further emphasizes how carriers are increasing their technology investments to improve overall performance. As underwriting is often considered the foundation of growth and profitability, its not surprising to learn that the top area for technology investment in 2013 was data and analytics initiatives that support underwriting, with 55% of insurers increasing spending in this area. Other investments support marketing (46%) and claims (37%).

In fact, when Accenture polled more than 550 North American commercial lines underwriters, 72% of respondents cited that maintaining underwriting discipline and pricing was their top challenge. And half of the underwriters surveyed said they need better access to intuitive tools that provide data and insight at the point they need to make a decision.

Develop Talent with STEM Education

Despite the growing dependency on data experts, the question remains whether there is enough qualified talent out there to fill our open positions. The insurance industry is not alone in this need to recruit the top talent availablewere competing with lots of industries for workers who have degrees in science, technology, engineering and math (otherwise known as STEM), and were not in good shape as a country. Across all industries, we will have a shortfall of 3 million positions requiring college degrees that cannot be filled by 2018.

As we recognize that we are competing for a limited pool of talent, take steps to develop and encourage STEM education. There are a variety of organizations and programs, such as Change the Equation. which aim to connect the dots between STEM education and building the workforce pipeline. When looking at the list of participants in initiatives like this, the insurance industry is largely absent from this effort, especially when compared to involvement from other sectors.

With many jobs to fill within the coming years, it behooves the industry to take a more active role now in building a strong educational foundation for our future workforce. Valen has begun an initiative, called Tomorrows Talent Challenge. to help the insurance industry work collaboratively to reach the next generation workforce. The Jacobson Group, which has an Emerging Talent recruiting program, also partners with Valen to coordinate an industry-wide effort to attract new talent.

Showcase Industry Strengths

As we know, insurance is comprised of much more than sales positions. Showcase what the insurance industry has to offer by correlating the personal interests of young professionals with related career paths. For instance, the industry employs claims adjustors who assess customers policies (ideal for someone with people skills), appraisers who offer assessments (for those who dont want to be bound a desk job), investigators (for those who are resourceful in gathering information), as well as underwriters and actuaries who can pull from their interests in business and finance to assess data.

Remember that exposure to the insurance industry is extremely limited for many young people. Paying high premiums or having to wait for long periods of time to reach customer service can lead to negative impressions of the industry. As such, be sure to emphasize the various positions within the industry as well as other key traits that make insurance so appealing, such as job stability, family-friendly and flexible work hours, and great benefits packages.

Coach and Mentor Emerging Talent

Running successful internship and mentorship programs is a great way to gain a positive reputation amongst your community. This is a chance for your business to showcase a real day-in-the-life of various positions, but it also gives back to interns in a positive way by teaching them entry-level skills needed for a permanent position at any insurance company.

This is something that the financial industry does really welltake a peek at any top internship programs round-up and youll notice that many of the companies listed are in the finance sector, such as JP Morgan Chase, Ernst & Young and Merrill Lynch. Thats because their programs often provide hands-on experience for interns allowing them to weigh the pros and cons of a position before pursuing it further. Also, many successful programs allow interns to dive into tasks that start off easy, with room to eventually take on more challenging tasks that require students to utilize the skills theyve learned at school or at a previous job.

While some may think that internship programs are time-consuming to run, consider the fact that interns are potential hires that youll make once they graduate or complete the program. Invest in the personal development of your interns and take an active role with training now, and youll soon see the rewards of your mentorship and guidance.

Broaden Your Reach

In the midst of headlines about healthcare reform and disaster relief, now is the time to educate youth about the opportunities within insurance. More than 40% of college graduates are unemployed and another 16% are in part-time positions. This means that there is a need by insurance to fill in jobs at the same time that many people are looking for work.

Dont limit yourself with recruiting efforts. The National Center for Education Statistics estimates that less than 1% of colleges are reached through traditional campus recruiting, which leaves thousands of candidates overlooked. Also, consider broadening recruiting requirements to consider those with associates degrees for your internship programs as there are people of various degree levels who are eager to participate. A look into the life of an insurance company may be exactly what persuades them to earn a bachelors degree or secure their credentials.

As young professionals are more diverse and technology-savvy than ever, the pool of talent is there. Foster a company culture that encourages people to explore insurance by taking an active role in education programs and internships. The responsibility lies with us all to start thinking strategically now in order to avoid future crises.